Back in March 2020, the Reserve Bank of India proposed an SBI-led restructuring package for the struggling Yes Bank by exercising a clause in a manner no one expected.1 The proposed restructuring entailed writing down of over Rs.8400 crores of outstanding Additional Tier-1 (AT-1) bonds to zero.

“The perpetual subordinated Basel-III compliant additional tier 1 bonds issued by the bank for Rs 3,000 crores on December 23, 2016 and perpetual subordinated Basel-III compliant additional tier 1 bonds worth Rs. 5,415 crores on October 18, 2017 have been fully written down and stand extinguished with immediate effect” Yes Bank had stated in the regulatory filing. 2

The move came as a shock because RBI set an unusual precedent by making bonds worthless while keeping the bank afloat.

“As per rules if authorities decide to reconstitute or amalgamate a bank with any other, then such a bank is deemed as non-viable, and a conversion or write-down of AT1 instruments is then activated. Accordingly, the AT1 instruments will be fully converted or written-down permanently before amalgamation or reconstitution” read the statement put forth by the bank.3 Even though the move was in accordance with the fine print, the precedent was unusual.

AT-1 bonds are often referred to as quasi-equity instrument even though structured like bonds.4 In the case of Yes Bank, AT-1 bonds came across as riskier than equity investment and the concept of bonds (debt) being safer than equities was turned on its head. AT-1 by definition was as risky or even riskier as equities but was till then perceived as just another Debt instrument which enjoyed higher protection of principal than equities and provided steady returns in the form of interest income. Seasoned investors and Mutual funds while already being aware of the risks would be discouraged by complete write-down because there is no risk-return trade-off in favour of AT-1 bonds over equities in that case. A small investor who assumed safety of principal which is typical of the true nature of AT-1 bonds unravel before them. AT-1 bonds were always riskier than generally perceived and the RBI intervention rightly enabled to drive home the point. However the Mutual funds and seasoned investors are well aware of how investors are pitched these products. The Supreme court is already hearing petitioners citing email evidence from Yes Bank wherein relationships managers claim “AT-1 bonds shall fetch better returns than what fixed deposit would yield, and that the same is a safe investment”5 The industry is aware that such a mis-selling is the norm rather than exception; Critics can rightfully claim that RBI didn’t place a quasi-equity instrument in true light but showed it riskier than equities when it chose to fully write-off to zero. With such a precedent, Mutual funds may be right if they shun the risks of AT-1(which is more than that of equities) for a return which doesn’t justify the associated risk. Implementing a limit on AT-1 write-off with a safety net to a small percentage of principal amount may be a policy worth considering.

This year in March, AT-1 bonds are in news again instilling apprehensions in the market. A Securities & Exchange Board of India (SEBI) circular regarding valuation of Additional Securities Tier 1 (AT-1) bonds on March 11, 2021 has made debt managers anxious.6

Noting that there are no specified investment limits for such bonds, it decided on prudential limits for such investments as below:-

- No mutual fund under all its schemes shall own more than 10% of such instruments issued by a single issuer.

- A mutual fund shall not invest –

- More than 10% of it’s NAV of the debt portfolio of the scheme in such instruments and:

- More than 5% of it’s NAV of the debt portfolio of the scheme in such instruments issued by a single issuer7

The circular among other things states that the value of all Additional Tier 1 (AT1) and Tier 2 bonds was to be treated as 100-year maturity instruments.

There are several implications for the bond market which may have played out if the circular came into effect.

Firstly, the limits on holdings of AT-1 bonds will constraint the incremental ability of Mutual funds to buy it. According to the Ministry of Finance, the exposure of mutual funds to AT-1 bonds is around Rs.35000 crore while the overall market is around Rs.90000 crore.8 State Bank of India has over Rs 11,000 crore worth call options due in FY22. Public and private sector banks have issued AT1 bonds worth Rs 1.02 lakh crore as of March 2021 and call option is due for Rs 31,290 crore in the next financial year.9

The Yes Bank case and Franklin Templeton fiasco had already lowered the risk appetite of investors and SEBI guidelines will reduce flexibility of Mutual Funds. Smaller and weaker banks may especially face crisis in raising funds. It may also cause existing retail investors to promptly withdraw and Mutual funds to seek redemptions. The coupon rates on these bonds will rise increasing borrowing costs and making the financial sector weaker as Banks cough up higher rates from their bleeding balance sheet. The incremental ability of Mutual funds to buy will reduce when the Public Sector banks (PSBs) need it the most necessitating higher infusion of capital by Government. Importantly, with tenure fixed at 100 years, there is no benchmark to mark these bonds against. The valuation may drastically fall which will hit the market sentiments and result in even higher borrowing costs.

There are reports that a letter from Department of Financial Services(DFS) stated “Considering the capital needs of banks going forward and the need to source the same from the capital markets, it is requested that the revised valuation norms to treat all perpetual bonds as 100 year tenor be withdrawn”

The excessive exposure of Mutual Funds in AT-1 poses systemic risks due to attractive yields while glossing over the risk factor. The Perpetual bonds yield a higher return than interest rate on Fixed deposits while seemingly providing the comfort of debt instruments. However, the comfort of owning a debt instrument with steady rate of returns is a misleading idea. AT-1 bonds are subject to write-downs if a bank’s capital falls below a certain threshold. Banks can even choose to not repay the principal and keep paying the interest. The investors in many a case fall prey to mis-selling and investors aren’t warned of the risks.10

The SEBI’s contention that these securities are risky and their value should reflect the associated risks level is a fair assessment. SEBI while defending is right in stating that Mutual Funds exposure is below the prescribed limit while the government is worried about incremental ability of MFs, lack of flexibility and negative sentiments in the market. The mutual funds face the prospect of instant hit on Net Asset Value (NAV) of their schemes invested in AT-1.

The root cause of Government’s concerns lies in its high priority goal namely - capitalization of banks and ensuring a favorable market condition for raising the same. Given the high fiscal deficit and the crucial role of privatization and bank recapitalization in ensuring economic growth, the Government is right in its approach to avoiding uncertainty in the debt market.

The Government in the Union Budget has pitched itself assertively in favour of privatization and chasing of higher growth. The gamble of choosing higher fiscal deficit than curtailing expenditure was a necessary one and capitalization of banks and meeting disinvestment targets are prerequisite for clocking high growth rate. A mark-to-market loss unexpectedly imposed by the capital market regulator can scuttle the government efforts.

Bank of Baroda the second biggest issuer has outstanding of Rs.11307 crore while figures for ICICI Bank stand at Rs. 10,120 crores out of which Rs.3425 crores call options are due next year.11 The concern in the market regarding valuation of bonds of such a magnitude is already impacting the yields. Yields of perpetual bonds issued by State Bank of India and Bank of Baroda have gone up by as much as 80-90 basis points. Yields of HDFC bonds with a call option in 2022 have risen by 100-120 bps.12 The rising yields may see HNI’s and wealth managers flocking to the industry but negatively impact sentiments in the biggest bond holders namely the Mutual Fund industry who face the prospect of sudden dip in NAV. The cut-throat competition in the Mutual fund industry doesn’t take kindly to sudden policy changes which make it difficult to convince clients and vitiates the industry.

The Finance Ministry’s concern is right in this regard as reflected in the purported letter by DFS to SEBI. Diminishing appetite for perpetual instruments in the mutual fund segment will increase the burden on government to infuse more equity into Public Sector Banks (PSB’s). With about Rs.30000 crore planned to be raised by PSBs through AT-1 bonds in the next financial year, a cloud of uncertainty looms. The plan of further Rs.30000 crores AT-1 bonds issue next fiscal seems like a tall order if uncertainty continues.13

The need of the hour is to introduce realistic expectations into the market by valuing the instrument fairly “without bringing anxiety or short-term uncertainty.” SEBI’s position on valuing the bonds realistically and Government insisting on stability of bond markets at such a crucial juncture are both understandable. A good course of action would be to a middle-ground which can enable a more realistic valuation in a time-bound manner without bringing in uncertainty in the bond market. The latest SEBI circular is the middle ground which allays the concerns of Finance Ministry and bond markets and is the perfect balancing act.

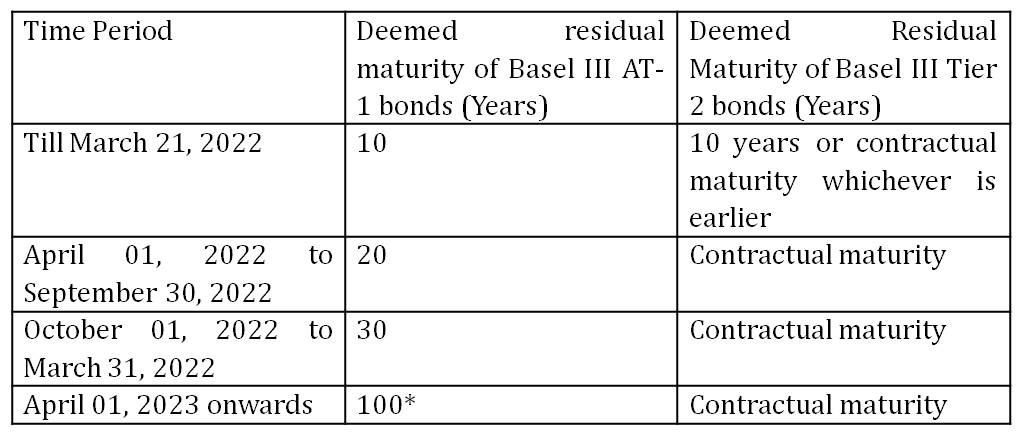

The SEBI circular said “Based on the representation of the Mutual fund Industry to consider a glide path for implementation of the policy and request of other stakeholders, it has been decided that the deemed residual maturity for the purpose of valuation of existing as well as new bonds issued under Basel-III framework shall be as below:-

*100 years from issuance of bonds14

While the latest circular puts the discussions on AT-1 bonds to rest for the time being, the regulators, government and other stakeholders will have to keenly follow the impact on the markets in next fiscal.

Endnotes

- https://economictimes.indiatimes.com/markets/stocks/news/yes-bank-at1-bonds-worth-rs-8400-crore-written-down-to-zero/articleshow/74634741.cms

- https://economictimes.indiatimes.com/markets/stocks/news/yes-bank-at1-bonds-worth-rs-8400-crore-written-down-to-zero/articleshow/74634741.cms

- https://economictimes.indiatimes.com/markets/stocks/news/yes-bank-at1-bonds-worth-rs-8400-crore-written-down-to-zero/articleshow/74634741.cms

- https://www.livemint.com/money/personal-finance/why-yes-bank-at1-bonds-are-being-written-down-to-zero-and-not-the-shares-11584273651874.html

- https://www.livemint.com/companies/news/rbi-sebi-seek-time-to-file-response-in-yes-bank-at1-bondholder-case-11616729329274.html

- https://www.livemint.com/mutual-fund/mf-news/whats-the-hubbub-over-sebi-and-at-1-bonds-about-11615561756560.html

- Circular No. SEBI/HO/IMD/DF4/CIR/P/2021/032 dated 10th March 2021

- https://www.moneycontrol.com/news/business/sebi-circular-on-at1-bonds-a-double-whammy-for-psu-banks-6667231.html

- https://www.moneycontrol.com/news/business/sebi-circular-on-at1-bonds-a-double-whammy-for-psu-banks-6667231.html

- https://www.livemint.com/money/personal-finance/beware-of-all-the-risks-in-bank-perpetual-bonds-11589913565563.html

- https://www.business-standard.com/article/markets/at1-bonds-over-rs-11-000-cr-worth-call-option-due-for-sbi-in-fy22-121031800061_1.html

- https://www.business-standard.com/article/markets/advisors-push-at1-bonds-to-hnis-to-take-advantage-of-surge-in-yields-121031800060_1.html

- https://economictimes.indiatimes.com/markets/stocks/news/did-amfi-do-a-u-turn-on-sebis-at1-bond-rule-for-mutual-funds/articleshow/81481944.cms

- https://www.livemint.com/news/india/sebi-may-relax-valuation-norms-for-at1-bonds-11616169503666.html

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://images.moneycontrol.com/static-mcnews/2021/02/Delisting-1-770x433.jpg?impolicy=website&width=770&height=431

Post new comment