Vietnam has taken over from Thailand as the Chair of ASEAN in 2020. Its theme at its opening summit in June is ‘Cohesive and Responsive ASEAN’1. Thailand is the country coordinator for India and will be followed by Singapore from 2021 till 2024. These two countries currently channel India ASEAN relations.

Vietnam hopes to conclude the RCEP during its second summit in November which traditionally coincides with the East Asia Summit (EAS) and the Asean-India Summit. Vietnam hopes to be a bridge for India to return to RCEP. Is this an indication that RCEP misses India?

For ASEAN, RCEP is a strategic issue for their community building. With WTO stalled, and the deep impact of Covid, RCEP is seen as a panacea which will aid economic recovery and economic cohesion. RCEP is a modern trade agreement (not as modern as TPP) based on unbundling of manufacturing with importance to regional value chains (RVCs). This encourages small economies to acquire scale of production and markets. Toyota’s vehicles are an example of products which use these facilities including the India ASEAN FTA to manage efficient and cost-effective production.

Thus, trade facilitation rather than market access or tariffs is more important to ASEAN whichthrough its ASEAN Economic Community (AEC) has surpassed them. ASEAN takes AEC seriously as it creates a single market and production area. Between 2007 and 2017 ASEAN GDP doubled from $1.3 trillion to $2.8 trillion. In 2018 intra ASEAN trade was 23% of its total. RCEP (then including India) members had 34% of ASEAN trade. FDI was 15% intra ASEAN and 25% from RCEP partners. Thus, intra RCEP trade was 57% and FDI 40% for ASEAN in 2018. Out of the 171 annual priorities for 2019 under the AEC Blueprint 2025, 132 have been implemented.2

The Ha Noi Plan of Action on Strengthening ASEAN Economic Cooperation and Supply Chain Connectivity in Response to the COVID-19 pandemic by the ASEAN Economic Ministers3 dealt with the role of supply chains for economic impetus. For ASEAN, ‘RCEP demonstrates its firm commitment to upholding an open, inclusive and rules-based multi-lateral trading system’4 RCEP for ASEAN means integrated value chains supported by investment protection measures. Japan and Australia also want this. As ASEAN countries policies evolve, RCEP is at the core of a post-COVID situation. Presently, they look at creating alternative supply chain networks, with support of Japan and China +1 initiatives. They believe that their recovery will benefit from of regional economic arrangements5. Thus, ASEAN is in favour of early conclusion of RCEP.

China is also in the same mould as it sees RCEP as a valve for its economic problems emanating from the trade war with the USA and as a means to stem the China +1 momentum. South Korea sees economic advantages too and would like RCEP to conclude early. Japan, now supported by Australia and New Zealand, emphasizes the inclusion of India as important for RCEP. This is more perceptible now as the Quad based challenge to Chinese supply lines through alternative and dependable value chains emerge.

The strategic aspect of RCEP (EAS-USA & Russia) is a rules based order in the region and as a building block it is incomplete without India. Now Japan and Australia areattempting to create new regional value chains and bringing in their strategic partnerships with India to overcome the gap from RCEP. The nascent Supply Chain Resilience Initiative (SCRI) between Japan India and Australia is a step in this direction where the value chains are pursued even outside the RCEP or bilateral Comprehensive Economic Partnership Agreements (CEPAs).

For India the objective is to harness the Japan-India-Australia evolving strategic partnership in the Indo-Pacific, and use it to enhance regional economic strategy against Chinese dominance. An official level discussion on this is likely on 1 September 2020.6This could be a good non RCEP congruence with the finalisation of the “Development of an ASEAN Database on Trade Routes and Framework for Enhancing Supply Chain Efficiency” to assist in strengthening the competitiveness of regional trade network and improve cross-border trade and supply chain efficiency, as mentioned at the 36th ASEAN Summit.7

Japan has a CEPA with ASEAN since 2008. It was revised in July 20208 even as RCEP dragged along. Japan has bilateral FTAs with seven ASEAN countries and is negotiating a trilateral with China and ROK.9 It is also in Trans pacific partnership (TPP) with four ASEAN members. The ASEAN-Australia-New Zealand (AANZFTA) is in place since January 2010. A review is underway since 2018. Australia has FTAs through four bilateral FTAs with ASEAN members and as part of TPP. 10 While India has a trade FTA with ASEAN since 2007 and on investment and services since 2012; it also has three bilateral with ASEAN countries. The talks on Indian FTA with Australia are suspended since 201511 but a thaw may be coming as part of the Comprehensive Strategic Partnership.12

The review of the India Japan CEPA is a slow starter much as the India-ASEAN review, as both feel that there is not much they can derive from India in its current phase. ASEAN through Malaysia has indicated that the review with India will follow the RCEP conclusion as that is their priority.

India still worries about market access andits attitude to RCEP and to FTAs in general has drawn concern among the ASEAN. In November last year, India decided not to join the RCEP agreement as its key concerns were not addressed.13 The main reasons why India withdrew from RCEP included unsatisfactory protection against import surges, inadequate differential with China, lack of adequate protection against violation of rules of origin, keeping the base year as 2014 and lack of credible offers on market access and non-tariff barriers. EAMs comments on the relevance of FTAs and their role ahead at the India@75 event14 drew attention to the thinking in New Delhi. ‘It’s important not to get into false choices. The choice is not today between will India engage or not engage the world. Proponents of FTAs make out as if that is the only vehicle to engage the world and if you missed out of RCEP, you are missing something very big in the world,’15 he said.

EAM recognised that ‘The contemporary relationship between India and the ASEAN was founded very much on our shared interest in globalization’.16 The supply chains are sought to be made more diverse and resilient.17 The Big Picture has altered after the Covid crises but have we changed enough? And have our partners?

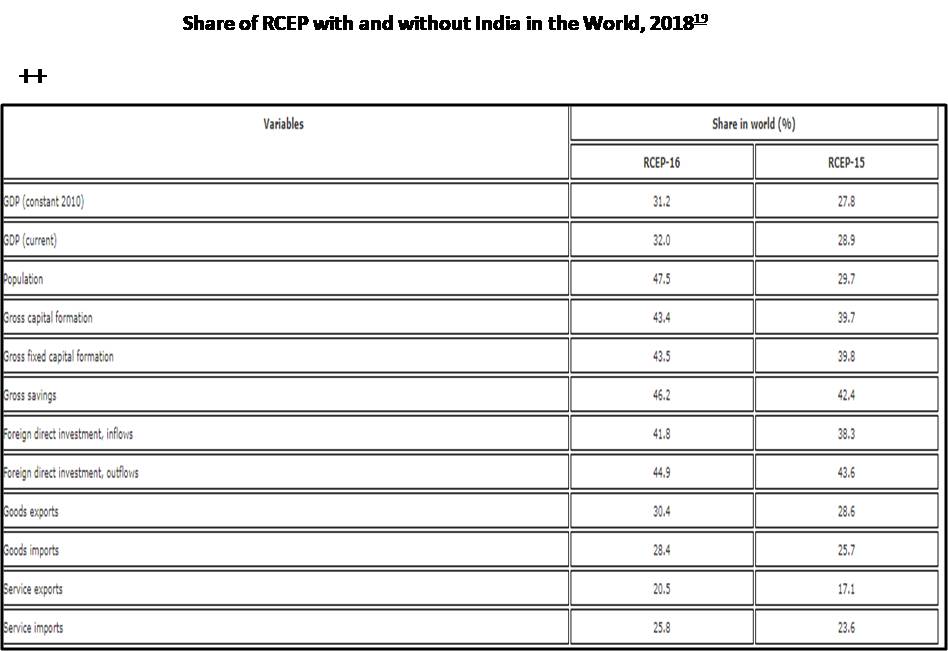

The table below shows the relative impact of the absence of India on RCEP ahead. The biggest change will be of population of RCEP which will decrease by 17.8% and the large open market that goes with it. Capital formation and savings will decrease by 4% each. FDI inflows by 3.5% and outflows by 1.3% Trade will decrease by about 2.5% and services exports by 3.4% and imports by 2.2%.18 Perhaps in 2018 this may not have looked impressive but as the world looks to revitalize every percentage point and market counts even more.

Among Japanese companies in India which are already exporting, 26% of their exports go to ASEAN, 12% to Japan, 6% to China and 4% to Korea. Thus 48% of Japanese exports from India are to RCEP countries. There is a fledgling integrated supply chain with ASEAN for Japanesecompanies for cars, motorcycles, chemicals and auto components.20 However, Japanese companies export barely 10% of their total production so thereis much scope to build on this RVC with ASEAN and Japan. A strengthening of the rules in the review of the India ASEAN FTA and the CEPA with Japan will aid this process but is likely after they have concluded RCEP later this year. Australia is not a real partner in this activity so far. India can obtain more FDI from them much as ASEAN countries have obtained FDI in the relocation and diversification from China exercise.21

Thus, the issue is that since India will not consider joining a RCEP as it currently stands, it yet needs to economically engage with East and South East Asia for economic reasons as well as to stay a worthy strategic partner. The pressure on China needs to be economically built up to make it adhere to rules. ASEAN is not a partner in that endeavour since it has adjusted to China’s rise differently from the other members of RCEP and EAS. The economic engagement with Japan and Australia thus is looking up from a strategic Quad based outlook and commonalities are being sought. India’s Atmanirbhar effort and focus on manufacturing value chain leads to adjusted investment ideas.

Endnotes

- https://asean.org/storage/2020/06/Chairman-Statement-of-the-36th-ASEAN-Summit-FINAL.pdf

- ibid

- https://asean.org/hanoi-plan-action-strengthening-asean-economic-cooperation-supply-chain-connectivity-response-covid-19-pandemic/

- https://asean.org/storage/2020/06/Chairman-Statement-of-the-36th-ASEAN-Summit-FINAL.pdf

- Jagannath Panda:India's return to RCEP is in everyone's interests; Nikkei Asian Weekly 26 August 2020

https://asia.nikkei.com/Opinion/India-s-return-to-RCEP-is-in-everyone-s-interests - ibid

- https://asean.org/storage/2020/06/Chairman-Statement-of-the-36th-ASEAN-Summit-FINAL.pdf

- Revised Japan-ASEAN trade deal takes effect : 1 August 2020 https://www.bilaterals.org/?revised-japan-asean-trade-deal

- Ministry of Foreign Affairs, Free Trade Agreement (FTA) and Economic Partnership Agreement (EPA)https://www.mofa.go.jp/policy/economy/fta/index.html

- ASEAN-Australia-New Zealand FTA

https://www.dfat.gov.au/trade/agreements/in-force/aanzfta/Pages/asean-australia-new-zealand-free-trade-agreement - About the Australia-India Comprehensive Economic Cooperation Agreement negotiations Australian Government DFAT:https://www.dfat.gov.au/trade/agreements/negotiations/aifta/Pages/australia-india-comprehensive-economic-cooperation-agreement#:~:text=Australia%2DIndia%20Comprehensive%20Economic%20Cooperation%20Agreement,-About%20the%20Australia&text=Two%2Dway%20trade%20in%20goods,to%20%2430.4%20billion%20in%202018.&text=Australia%20and%20India%20launched%20negotiations,Cooperation%20Agreement%20in%20May%202011.

- Joint Statement on a Comprehensive Strategic Partnership between Republic of India and Australia 4 June 2020 ; Australian Government DFAT:https://www.dfat.gov.au/geo/india/Pages/joint-statement-comprehensive-strategic-partnership-between-republic-india-and-australia

- Dr Sithanonxay Suvannaphakdy :Multiplicative effects of RCEP on ASEAN trade; The Asean Post 15 March 2020

- EAM at India@75 Summit - Mission 2022 organised by CII: https://www.youtube.com/watch?v=oUQsCI2RLIQ

- Ibid

- Remarks by EAM during the 6th Roundtable Meeting of ASEAN-India Network of Think Tanks (AINTT) 20 August 2020 https://www.mea.gov.in/Speeches-Statements.htm?dtl/32904/Remarks_by_EAM_during_the_6th_Roundtable_Meeting_of_ASEANIndia_Network_of_Think_Tanks_AINTT

- ibid

- Pankhuri Gaur: India’s withdrawal from RCEP: neutralising national trade concerns; 24 August 2020 https://doi.org/10.1080/13547860.2020.1809772

- https://www.tandfonline.com/doi/full/10.1080/13547860.2020.1809772

- JETRO Survey results of Supply Chain Mechanisms for Japanese companies based in India; 14 May 2020 p4

- Gurjit Singh:Enticing post-COVID Japan to India; Gateway House 14 May 2020 https://www.gatewayhouse.in/post-covid-japan-india/#_ftn4

https://theaseanpost.com/article/multiplicative-effects-rcep-asean-trade

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://www.sundayguardianlive.com/wp-content/uploads/2019/10/gauri.jpg

Post new comment