A special virtual edition of Vimarsh was organized on Global & Indian Economy in the Post-COVID era by the Vivekananda International Foundation on June 8, 2020. The public webcast brought together an eminent panel comprising of Sh. S. Gurumurthy, Chairman, VIF and Independent Director, Reserve Bank of India; Member of Parliament [RS] Sh. Rajeev Chandrashekhar, Vice Chairman, Centre for Economic Studies; Ambassador Prabhat P. Shukla, Distinguished Fellow, VIF and veteran diplomat; and Dr. Arvind Gupta, Director, VIF.

Dr. Gupta in his welcome address briefly focused on the massive disruption triggered due to the outbreak of COVID-19 pandemic. Countries across the world have been faced by an unprecedented challenge of battling both the health crisis as well as the impending threat of global recession. The Indian government has announced a special economic package of Rs.20 lakh crores in order to mitigate the immediate and long-term economic impact of the pandemic. The path for India’s recovery however needs to be charted out keeping in mind the uncertainty brought on by the pandemic. This Vimarsh session thus, comes at a crucial juncture and would take this valuable discussion about India’s future economic trajectory further.

Sh. Gurumurthy’s opened the discussion by reinstating the need for a new ‘post-COVID world order’. He said COVID-19 has only expedited the inevitable decline of the post-Cold War, sans-ideology, globalization-driven world order that created an unnatural mix and allowed for the rise of politically non-transparent, communist China, into the rules-based world market. Not only did this give an undue advantage to China for the past few decades, it also resulted in the decline of the multilateral trading order, beginning with the US-China trade war in 2017. This Pandemic now has exposed the fragility of such an order that mixes an autocratic polity and a democratic liberal market-based economic system.

In the evolution of a new, post-COVID world order, India – due to its vast demography and strategic location – has a crucial role to play, and its economic trajectory should be shaped keeping this is mind. Sh. Gurumurthy raised questions over the global financial and monetary order that focused on Central banks pumping unchecked liquidity for reviving economies following the 2008 Global Financial Crises. He contrasted this with the Indian government’s special economic package that has been conservatively funded by encouraging borrowings from commercial banks, without impinging on the Government’s balance sheet.

Discussing the post-COVID roadmap for the Indian economy, Sh. Gurumurthy put forth the following policy suggestions for the Government:

- Managing the post-crisis recovery by invoking the Contingency fund provision under Article 267 of the Indian Constitution, for mitigating the economic impact of the extraordinary situation and provide further stimulus when the need arises.

- Constitute a special ‘COVID Financial Management Trust’, to issue interest-free bonds to the RBI, payable over the next 15-20 years. The funds so raised to be used for rebuilding the economy. Government to commit to the RBI for repaying Rs.1.0-1.5 lakh crores from the consolidated fund of India each year for this.

- Prudential rules meant for normal times to be done away with during the crises times, in order to protect viable units from failing during this time and prevent capital losses. The Central banks and Reserve Bank have to carry out one-time clear restructuring of loans for enabling businesses to be viable again.

- Formation of a Gold Monetization Plan, with a provision for one-time, tax-exempted deposition of undeclared gold holdings to incentivize gold-backed lending. This would boost influx of liquidity into the economy.

- Formation of an alternate economic model to replace the failing globalization-based model. Reworking supply chain networks for maximizing gains for India in the post-COVID world.

Rajya Sabha MP and member of Parliamentary Consultative Committee on Finance, Sh. Chandrashekhar began by putting forth the most urgent economic challenges facing the government in the post-COVID world. The Indian economy is estimated to contract by Rs. 17.5-Rs.22 lakh crores in 2020-21 due to the pandemic. The government thus has to protect the hard-hit businesses, jobs, and markets from this disruption, and work towards ensuring revival of investments and consumption, and rebooting supply chains to put the economy back on its growth trajectory.

This however is hindered by legacy problems in the financial sector. While the government has undertaken significant steps in the last six years to reform the sector, considerable mistrust between firms and banks remain that hinders the flow of credit. Despite holding liquidity of Rs.10 lakh crores, banks are risk averse and are bound by stringent NPA norms. On the other hand, enterprises either have little or no appetite to make new investments, or face the risk of being declared as NPAs due to non-availability of credit. To add to this, credit intermediaries such as non-banking financial corporations (NBFCs) are also facing liquidity issues further exacerbating the credit market crisis.

For this, he posits, the government requires to formulate a new economic model for bringing about deeper structural reforms, customized for the Indian scenario. Policies need to be geared towards boosting enterprise confidence for encouraging new investments and generating employment opportunities. Ensuring liquidity reaches the market is essential for rebooting the economy, and Sh. Chandrashekhar reiterated Sh. Gurumurthy’s suggestion of revision of prudential norms for borrowers and specific sectors in the post-COVID times. These policy objectives are crucial to be undertaken in the next 10-12 months, for leveraging emerging global opportunities and building a globally competitive and Self-reliant or Aatmanirbhar India.

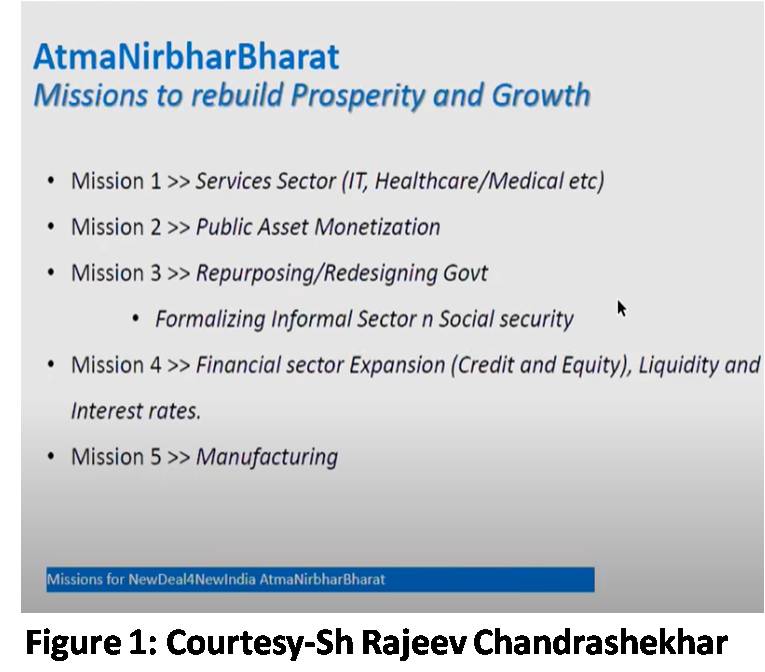

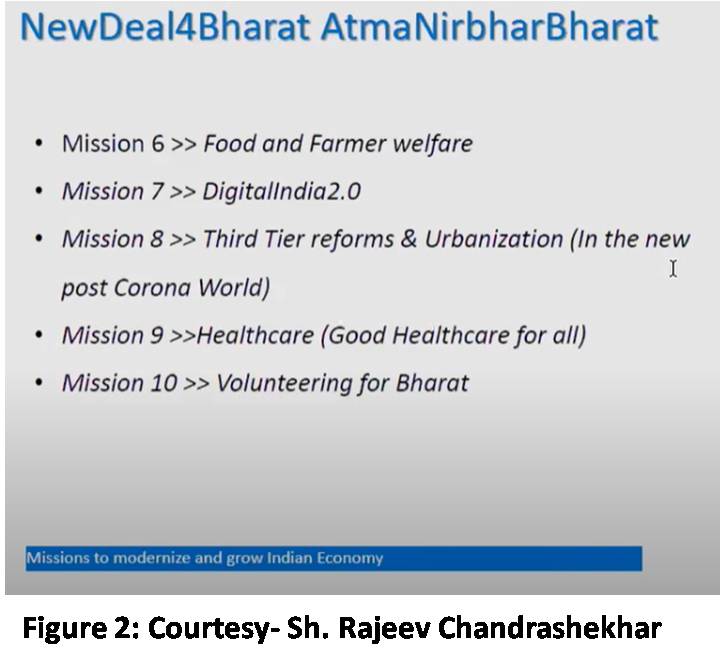

Further, Sh. Chandrashekhar also put forth his vision for the post-pandemic New Deal for Bharat, for the next decade (2021-31):

- Post COVID-19 Shock – the decade of Aatma Nirbhar Bharat:

- India will invest to protect and grow its economy

- India will reform and modernize its Government, Economy

- India will develop its own economic model of global competitiveness and Self-Reliance

- India will achieve AatmaNirbhar Bharat using spirit and hard work of its people and finance it through enormous natural resources and wealth

- In order to realize AatmaNirbhar Bharat, he identified the following long-term policy objectives for the Government of India :

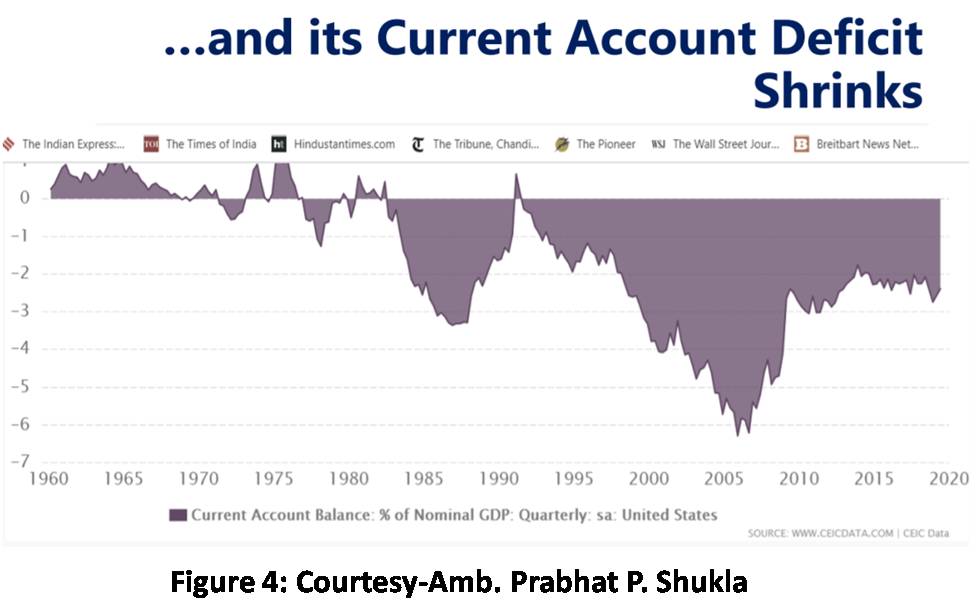

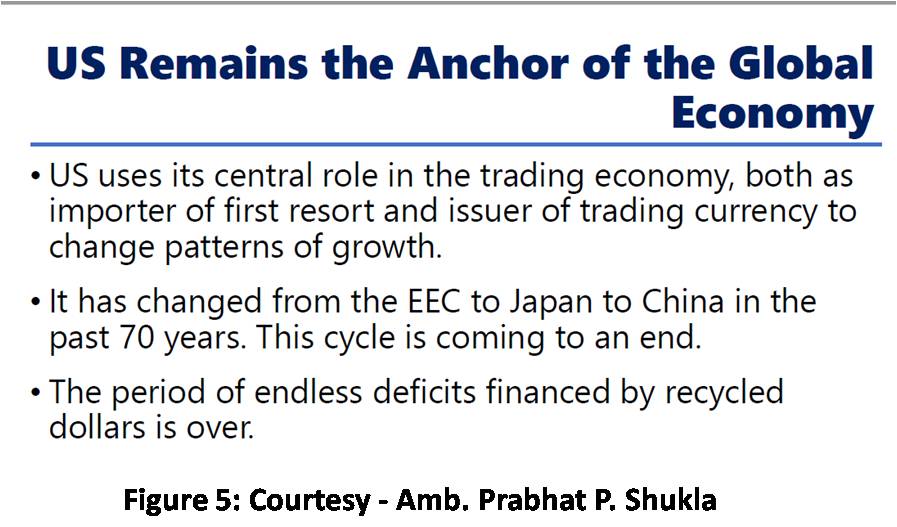

Amb. Shukla’s presentation focussed on changing nature of global economy and its implications for India in the post-COVID scenario. He began by highlighting the centrality of the United States and its role as the driver and consumption base for the global economy. He explained the decline in global trade in relation to the rise of domestic savings rate in the U.S. and its shrinking Current Account Deficit. (Fig. 3&4)

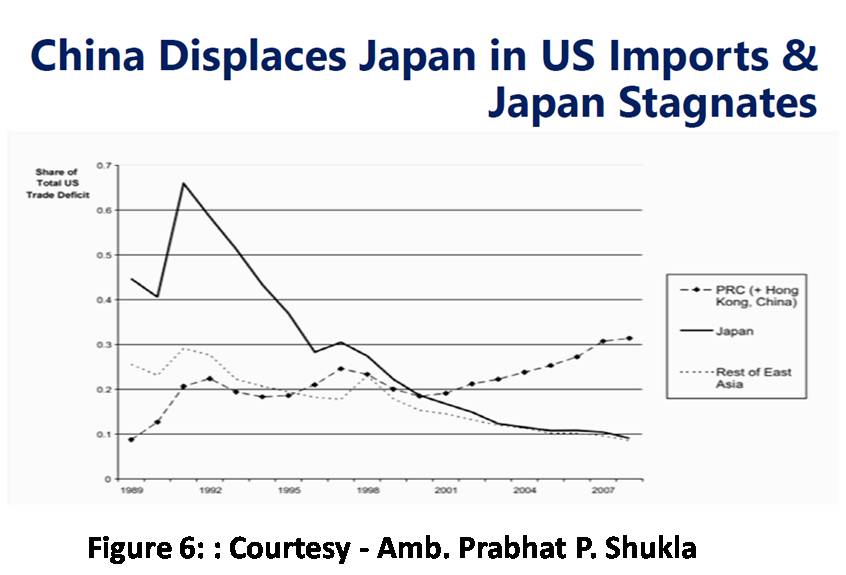

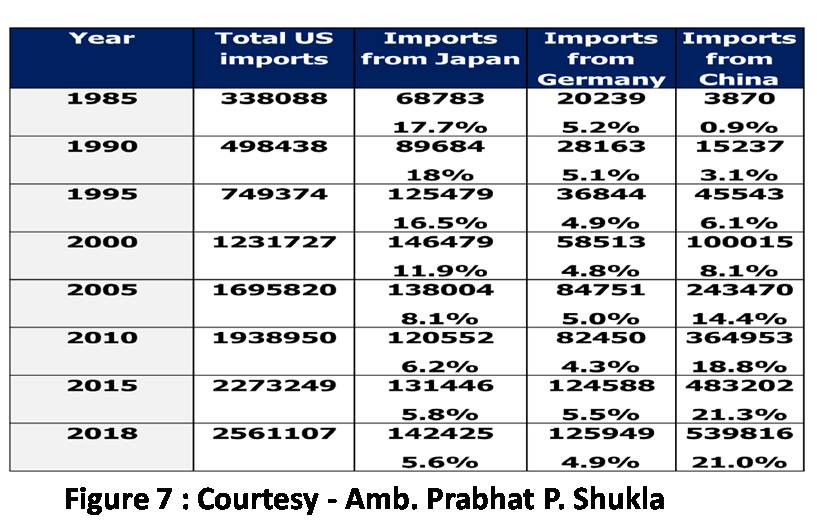

On the Chinese economy, Amb. Shukla pointed out that China has been following the British strategy of circulating and internationalizing its currency by investing abroad through its BRI project. He correlated the Chinese economy’s rapid rise with its exports forming a high share in total imports of the U.S. (Fig 5,6&7)

He further listed the challenges that have arisen in the global economy as a result of a loose monetary policy, financialization and unsustainable levels of global debt:

- A stagnation in aggregate demand, as the middle classes have lost purchasing power. Growing inequality.

- Some $15 trillion of bonds – the total global bond market is approximately $100 trillion - have been bought with negative yield.

- Another has been continued rise in global debt [$250 tr] and derivatives [$640 tr] – debts that cannot be repaid.

- Asset bubbles in several sectors.

- The US response, and of most of the world, has been quantitative easing – since 2008, the Fed has raised its balance sheet $4.5 tr, then drew it down, and raised it again to $4.7 tr. With its fresh pledge of $2.3 tr, it will end up with $7 trillion – a record.

- The result of similar monetary policy has been the Liquidity Trap in Japan, and early signs that the US is on its way.

He further pointed out that the process of US-China economic de-coupling actually started well-before POTUS Trump’s tenure, right after the 2008 global financial crisis. In the years hence, China has been making efforts to stimulate ts domestic demand to reduce dependence on the US. He further highlighted the implications of these major risks facing the global economy in the post-COVID times. Amb. Shukla stressed that due to decline in global demand, it is imperative for India to leverage the strength of its enormous domestic consumer base. His policy recommendations for battling post-COVID economic disruption and reviving growth focused on the following:

- Supply side well taken care of, but other aspects, especially aggregate demand, need to be addressed. It is an error to base policy on the view that supply will stimulate its own demand. One Great Depression and one great book disprove this postulate, known in the theory as Say’s Law.

- First, therefore, address the stagnant demand. This has been a problem since 2017, and is related to the squeeze on the cash economy.

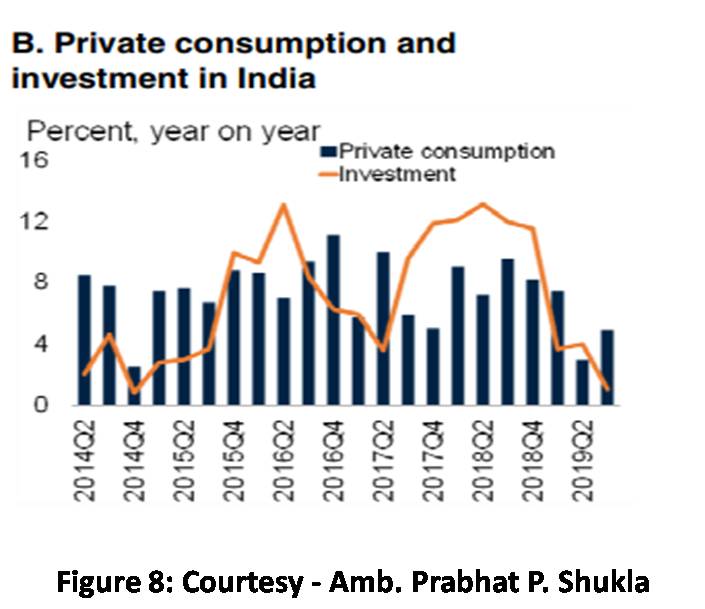

- Link between consumption and private investment (Fig 8)

- Bring the cash economy into the main through-

- amnesty [with a reasonable penal tax rate];

- reduction of income and property –related taxes; and then ;

- phase out the high denomination notes over a period of a year or more, so as to cover at least one budget

- Do not weaken the Rupee by deliberate policy. It is a fallacy that this promotes exports.

- We have to let go of the FRBM constraints; the ratings agencies will do a downgrade, but that can be overcome with domestic policy changes.

- Raise tariffs, because we need some protection at this stage of development.

- Good economics and good environment policies demand control on population growth.

- Agricultural reforms seem too point in the right direction, but we need to see how they work in practice over time.

- Set up large-scale SEZ’s for FDI, with quality infrastructure with relaxation on labour laws. This will be a demonstration for the rest of the country that easing labour laws will actually increase employment.

- The SEZ’s are needed to maintain some level of exports – to meet essential import requirements, like energy and certain capital goods.

- Join TPP 11; China has expressed openness to joining. Once, and if, they join, they will shut the door on us, as in UNSC and NSG.

The presentations were followed by a questions and answers round where audience members further deliberated and contributed to the vital discussion.

Post new comment