The Indian stock market has experienced a remarkable surge in market capitalization, expanding from USD 1.1 trillion in December 2013 to USD 4 trillion in December 2023. This extraordinary growth signifies a fourfold increase within the last 10 years, indicating a noteworthy compound annual growth rate of 17.5% for all companies listed on the National Stock Exchange (NSE). The attainment of a market capitalization exceeding $4 trillion stands as a substantial milestone for the Indian economy in the realm of stock markets.

In the post-COVID years, India’s economic resilience has increased significantly. India is outperforming in GDP growth with a growth rate of 9.1% in 2021–22 and 7.2% in 2022–23, respectively. The first half of the current fiscal year saw a growth of 7.7%. The economy is expected to grow to a size of more than USD 4 trillion in FY 2024–25 and USD 5 trillion in FY 2026–27.

By 2030, India will be a USD 7 trillion economy, positioning itself as the 2nd largest economy in the Asia-Pacific region and the 3rd largest in the World economy. The fundamentals of the economy have become robust at the back of various effective reforms undertaken by the Government during the last decade, starting from the Make in India campaign to startups, the Atmanirbhar Bharat, and the PLI Scheme along with various tax reforms and corporate tax incentives to the business firms. All these reforms have strengthened the growth trajectory of the Indian economy and have expanded the financial landscape as markets are making new highs year after year.

COVID-19's devastating effects were felt deeply by almost every financial system in the early 2020s throughout the World. Financial markets crumbled as the COVID-19 epidemic erupted in March 2020. As investors became alarmed by the mounting economic damage and the lack of certainty surrounding the future course of the economy, global stock markets crashed and borrowing costs skyrocketed. The global financial system saw significant change following months of unprecedented economic volatility that resulted in the closure of thousands of enterprises, the loss of employment and millions of livelihoods.

The India’s financial markets too experienced the daunting impact of COVID-19, causing the Indian stock market to decelerate by around 40 percent during the January- March 2020. It did, however, rebounded greatly from its lowest point in March 2020, at a rate of 81 percent, in the next six months by October 2020. During the same period, the Dow Jones decelerated by 37 percent and rebounded almost 65 percent; China's Shanghai Composite experienced a 15 percent decline before rising 30 percent from its lowest point. The European financial markets had a 35 percent decline, followed by a corresponding 5 percent recovery.

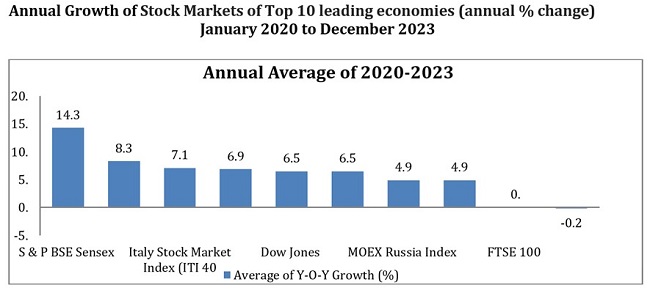

The Indian stock markets recovered within a short span of time. India’s stock index SENSEX emerged as the leading index as it outperforms the stock indices of the top ten World economies. The SENSEX has grown at an annual growth rate of 14 percent between January 2020 and December 2023 (average). It demonstrates a growth of 16 percent in January 2021 over January 2020. Going one year ahead, SENSEX displayed an explosive growth of 23 percent in January 2022. Subsequently, continuing the growth on a positive trajectory, SENSEX grew by 3 percent in January 2023 over January 2022. SENSEX grew by 14 percent during January 2023 to December 2023. (Table appended)

Japan’s NIKKEI 225 holds the next position to India’s SENSEX. The NIKKEI 225 has grown at an annual average growth rate of 8 percent between January 2020 and December 2023 (average). It experienced a growth of 18 percent in January 2021 over January 2020. Thereafter, it grew at an average growth rate of 1 percent in January 2022. Subsequently, the growth touched a negative territory, NIKKEI 225 dipped by (-9) percent in January 2023 and recovered by 23 percent in December 2023.

It was followed by Italy’s ITI 40 (7 percent), France’s CAC 40 (7%), USA’s Dow Jones (6 percent), Germany’s DAX performance-Index (6 percent), Russia’s MOEX (5 percent) and Canada’s S&P/TSX Composite index (5 percent) according to the annual average growth rate between January 2020 and December 2023. While the UK's FTSE 100 (0 percent) and China’s Shanghai Stock Exchange (- 0.2 percent) occupy the last position among the top 10 leading economies.

Many factors are contributing in the growth trajectory of the Indian stock markets. Although India’s large conglomerates are making significant strides with their ever expanding growth trajectory in the national and international arena, there is a great breakthrough in the MSMEs segment. MSME contribute significantly to the national GDP. The share of MSMEs Gross Value Added (GVA) in India’s GDP increased significantly from 27% in 2020–21 to an astounding 29% in FY 2021–2022. Remarkably, the manufacturing GVA of MSMEs increased as well, reaching 41% in FY 2021–2022, demonstrating the competitiveness and durability of the industry. The share of MSME specified products in India's exports increased to 45.5% in 2023-24 (up to September 2023) from 43.5% in the previous year highlighting the sector's Global outreach.

India's exports performance has displayed remarkable resilience in the aftermath of the global economic slowdown post-pandemic. Exports have surged from USD 375 billion in FY 2011 to a robust USD 770 billion in FY 2023, marking a significant upward trajectory. As the topmost export-resilient country among the leading 20 global exporters, India's fast-emerging products and destinations serves as a strategic pathway to realize the ambitious vision of reaching USD 2 trillion exports by 2030, solidifying its pivotal role in the evolving landscape of international trade.

India’s Government has undertaken significant initiatives to foster economic growth and enhance the ease of doing business in the country. Around 40,000 compliances creating hurdles in ease of doing business have been removed and 3400 criminal codes have been converted in the civil codes for a fearless eco system and decriminalization of minor business offences. Not only the business reforms but welfare inducing reforms are also at the radar of the Government. The growth provoking reforms such as the Pradhan Mantri Kisan Sampada Yojana (PMKSY) across 36 states/Uts supplement agriculture and modernize food processing. Simultaneously, there's been a noteworthy upswing in coal production, railway projects aligning with the PM Gati Shakti vision, ensuring robust coal evacuation infrastructure for energy security and self-sufficiency. Complementing these economic reforms, the Ministry of Mines has taken proactive steps by decriminalizing 49 rules under the Minerals Concession Rules, 2016, and 24 rules under Mineral Conservation and Development Rules, 2017. The implementation of this measure simplifies the mining industry's regulatory environment and streamlines operations.

The Government of India's proactive measures to establish a world class sustainable infrastructure have resulted in significant achievements in the aviation sector. Notably, airports including Delhi, Mumbai, Hyderabad, and Bengaluru have attained Level 4+ and higher Airports International Council (ACI) Accreditation, marking a notable stride in operational excellence and sustainability. Furthermore, these airports have successfully become carbon neutral. Additionally, a commendable 66 Indian airports are operating entirely on 100% green energy, exemplifying the government's commitment to fostering environmentally conscious practices within the aviation industry.

These reforms underscore a comprehensive strategy, addressing economic, social, and environmental facets, fostering an environment conducive to national progress. Going ahead, India’s economy will be outperforming among the world economies and the markets momentum will continue and is expected to reach new and new highs in the coming times too as Amritkal of our 100 years of Independence has started with a great zeal and broadband expansion of the Indian economy.

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://upload.wikimedia.org/wikipedia/commons/thumb/4/4b/BSE_building_at_Dalal_Street.JPG/800px-BSE_building_at_Dalal_Street.JPG

Post new comment