The Vivekananda International Foundation organized a virtual interaction with Dr. V. Anantha Nageswaran to discuss the Special Economic “Atmanirbhar Bharat” Package announced by the Government of India in the wake of COVID-19. Dr. Nageswaran is a member of the Prime Minister’s Economic Advisory Council. He is a Distinguished Fellow at VIF and a senior economist with a vast body of work in the financial and management sector.

Dr. Nageswaran began by emphasizing that the uncertainty brought on by the pandemic has challenged all existing notions of economic policymaking and all relief measures should be understood in this context. The mobility restrictions and lockdowns imposed by Governments around the world thwarted economic activity leading the global economy to the verge of massive recession. In India too, the stringent lockdown lasted almost two months, and has effectively placed the Government at the helm as the sole actor to drive growth and revive the economy. The Government announced Rs. 20 lakh crores worth Atmanirbhar package which encompasses a series of structural reforms, along with emergency credit facility.

Timing & Size of Package

According to Dr. Nageswaran, the Government employed a cautious approach while formulating the package, both in terms of timing (~ 6 weeks after the lockdown was imposed) and in terms of its magnitude (~1% of GDP as per various agencies). It is important to understand however, that the already high fiscal deficit levels preceding the outbreak of the pandemic (4.4% in 2019-20) combined with loss of revenue from GST collections and disinvestments, left little room for the government. A larger package amounting to 4-5% of GDP would have bloated the fiscal deficit to extremely high levels (~15% of GDP), shooting up the Government bond yields higher.

Emergency Credit Facility

The emergency credit facility announced is, according to Dr. Nageswaran, the most important component of the package. This arrangement provides immediate support to MSMEs in the country in the short run which enables them to stay afloat during the pandemic. The Government of India would also have to undertake recapitalisation of these credit trust guarantee corporations, taking the spending higher by about Rs. 3.2lakh crores. Dr. Nageswaran suggested that this scheme should also be extended to firms with >Rs.100 crores turnover. The scheme also needs to be rolled out much quickly. The interest rate cost of borrowing also needs to be brought below the current borrowing costs to make the scheme effective, he added.

Financial Sector Reforms

According to Dr. Nageswaran the package should have included announcements of reforms in the financial sector, which is suffering from long-standing legacy problems and NPAs. The Indian economy is largely bank credit-driven and cannot completely become self-reliant without a healthy functioning financial sector. The credit market and financial sector in India has been facing twin challenges of low demand (companies not willing due to low aggregate demand) and deficient supply (due to risk aversion from the banking side) that need to be addressed at a priority.

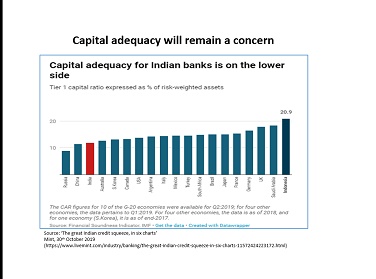

Additionally, the NBFC support scheme need to be extended beyond the three-month period announced in order to induce trust from the banks’ side. The Indian financial sector also has low capital adequacy compared with others (Fig) which can give rise to other issues in the future and delay revival.

Dr. Nageswaran concluded by reiterating that India has so far managed to maintain a low rate of mortality from the pandemic compared to several other countries. This he says, should signal to the policymakers that economy should be reopened gradually as long as proper precautions are in place, and those at a higher risk are adequately cared for.

The talk was followed by a questions and answers round where participants further deliberated and contributed to the vital discussion.

Post new comment