Since the 04 Feb 2022 Xi-Putin summit, strategic analysts have accorded greater attention to the growing ties between China and Russia. The Russia-Ukraine war that would start twenty days later has brought forth new dynamics, as well as limitations of the alleged no-limits partnership. However, what we have seen is China and Russia are very aware of each other’s vulnerabilities and sensitivities. The communication and coordination afforded by the very large intergovernmental exchanges in the last three decades are now benefiting the relationship. The political framework underlying their bilateral relations includes more than 300 treaties and agreements, embracing practically all spheres of cooperation. A major factor behind strengthening of the relationship has been that China and Russia have practically identical views on international issues, and the west has aided that even further. But there is an overwhelming trend to dismiss the bilateral aspects of China-Russia relationship by many experts. The influence of current strategic environment and top leaders on the bilateral ties is undeniable, but the realities of costs and benefits make the relationship more than tactical opportunism. One of those aspects is the energy cooperation between them.

Currently, despite good intentions, the world largely ignores the speed and consequences of a haphazard energy transition that is underway. Energy and electricity are not synonymous as electricity is only 30 per cent of total global energy consumption. Also, the climate change narratives narrowly look at carbon emissions, ignoring the entirety of environmental degradation caused by unabashed greed and hedonic tendencies of modern culture. Additionally, renewables, though being very important are not the blanket answer to the entire problem. Furthermore, the multiple crisis generated by the de facto war between the west and Russia has perpetuated a global energy crisis that is disproportionately impacting the global south. Russia is one of the most important nodes in global energy hub today. Despite weak capacities in Liquefied Natural Gas (LNG) and refining (compared to its reserves), Russia’s ability to bring large export amounts of oil and gas to energy markets is more than substantial in a global market mismatched between demand and supply. The market is unlikely to reverse as G7 governments and major multilateral lending institutions including big banks seek to halt funding for oil, gas and coal projects in the coming time.

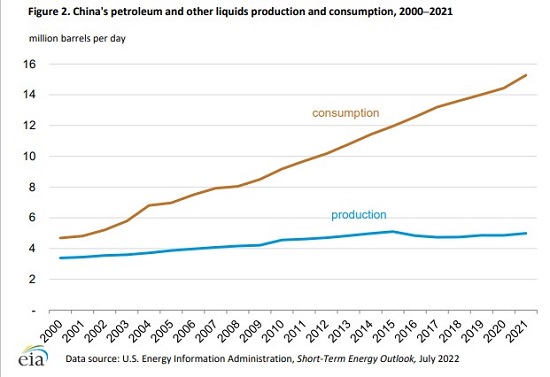

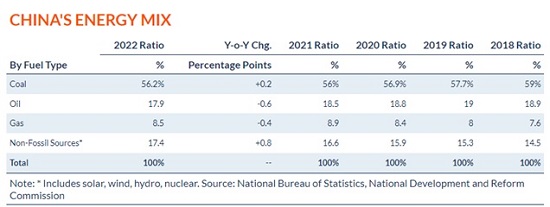

In this context, China which is the largest energy importer in the world of all three- oil, gas and coal finds itself in a very favourable position. According to BP Statistical Review of World Energy 2022, China consumed total 157.65 exajoules of energy in 2021- 30.60 exajoules from oil, 13.63 exajoules from gas, 86.17 exajoules from coal, 3.68 exajoules from nuclear, 12.25 exajoules from hydro and 11.32 exajoules from renewables. One exajoule is equivalent to 174 million barrels of oil. With an economy of $18 trillion, footing a bill for $365 billion for crude oil and another $70 billion for natural gas ($42.6 billion for coal) isn’t even a problem (2022 customs data)[1]. But when that is roughly an import dependency for crude oil (73 per cent), natural gas (44 per cent) and coal (8 per cent), it is a problem. In a global crude oil market of roughly 100 million barrels per day (bpd), China imports close to an average of 10 mn bpd of crude oil (other condensates increase imports further). Though China’s total petroleum and other refined production is the fifth largest in the world, having risen by about 50 per cent over the past two decades, China’s demand for energy continues to far outstrip its own resources.

Many of China’s key onshore oil fields are maturing. Offshore production is costlier and at times brings in strategic challenges (such as in South China Sea and East China Sea). Also, offshore oil production represents less than 7 per cent of total Chinese production. Beijing has focussed on trying to find and develop shale oil and gas resources (replicating US). However, China’s known shale formations – be they oil or gas – are all located in very difficult to exploit terrain. Xinjiang’s lack of adequate water resources is fairly known. Faced with an unavoidable reliance on energy imports, more so since the 2010s, China has set in place an external strategy with large support to state owned energy giants and aggressive foreign policy backed with massive investments. The largest recipient of BRI funding in recent years have been petro states- Iraq (2020) and Saudi Arabia (2021). There was also the announcement of China-Iran 25 Year Cooperation Programme in 2021 where China would invest $400 billion in Iran’s petro sector. Earlier from 2007 to 2017, China also poured in $65 billion foreign investment into Venezuela. Today there are no imports from Venezuela officially making the entire amount a virtual liability. There are also huge liabilities from Libya, South Sudan etc.

Carbon neutrality commitments (2060) along with a rise in extreme weather events have prompted China to boost renewables and nuclear energy. The 2022 heat wave saw large parts of the Yangtze River drying up and resulting hydropower crisis for many southwestern provinces. Even with large import dependency and a high annual growth rate per in energy consumption, China has carefully diversified its sources of imports to account for geopolitical risks. Professor Xue Li from Chinese Academy of Social Sciences noted in a paper in March 2023[2] that “For China, ‘energy independence’ is not about achieving energy self-sufficiency, but about achieving a diversified, stable and reasonably priced energy supply system in order to ensure [our] sustained economic development.” He also argued that the share from any one country should not exceed 20% of our imports. On that count, the Chinese have limited room to increase the shares from Saudi Arabia (17%) and Russia (15%). But Russia has proven to be a beneficial partner beyond fossil energy to include even nuclear cooperation. In March 2023, when Xi Jinping visited Moscow, China and Russia signed agreement on fast neutron reactors cooperation. But the agreement on Russia supplying highly enriched uranium to China raised many concerns as it can go beyond fuelling just nuclear energy reactors. That is more so when China is expanding its nuclear arsenal.

Despite old technology and a manpower heavy oil sector, Russia probably has the lowest breakeven price among oil producing nations. It accounts for 12% of global crude supply. As a gas powerhouse, Russia has lagged in its LNG standing. It has sought to emerge as the leading LNG player with a renewed focus and expansion of capacity in the Arctic. Since the Crimean Crisis in 2014, Russia has lacked access to adequate investments and financing due to sanctions despite a spurt of extremely promising discoveries. Russia has also faced shortages in technology and modern equipment. Russia’s oil and gas revenues comprise 45% of federal budget. Europe has sought to reduce dependence on Russian oil and gas and pressed forth with massive primary sanctions on Russian energy sector through sanctions on banking, insurance, shipping, entities, and individuals etc. Unlike with Iran, the west has sought to restrict price and not supply as removing Russian energy from markets without affecting themselves is plain impossible. But Russia’ increasingly close ties with major energy producers (and now the OPEC plus) and big Asian consumers- India and China make it a power to reckon with.

In the case of Russia, China has hopped onto new opportunities opened by Russia since the Crimean Crisis coinciding with China’s Coal to Gas switching. The scheme has sought to replace the more than 55 per cent share of coal with natural gas (average global share of coal is 30 per cent). China in recent decades has massively expanded its gas pipeline infrastructure. The West-East Gas Pipeline in China beginning operations from 2004 intends to establish a 20,000 km network with annual transmission capacity of 77 billion cubic meters (bcm). Currently it is in its fourth phase. China’s gas production stood at 209.2 bcm while pipeline gas imports were 53.2 bcm and LNG imports were around 109.5 bcm in 2021. But there is now requirement for more gas expansion to serve as a transition fuel. Despite differences, especially on the principle of freedom of navigation in Arctic, Russia and China have gone ahead with investment projects as well as identifying opportunities in further collaboration. Until now, the flagship China-Russia project in the Arctic has been the $27 billion Yamal LNG. It is now followed by the $25.5 billion Arctic LNG 2, where Chinese companies- China National Petroleum Corporation (CNPC) and China National Offshore Oil Corporation (CNOOC) have acquired 10 per cent stake each.

The political agreement on Power of Siberia 2 during the Feb 04 summit shows a turning point. China’s decision to go with Russian gas over increasing LNG/ Central Asian imports, and Russian decision to turn Siberian supplies to China along with agreement on the pipeline route through Mongolia are very significant. The China-Russia East-Route natural gas pipeline also called Power of Siberia that commenced partial operation in December 2019 is the first pipeline to supply Russian gas to China. Gazprom agreed to supply natural gas to China for a period of 30 years from the start of pipeline operation, reaching the design capacity of 38 bcm a year from 2024 onwards. The construction of Power of Siberia 2 pipeline linking Russia and China is expected to commence within two years, a megaproject that will put Mongolia in the middle. It will deliver Europe-bound gas from western Siberian fields to China for the first time, is expected to go online in 2030. The new pipeline will be able to transport 50 billion cubic meters of gas annually from Russia to China, marking a boost from the 38 billion cubic meter capacity of the original Power of Siberia pipeline which commenced operations in December 2019. For comparison, Russia previously exported around 35 billion cubic meters of gas per year to Germany annually. There is also another 10 bcm agreement to buy gas from Russia's Far East island of Sakhalin, which will be transported via a new pipeline across the Japan Sea to China's Heilongjiang province[3].

The two main oil pipelines from Russia to China are the ESPO and the Atasu-Alashankou pipeline (via Kazakhstan). The Atasu-Alashankou oil pipeline has a limited capacity of 40,000 bpd (the renewed contract is for 200,000 bpd for ten years- Feb 2022). The ESPO or the Eastern Siberia–Pacific Ocean oil pipeline has a China capacity of 700,000 bpd with the contract in 2011 agreeing to 300,000 bpd for twenty years. Observers estimate that China’s imports of Russian oil have averaged 1.3-1.9 million bpd since the Ukraine conflict. One can assume with limited pipeline infrastructure, much of it is seaborne trade. Numerous Chinese scholars have noted the increasing dependency on Russia for energy imports. Wang Yuanda, China gas analyst at data intelligence firm ICIS commented that "the original target was for China to import 38 bcm of Russia gas by 2025. Now Russia is saying this will reach 98 bcm by 2030. That is a very big jump, so it pays to be slightly cautious on that” [4]. With majority of gas produced in Russia being used for domestic consumption, the Russian officials in recent time have sought to reduce overall gas production but increase Russian LNG supplies. But China remains a prized client for future redirection of Russian energy supplies.

The share of new energy such as in transportation sector does reduce Chinese demand relatively, but on absolute basis, Chinese energy requirements remain massive. New hydropower projects are seen with some controversy within China too as environmental impacts have gained salience in policy making. But one can expect energy independence to still take precedence. The earlier efforts at coal to gas switching have shown large shortages of gas to match the demand. Thus, local governments have approved more coal power in first three months of 2023 than all of 2021[5]. For China, Russia’s tightening market conditions allows China to negotiate as it sees fit and granting it a comfortable mix of scale and reliability of energy imports. But as global energy flows are being redirected amidst an energy transition, the ability of Russia to guarantee stable and scalable supplies to China are equally significant. Further the mix of nuclear and fossil energy cooperation allows for both countries to be equal partners. Certain narratives of China using Power of Siberia 2 to get Russia to comply with Chinese directives on India are overstated. Yes, the Russians will be constrained by their dependency on China in coming time especially for technology and capital. But with efforts to expand energy exporting infrastructure and finding new clients, including the emergence of India as a major Russian buyer, energy cooperation for Russia is unlikely to be a major influencing factor.

References

[1]China's Major Imports by Quantity and Value, December 2022 (in USD), http://english.customs.gov.cn/Statics/c05328ad-bfea-43f2-91a8-cde22887e53e.html

[2]Civilization Competition Civilization Competition Behind Energy Politics in Russia-Ukraine Conflict: Features and Suggestions, https://www.thepaper.cn/newsDetail_forward_22288283?utm_source=substack&utm_medium=email

[3]Explainer-Does China need more Russian gas via the Power-of-Siberia 2 pipeline?, https://kalkinemedia.com/ru/news/energy/explainer-does-china-need-more-russian-gas-via-the-power-of-siberia-2-pipeline

[4]Ibid, no.3

[5]China ramps up coal power despite carbon neutral pledges, https://www.theguardian.com/world/2023/apr/24/china-ramps-up-coal-power-despite-carbon-neutral-pledges

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://www.ifw-kiel.de/fileadmin/_processed_/6/2/csm_Xi_Putin_02_2022_C_President_of_Russia_853f67e93d.jpg

Post new comment