Over the last 10 years, India has witnessed phenomenal growth in the digital payments’ domain. In terms of volume, the total number of digital transactions have increased from a mere 162 crores during Financial Year (FY) 2012-13 to over 16,443 crore transactions during FY 2023-24, which is more than 129 times increase. [1] The Department of Payment and Settlement Systems (DPSS) of the Reserve Bank of India (RBI) recorded a growth of 44 percent in terms of transaction volume during the FY 2023-24. [2] At present, over 30 crore individuals and over 5 crore merchants in India use digital payment systems and more than 40 percent of all payments are done digitally. [3] In terms of value, total digital payments increased from Rs. 1,370 lakh crores during FY 2017-18 to Rs. 2,428 lakh crores during FY 2023-24. [4] It is projected that by FY 2025-26, India’s digital payments market will reach US$10 trillion and digital payments will account for 2 out of 3 payment transactions. [5] The introduction of 5G/6G networks, Internet of Things (IoT), and Central Bank Digital Currency (CBDC) will further provide impetus to the growth of digital payments in India.

Currently, India leads the world in digital payments. Digital payments in the country account for nearly 46 percent of the world’s digital transactions and it is expected to retain the position by 2028. [6]India is followed by Brazil, China, Thailand, and South Korea. This remarkable growth of digital transactions in India has provided several benefits. It fosters economic development, it leads to innovation in the FinTech sector, it promotes financial stability, it supports financial inclusion, it enhances transparency in government systems, and it provides valuable data for informed decision-making. [7] That has strengthened the Indian economy by transforming its informal economy into a more formal and knowledge-based economy. It also drives sustainable growth and improved ease of doing business and ease of living in the country. The RBI in its Annual Report 2023-24 underscored these transformative impacts of digital payment innovations. [8] Persons, merchants, small and big, have fast adopted the opportunities presented by the continuously evolving digital payment ecosystem in India. Consequently, Person-to-person (P2P) and Person-to-merchant (P2M) transactions have grown significantly in terms of volume and value. Several enabling factors like digital India campaign, internet adoption, mobile phone use, opening of bank accounts, FinTech innovation, digital literacy, UPI (Unified Payments Interface) adoption, etc. have all contributed to the rapid growth of digital payments in the country. With the 10 years’ completion of the Modi government, this paper highlights 10 key factors that significantly contributed to the growth of digital payments in India, which helped India emerge as “the world leader in digital payments”.

Digital India Programme

The Modi government in July 2015 launched the Digital India (DI) programme with an aim to transform India into a digitally empowered society by infusing digital technologies into the public service ecosystem with the use of Information Technology (IT) and to make India adept at emerging technologies to transform the country into a leading knowledge-based economy. [9] The DI programme focussed on three main vision areas: “digital infrastructure as a core utility to every citizen, governance and services on demand, and digital empowerment of citizens.” [10] The DI campaign has played a key role in promoting digital transactions, fostering increased awareness among users, and encouraging acceptance of digital payment solutions. In August 2023, the Indian government approved the extension of the DI programme with a total outlay of Rs. 14,903.25 crore, covering the period from 2021-22 to 2025-26, which will further expand the digital payments across the country. [11] The DI’s vision of a “faceless, paperless, and cashless” economy is gradually translating into easier access to various services and digital platforms.

Rapid Internet Adoption

The DI campaign has led to rapid internet adoption across socio-economic structures of India. As the second largest base of internet users, after China, India was quick to adopt financial technology. The internet market in India is a game-changer for the economy. The setting up of necessary digital infrastructure with affordable data plans, there is now a total shift to the digital ecosystem in the country. Since 2014, broadband connections have grown substantially up from 61 crore in 2014 to 83.22 crore in 2023 as on 31 December 2022. There was an impressive 200 percent increase in internet subscriptions in rural areas and a 158 percent increase in urban areas between 2015 and 2021. [12] The objective was to ensure the easy availability of high-speed internet to all the citizens. This growth can be attributed to the success of India’s ‘Digital India’ programme. Currently, India has more than 836 million active internet users. By 2025, that could reach over 900 million. With the 5G auction in mid-2022 and the largest rural broadband connectivity network project at ‘Bharat Net’, it aims to connect more than 400 million users in the near future and bring the number of people having access to the internet to more than 1.2 billion. [13] This will bridge the digital divide in the country and improve digital literacy. This will improve digital affordability, accessibility, connectivity, and inclusivity across India. This in turn will help in realising the vision to digitally empower every citizen, as the country marches ahead with the vision of ‘Techade’, a period, 2021-30, dedicated to achieve all-round technology development in India.

Bank Accounts to Every Citizen

The Pradhan Mantri Jan Dhan Yojana (PMJDY) was launched in August 2014 as the National Mission for Financial Inclusion to ensure access to financial services such as Banking Savings & Deposit Accounts, Remittance, Pension, Credit, and Insurance in an affordable manner. The PMJDY aims to ensure access to financial products and services at an affordable cost; use of technology to lower cost and widen reach; and, basic tenets of the scheme. As on 29 November 2023, a total of 51.04 crore PMJDY accounts were opened having a deposit balance of Rs. 2,08,855 crores. [14] This rapid growth of bank accounts suggests a move towards financial inclusion of marginalized groups within the country from women, to the out-of-labour force, street vendors, the less educated and the poor. During the Covid-19 pandemic, financial assistance and food aid were provided to vulnerable sections of the society under the Prime Minister Garib Kalyan Scheme. The PMJDY account-holders received Direct Benefit Transfer (DBT) from the government which ensured every rupee reaches the intended beneficiary. India’s use of FinTech to directly transfer benefits to its citizens has been well recognised and received by the international community. For instance, praising India’s DBT programme that helped 85 percent of rural households and 69 percent of urban households during the pandemic, World Bank President David Malpass asked other nations to adopt India’s approach of targeted cash transfer. [15] And last year, G20 member countries welcomed India’s plan to build and maintain digital infrastructure to benefit from India’s success story. Therefore, the introduction of Aadhaar, a 12-digit number that serves as a biometric identity, and opening of bank accounts not only helped the government to transfer subsidies directly to the beneficiaries’ accounts, but also helped bring a large section of the people into a formal economy. The DBT via PMJDY account has been a significant achievement for the country that improved financial inclusion and cut leakages in access to government services. This paved the way for a rapid growth of digital payments in the country.

Use of Mobile Phones

At present, India has over 1.2 billion active mobile phone users and 600 million smartphone users. [16] It is estimated that by 2040, the number of mobile phone users in India will reach 1.55 billion.[17] This rapid growth of mobile phones has provided a convenient platform for digital payment services, making UPI, quick response (QR) codes, mobile wallets, mobile banking and other mobile apps more accessible to a growing number of users in India. The Jan-Dhan-Aadhaar-Mobile or JAM trinity connects bank account, Aadhaar, and mobile phone number, enabling direct cash transfer of subsidy to the beneficiaries. So far Rs. 34 lakh crores, which is more than US$400 billion, has been deposited directly into the bank accounts of the beneficiaries through this system. [18] The JAM trinity thus accelerated financial inclusion in the country.

FinTech Innovation

FinTech companies have introduced innovative digital payment solutions like UPI and RuPay offering users diverse and user-friendly options, from mobile wallets to P2P and P2M payment platforms. FinTech strengthened India’s Digital Public Infrastructure (DPI) or the India Stack, a unified software platform established through a public-private partnership. During the Covid-19 pandemic, the CoWin app also helped the government to execute the world’s largest vaccination drive. The app enabled to administer more than 220 crore Covid vaccine doses across the country. The use of FinTech thus reduces corruption, fosters inclusivity, enhances transparency, and boosts public confidence in the government. [19] Notably, FinTech adoption rate in India is 87 percent as against the global average of 64 percent. It shows that FinTech is playing an important role in financial inclusion and empowerment of every citizen across the country. [20] With FinTech innovation, deployment and rapid adoption, India has emerged as one of the largest digital markets in the world.

Digital Literacy Campaign

Keeping in view of deploying digital technologies to transform the people’s lives and further aid faster digital adoption, the Indian government has focused on providing digital literacy to every citizen across the country, especially in rural areas since 2014. During the years 2014 to 2016, two schemes namely “National Digital Literacy Mission (NDLM)” and “Digital Saksharta Abhiyan (DISHA)” were implemented with a target of training 52.50 lakh persons (one person from every eligible household). A total of 53.67 lakh persons were trained under these two schemes, out of which around 42 percent were from rural India. Under the scheme “Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA)”, which was approved in 2017 with a target of covering 6 crore rural households (one person per household) across the country, so far more than 6.62 crore were enrolled, out of which 5.68 crore persons have been trained. [21] The digital literacy campaign significantly contributed to the growth of digital payments in India. The RBI has also been conducting Electronic Banking Awareness and Training (e-BAAT) programmes regularly across the country; Digital Payments Awareness Week (observed during 4-10 March 2024); and Mission ‘Har Payment Digital’ in order to encourage customers to adapt to digital banking. The regional offices of the RBI conducted 340 e-BAAT programmes in FY 2023-24, where the usage of digital payment systems, their benefits and grievance redressal mechanisms were explained to the user community. The RBI also launched ‘75 Digital Villages’ programme in observance of 75 years of Independence. Moreover, the RBI conducts public awareness campaigns under the tag of ‘RBI Says’ to create awareness about various digital payments systems and initiatives that “cover customer’s safety, security and convenience.” [22]

Availability of Digital Resources across the Country

With the vision of developing digital infrastructure as a core utility for every citizen, the Digital India programme was launched in 2015. Under the programme, the digital infrastructure, also known as the India Stack, a collection of digital platforms such as Aadhaar scheme, DigiLocker, E-Hospitals, E-Pathshala, DigiYatra, UPI, and other technologies were developed and deployed through collaboration between the government, private sector, startups, and academia. The availability of these digital infrastructure across the country contributed significantly to the growth of digital payments in India and built a digital economy. The digital economy empowers every individual and business to transact “faceless, paperless and cashless”. The underpinning of India’s digital transformation thus lies in building digital infrastructure across the country to ensure ease of living.

Faster UPI Adoption in India

UPI, which was launched in 2016, has revolutionized P2P and P2M digital payments in India. It has recorded phenomenal growth both in terms of volume and value of transactions in recent years (See Table 1). UPI transactions in terms of volume have grown from 92 crores in FY 2017-18 to 8,375 crores in FY 2022-23 at a CAGR of 147 percent. The transaction volume reached an all-time high of 13,115 crores in FY 2023-24. In terms of value, UPI transactions have grown from Rs. 1 lakh crore in FY 2017-18 to Rs. 139 lakh crores in FY 2022-23 at a CAGR of 168 percent. [23] The total value of UPI transaction reached Rs. 199.87 lakh crore in FY 2023.24. UPI, which on-boarded 572 banks in March 2024, has emerged as the most popular and preferred payment system in India. It has transformed the digital payments ecosystem in India.

Therefore, UPI with its user-friendly nature, safety, security, and real-time feature has emerged as the most popular payment method for seamless and fast fund transfers between P2P and P2M. By allowing payments through a Virtual Payment Address (VPA), QR code scanning or phone number authentication, UPI not only ensures convenience and ease of use but also quick, smooth and secure transactions, while incurring no additional fees. It contributes to financial inclusion and transparency. It is projected to dominate the payments system in the country as the NPCI, established as an initiative by the RBI and the Indian Banks’ Association (IBA), aiming for 15-20 billion monthly digital transactions by volume. It is expected to facilitate over half of all digital payments in India by the end of 2024. In addition, international remittances and merchant payments will further boost UPI adoption in coming years.

Discounts, Cashbacks and Incentives

Digital payment platforms like PhonePe, Google Pay, Paytm, Amazon Pay, Flipkart, etc. are attracting users with discounts, cashbacks, and incentives have contributed to the widespread adoption of these payment platforms, creating a mutually beneficial scenario for both consumers and service providers. The NPCI is also offering cashbacks and incentives from time to time for promoting its digital payment platforms such as RuPay[24] and Bharat BillPay. [25]

Digital or E-commerce Growth

The flourishing of the digital commerce sector has been significantly driven by the surge in digital payments in the country. The total digital transaction value of digital commerce increased from US $ 78.67 billion in 2017 to US $ 211.30 billion in 2024. [26] Indian households are playing an important role in the growth of e-commerce as 80 percent of transactions are done for buying food, groceries, household goods, and travel. Amidst growing online shopping activities, India’s FinTech innovations have provided safe, secure and easy payment options. Hence, with the convenience of mobile phone payments, the value of digital commerce in India will further increase. Looking at these trends, the RBI predicts that P2M transactions would constitute 75 percent of all UPI transactions by 2025. [27]

Therefore, these enabling factors are driving the growth of digital payments in India. The rolling out of the digital initiatives from time to time have brought faster changes and helped build new economic structures in the country. In the last 10 years, several initiatives were undertaken to promote digital transactions and build a robust digital payments ecosystem in India, which include advisories issued to various stakeholders to improve payment acceptance infrastructure; allocation and monitoring year-wise digital payment transaction done; PMGDISHA was launched to augment digital literacy in rural India; and, numerous promotion activities conducted with digital payment stakeholders.[28]

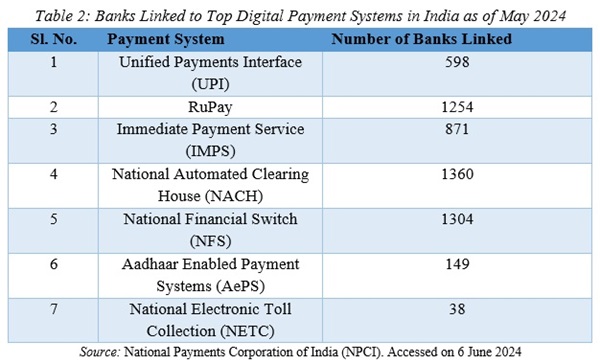

Notably, NPCI, RBI, and Indian Bank’ Association (IBA) are facilitating various modes of digital payment transactions in India, while the NPCI provides necessary infrastructure for the digital payment systems. The major digital payment methods in India include UPI, RuPay, Immediate Payment Service (IMPS), Aadhaar Enabled Payment Systems (AePS), National Automated Clearing House (NACH), National Financial Switch (NFS), and National Electronic Toll Collection (NETC) system. A large number of banks are linked to these digital payment methods (See Table 2).

In addition, there are pre-existing payment methods such as credit cards, debit cards, National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS). The investments in FinTech innovations and emerging trends in digital payments have therefore created a highly competitive digital payment market in the country. PhonePe, GooglePay, Paytm, and Amazon Pay have emerged as popular FinTech companies in the digital payment sector. They have steadily moved towards localizing their products by providing services in multiple Indian languages. [29]

Over the last 10 years, therefore, India’s digital payments system has undergone a significant transformation and witnessed one of the most remarkable digital revolutions, especially considering the way the financial transactions are done in this country. With the government’s push towards a digital economy, the digital infrastructures are built under the Digital India programme which led to a landmark shift in India’s digital payment landscape. The digital payments are now omnipresent in the everyday life of India and have dramatically changed customer and merchant behaviour in the country. This has brought notable changes in India’s economy, enabling it to leapfrog from a cash-centric economy to a “Digitally Empowered Economy” and rapidly moving towards a cashless society. Hence, having built one of the largest digital payment ecosystems in the world, India is poised to become the third largest economy in the next five years from its present position as the fifth largest economy, where digital payments are going to play a critical role.

References

[1] Annual Report 2023-24, Reserve Bank of India (RBI), Government of India (GoI), Delhi, 2024, p. 164; and, “Address by Governor, Reserve Bank of India at the Digital Payments Awareness Week celebrations,” RBI, GoI, Delhi, 24 March 2024 at Reserve Bank of India - Speeches (rbi.org.in). Accessed on 14 June 2024

[2] Annual Report 2023-24, RBI, GoI, Delhi, 2024, p. 162.

[3] “India’s UPI: A Global Front-runner in Digital Payment Systems”, Press Information Bureau (PIB), GoI, Delhi, 30 October 2023, at Press Information Bureau (pib.gov.in). Accessed on 14 June 2024

[4] Annual Report 2019-20, RBI, GoI, Delhi, 2020, p. 188; and, Annual Report 2023-24, RBI, GoI, Delhi, 2024, p. 164.

[5] “Digital Payments in India: A US$10 Trillion Opportunity”, Boston Consulting Group (BCG), in association with PhonePe, India’s leading digital payments company, June 2022, at future-of-digital-payments-in-india.pdf (bcg.com). Accessed on 21 June 2024

[6] “India’s UPI: A Global Front-Runner in Digital Payment Systems”, PIB, GoI, Delhi, 30 October 2023 at pib.gov.in/PressReleaseIframePage.aspx?PRID=1973082&ref=indiatech.com. Accessed on 30 June 2024

[7] “Digital Revolution: Transforming India’s Economy through Digital Transactions”, PIB, GoI, Delhi, 21 May 2023 at https://static.pib.gov.in/WriteReadData/specificdocs/documents/2023/may/doc2023521200801.pdf. Accessed on 6 June 2024

[8] Annual Report 2023-24, RBI, GoI, Delhi, 2024, pp. 162-177.

[9] Saroj Bishoyi, “Technology, Geopolitics and India’s Quest for Tech Self-Reliance”, VIF Paper, Vivekananda International Foundation (VIF), New Delhi, April 2024, pp. 33-34.

[10] “Achievements Made under Digital India Programme”, PIB, GoI, Delhi, 23 December 2022 at Press Information Bureau (pib.gov.in). Accessed on 14 June 2024

[11] “Expansion of Digital India Programme”, Unstarred Question No.2782, Lok Sabha, 20 December 2023 at https://sansad.in/getFile/loksabhaquestions/annex/1714/AU2782.pdf?source=pqals. Last accessed on 5 June 2024

[12] “India’s Techade: Broadband Connections Grow Exponentially”, PIB, May 24, 2023 at https://static.pib.gov.in/WriteReadData/specificdocs/documents/2023/may/doc2023524202601.pdf. Accessed on 7 June 2024

[13] Note 9, p. 46.

[14] “51.04 Crore Pradhan Mantri Jan Dhan Yojana (PMJDY) Accounts Opened with Deposit Balance of Rs. 2,08,855 Crore”, PIB, GoI, Delhi, 12 December 2023 at

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1985619. Accessed on 7 June 2024PI

[15] “How Direct Benefit Transfer Became India’s Booster During Pandemic, and Why World Bank is in Awe”, News18, 6 October 2022 at How Direct Benefit Transfer Became India’s Booster During Pandemic, and Why World Bank is in Awe - News18. Accessed on 20 June 2024

[16] “India has over 1.2 bn Mobile Phone Users: I&B Ministry”, Mint, 16 November 2022, at

https://www.livemint.com/technology/gadgets/india-has-over-1-2-bn-mobile-phone-users-i-b-ministry-11668610623295.html. Accessed on 7 June 2024

[17] Number of Smartphone Users in India in 2010 to 2023, with Estimates until 2040(in millions), at https://www.statista.com/statistics/467163/forecast-of-smartphone-users-in-india/. Accessed on 7 June 2024

[18] “English Rendering of PM’s Remarks at the Launch of UPI Services in Sri Lanka and Mauritius”, PIB, GoI, Delhi, 12 February 2024 at https://pib.gov.in/PressReleseDetail.aspx?PRID=2005229. Accessed on 6 June 2024

[19] Ibid.

[20] “GIFT City to be the Gateway for India’s Vision to Become Developed Nation by 2047, says Union Finance Minister Smt. Nirmala Sitharaman at the 10th Vibrant Gujarat Global Summit in Gandhinagar”, PIB, GoI, Delhi, 11 January 2024 at pib.gov.in/PressReleaseIframePage.aspx?PRID=1995103. Accessed on 14 June 2024

[21] “Digital Literacy Mission”, PIB, GoI, Delhi, 21 December 2022, at

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1885365. Accessed on 13 June 2024.

[22] “UPI Transactions Grew from ₹ 1 Lakh Crore in FY 2017-18 to ₹ 139 Lakh Crore in FY 2022-23 in Value, at a CAGR of 168%”, Ministry of Finance, GoI, Delhi, 18 December 2023 at

https://pib.gov.in/PressReleseDetail.aspx?PRID=1987764. Accessed on 6 June 2024

[23] Ibid.

[24] “RuPay Credit & Debit Cardholders can now Avail 25% Cashback on in-Store Purchases in Canada, Japan, Spain, Switzerland, UAE, UK and USA”, the offer will be valid from 15 May 2024 to 31 July 2024, at NPCI-Press-Release-RuPay-Credit-and-Debit-Cardholders-can-now-avail-25-cashback-on-in-store-purchases1-in-Canada.pdf. Accessed on 14 June 2024

[25] See “NPCI Bharat BillPay onboards Disney+ Hotstar as a new Biller under Subscription Category”, NPCI, GoI, at NPCI-Bharat-BillPay-onboards-Disney-Hotstar-as-a-new-Biller.pdf. Accessed on 14 June 2024

[26] “Digital Payments – India”, Statista Market Insights, March 2024 at Digital Payments - India | Statista Market Forecast. Accessed on 20 June 2024

[27] “P2M Transactions To Constitute 75% of UPI Transactions by 2025: RBI bulletin”, Money Control, 20 October 2023 at P2M transactions to constitute 75% of UPI transactions by 2025: RBI bulletin (moneycontrol.com). Accessed on 20 June 2024

[28] Note 22.

[29] “Digital Payments in India - Statistics & Facts”, Statista, 21 December 2023 at https://www.statista.com/topics/5593/digital-payment-in-india/#topicOverview. Accessed on 7 June 2024

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://media.licdn.com/dms/image/C5112AQHUgnYzLZFzrw/article-cover_image-shrink_600_2000/0/1572953249284?e=2147483647&v=beta&t=A_GoOK8Cn093eUx3dSF2wpi1t_G8GZRcCJTK_sIp8oU

Post new comment