At the recently held triennial Forum of China-Africa Cooperation (FOCAC), China offered USD 60 billion to the African countries in the next three years. The amount is the same as promised in 2015 but the dispersal of the funds are different from the previous years. Over a period of time, China has increased its funds under FOCAC to Africa from USD 5 billion in 2006 to USD 60 billion in 2015.1

The 7th Forum of China-Africa Cooperation (FOCAC) was held in Beijing from 3-4 September 2018. A total of 53 countries from the African continent and the African Union participated in the summit. The FOCAC was launched in 2000. Since then it has become the cornerstone of Chinese investments in Africa. At the 7th FOCAC, the Beijing Declaration –“Toward an Even Stronger China-Africa Community with a Shared Future” and the FOCAC Beijing Action Plan (2019-2021) were adopted. According to the action plan, China will implement eight major initiatives for the African countries. The action plan covers fields such as industrial promotion, infrastructure, connectivity, trade facilitation and green development. 2

Dispersal of the Funds

According to Xinhua News Agency, the financing includes USD15 billion in grants, interest-free loans and concessional loans, USD 20 billion of credit lines, the setting up of a USD10 billion special fund for financial development and a USD 5 billion fund to help finance African imports. Chinese companies are also encouraged to make at least USD10 billion worth of investment in Africa over the next three years.31 Additionally, Xi Jinping waived the debt of some of the African countries. In 2015, China pledged USD 35 billion in interest-bearing loans and USD 5 billion in grants and interest-free loans, USD 5 billion for a special fund for development financing, USD 5 billion to the China-Africa Development Fund, USD 5 billion for the Special Loan for the Development of African Small and Medium Enterprises, and USD10 billion for the China-Africa production capacity cooperation fund.4

Dispersal of the fund exemplify that the component of USD 15 billion grants, interest-free loan and concessional loans have increased in the overall package. It means that China is providing USD 5 billion in concessional loans every year to African states. This is considered to be the largest amount announced by China. This is marginal in comparison with the overall foreign aid coming to Africa. The total grants and loans including loan and credit lines have declined from USD 40 billion in 2015 to USD 35 billion in 2018.5 The USD 20 billion credit line is no longer specifically confined to the export credit as it was in 2015. Furthermore, increasing Chinese concerns about the viability of its financing have led to removing the concessional loans from China’s composition of its fund. The main reason for this could be the increasing Chinese concerns about its returns and the commercial viability of the financing. The allocation of USD 10 billion special funds for financial development is indicative of a novel way of Chinese engagement in Africa6 Additionally, Chinese companies will be encouraged to invest USD 10 billion in Africa in the subsequent three years. Thus it is the Chinese companies and not the government that is expected to make the investment. China is encouraging the Chinese companies in Africa because the African states have urged for more investment in manufacturing and services. 7

Domestic Response to the Funding

According to the International Monetary Fund, the debt of China will increase as a proportion of its Gross Domestic Product; it would rise from 235 per cent to almost 300 per cent by 2022.8 Sanctioning of USD 60 billion to Africa has sparked off domestic criticism in China. Many Chinese citizens were unhappy with the aid and expressed that the money should be rather spent on the welfare schemes for the benefit of their citizens rather than outside the country. Sensitive posts, like, “China is a poor country as well…is there any country that can provide China with USD 60 billion in aid?”, were deleted from Chinese social media.9

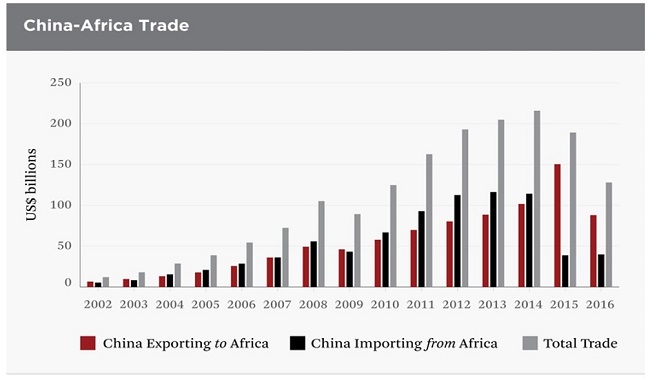

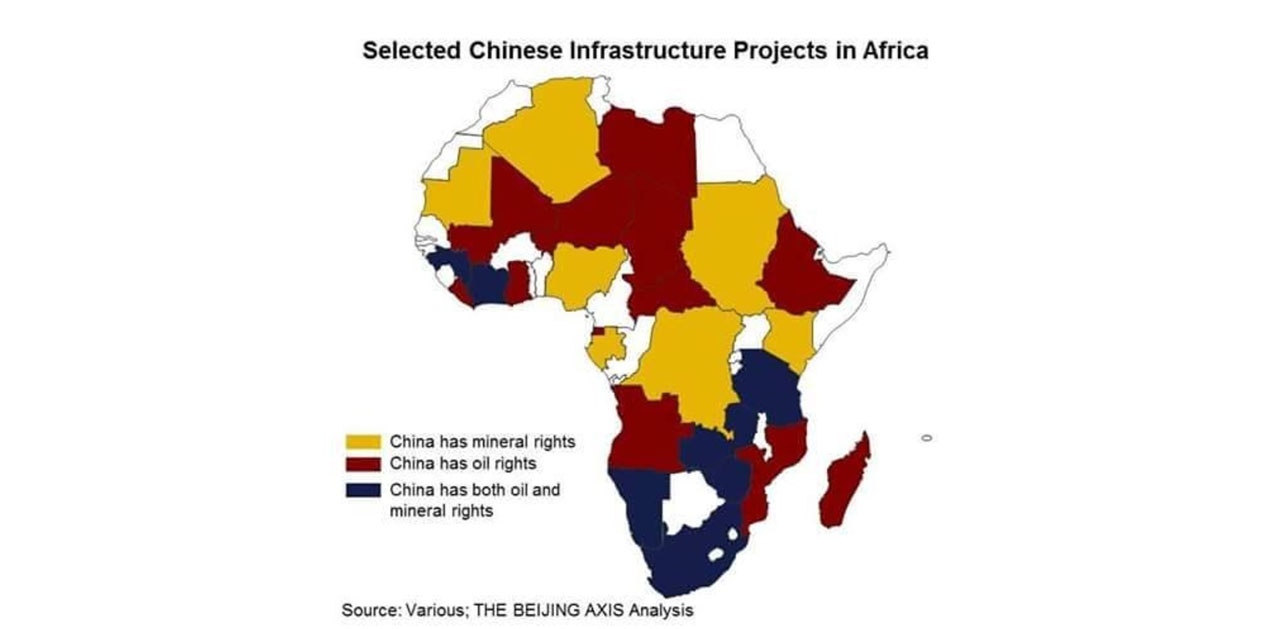

China’s increased appetite for energy and natural resources has enhanced its interest in the African continent. China’s primary imports from Africa are crude oil, gas, iron ore, copper, cotton, diamond. The exports comprise of machinery, electronics, textile, hi-tech product and finished goods. According to the Ministry of Commerce, China, the China Africa trade was USD 170 billion. China’s export to Africa was USD 94.74 billion and China’s imports from Africa were USD 75.26 billion in 2017.10

African Concern

According to the International Monetary Fund, in 2017-18 six of the Sub- Saharan African region’s 35 low-income countries (LIC) are in “debt distress,” and nine LICs are classifies as being at high risk of debt distress”. China is using the debt as a bargaining chip to take over strategic ports and get access to the oil in Angola, Kenya and Djibouti. China has offered lucrative infrastructure projects to the African countries in return for its increasing influence. Since 1983, China has given loan worth USD 60 billion to Angola. Instead of using cash, Angola pays China back with oil, which means that its ability to repay debt is dependent on the price of oil. China is buying more oil from Angola; it imported 1.05 million bpd from Angola in the first eight months of 2017. Overall, it imported 20 per cent of its crude oil from Africa. Notably, China is increasing its oil import from Angola to compensate for declining imports of natural gas from the US as well as the threat of the US imposing sanction on Iranian crude oil. In Djibouti, China has built its first overseas base. This has increased Djibouti’s overdependence on China. Until 2016, China owned 82 per cent of Djibouti’s foreign debt.11

During 2007-2017, China has given USD 143 billion in loans to Africa. Amongst all African countries, oil producing Angola is the top recipient of Chinese loan - USD 42.8 billion in 17 years.

Conclusion

China has emerged as a major creditor nation that is lending money to other countries for building their infrastructures or bailing out the countries. The Belt and Road Initiative will further expand China’s linkages with Africa. China is also trying to project itself as a dependable ally of Africa as compared to the US on the other hand. The US-Africa commercial relations are based on the African Growth and Opportunity Act. In 2017, the two-way trade was USD 39 billion, substantially lower than China-Africa trade.

Despite the growing domestic disquiet and a sluggish economy, through holding FOCAC on a grand scale China wants to showcase that it remains committed to its goal. By expanding trade with Africa, China is trying to reduce the risk from the ongoing China-US trade dispute. Given its own economic situation, it remains to be seen if China can actually deliver the promised funds without further pushing the African countries into the ‘debt trap’.

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct).

References

- https://www.odi.org/comment/10674-focac-2018-what-expect-next-weeks-china-africa-summit

- http://www.xinhuanet.com/english/2018-09/03/c_137441563.htm

- http://en.people.cn/n3/2018/0905/c90000-9497827.html

- https://www.washingtonpost.com/news/monkey-cage/wp/2018/09/17/xi-jinping-pledged-60-billion-for-africa-where-will-the-money-go/?utm_term=.3ca100932d71

- http://www.chinaafricarealstory.com/2018/09/chinas-focac-financial-package-for.html

- https://www.brookings.edu/blog/africa-in-focus/2018/09/05/chinas-2018-financial-commitments-to-africa-adjustment-and-recalibration/

- https://www.ft.com/content/fb7436d6-b006-11e8-8d14-6f049d06439c

- https://www.theguardian.com/business/2017/aug/15/imf-warns-china-debt-slowdown-financial-crisis

- https://www.ft.com/content/fb7436d6-b006-11e8-8d14-6f049d06439c

- http://english.mofcom.gov.cn/article/statistic/lanmubb/AsiaAfrica/201803/20180302719613.shtml

- https://www.axios.com/china-debt-africa-djibouti-kenya-angola-belt-and-road-initiative-c65b82fa-48a6-4140-bb01-bc19580a16c9.html

Image Source: https://johnjohns1.fjcdn.com/pictures/Africa+is+the+new+china_104df8_6627322.jpg

Post new comment