In September 2017, the Chinese Government, to make the State Owned Enterprises (SOE) “navigate towards development direction”, revised certain rules and regulations, giving more power to the Communist Party units. This was done with the belief that the Party groups will help steer SOEs towards profitability. Previously, the party group in SOEs only played political roles, but now with these new revisions, they are expected to play managerial roles.1 The process to change the bylaws of SOEs started in 2016, which essentially means that before any big decision is made, the management will have an obligation to listen to internal party committees.2

Another development which simultaneously took place was that the Chinese Government, instead of privatising the state entities, started selling minority stakes to private Chinese firms, with a hope that it will improve their performance. According to China United, “mixed ownership reform” would “further optimise its corporate governance in accordance with the market-oriented principles ... and enhance its overall efficiency and competitiveness”3. This development is a justification given for the Party taking management of SOEs in their purview, as they would work to ensure positive results for shareholders and create a win-win situation.4 The question remains that whether the party can turn things around?

The Chinese economy is facing a series of problems - like decline in growth and productivity, ageing population, rising labour costs and high internal debt - which are getting difficult to resolve. While countries affected by the global financial crisis in 2008 are now in a position to spend, China has to focus on cutting its debt. China, due to its rigid, autocratic policies and loss-making sprawling state sector, might be heading towards a socio-economic crisis.

The International Monetary Fund (IMF) working paper of September 2016, titled ‘Rebalancing in China - Progress, and Prospects’, points out four flaws in the Chinese economy:-

• China has relied on an investment/export-led growth model in the past decade.

• Imbalances have similarly rotated from external to internal over the past decade.

• Rapid economic growth has come at the cost of rising inequality and a deteriorating environment.

• China has reached an inflection point, continuing with the old-growth model will likely either drag the economy into the middle-income trap or trigger a financial crisis.5

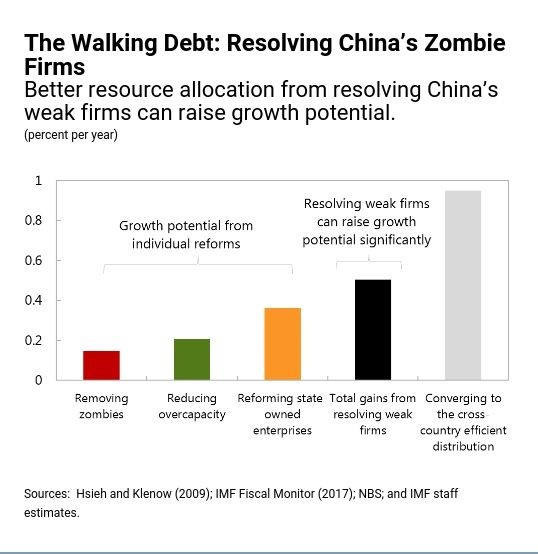

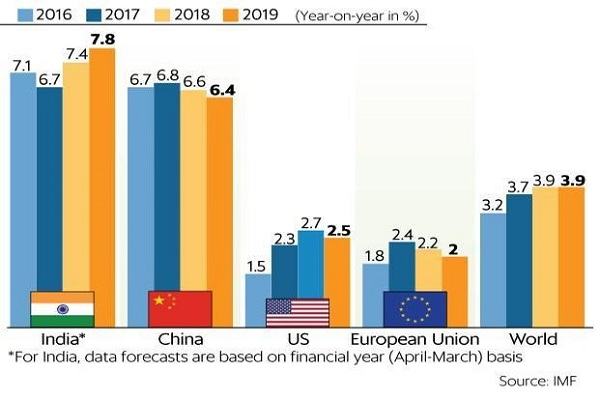

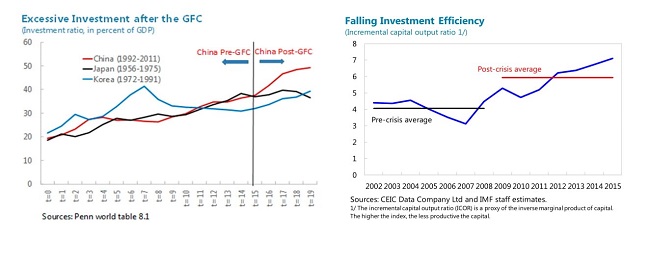

China, at this point of time, is trying to cut its USD 30 trillion internal debt load which is roughly 259 percent of its Gross Domestic Product (GDP); that is expected to rise to 327 percent by 2022. It is capital-output ratio compared to other Asian economies is worsening. According to a data by IMF, before the financial crisis of 2008, China’s output was 1 Yuan after investing 4.4 Yuan, now it is more than 6 Yuan worth of investment to get 1 Yuan back. The economic growth in 2017 was still strong at 6.9 percent.6 However, the trend-line is declining; the Chinese Economy is projected to grow at 6.5 percent in 2018.7

In 2012, China passed from the demographic bonus to demographic burden as the working age population began to shrink. In 2013, the Chinese working-age population fell by 3.45 million. Although the One-Child Policy was abolished in 2015, whether Chinese couples will adapt to the new policy is yet to be seen. As there are fewer children per worker, it means more income has to be saved and invested. The abolishing of One-Child Policy may not help change things much as far as the severe demographic problem at hand is concerned.8 Even though the policy has been scrapped, if couples do have a second child, it will take 15 Years for the child to be considered as a part of the working-age group.

The global financial crisis was disastrous for the West, but the Chinese did not feel the heat because the government at the time had a bailout package of 586 billion USD for its SOE’s to avoid significant layoffs.9 The SOE’s currently contribute less than a tenth to the GDP. These enterprises dominate critical sectors of the Chinese economy like the financial institutions, telecommunications, energy and industries. The situation will get worse, as there are going to be more tax breaks, easy credits, subsidies and other perks for SOE’s to compliment the 13th Five-Year Plan and ‘Made in China 2025’ blueprint for a comprehensive overhaul and technological upgradation of the industrial sector. The Centre and Provincial Governments are extending the life-lines of the no profit making, money guzzling SOE’s. Gavekal Dragonomics analysts, a research firm based out of Beijing and Hong Kong, believe that for dynamic economic growth, the bad firms have to leave the market while the good ones get to grow and capture the market, eventually leading to the non-profit making firms to shut down.10 However, this is not taking place since the SOE’s are crucial for the party to control economic power.

China’s manufacturing wages have doubled in the last decade or so to around USD 607 per month, which is more than Malaysia and Mexico. The increasing wages are putting more pressure on profits of Chinese firms. China’s economic growth in the last 30 years has made it a mid-income developing economy, but it is now facing competition from Vietnam, Malaysia, and Mexico as manufacturing wages there are not as high as Chinese wages. Chinese standard of living has increased along with rising wages, so the days of cheap labour are getting over. Consultancy firms like Gavekal recommend opening protected sectors of the economy to competition, especially telecommunication, freight handling, etc. to let no-profit making SOE’s to die natural death before these become a more significant liability than they already are.11

These problems have put China in a Catch-22 situation. If China implements the IMF recommendations, then it will lead to massive unemployment, as most SOE’s have to be shut down to reduce the debt load and to move beyond the trap of middle-income economy. If the Government does not shut down the SOE’s, then it struggles to deal with higher wages while productivity falls, and at the same time, debt of the SOE’s remains, high which is already a burden on the economy.

The Chinese Government, to make their SOE’s better managed, has increased the purview of the Party’s role. However, unless the Government opens the market for the SOE’s to compete against foreign or private Chinese firms, they will not be productive and competitive. Placing a Party member in the managerial board might have an adverse effect because there is a possibility of the Party overseers following orders from the top, rather than working according to what the shareholders want.12 Moreover, instead of ensuring healthy competition between public and private enterprises in China, a new system has been set in place to wrest control over both forms of enterprises.

Two years after the party started to take over the day-to-day operations of SOE’s, now it expects private companies to sell their stakes to them. It is a part of a broader “mixed ownership” initiative by Xi to ensure that the party controls every aspect of the economy. It was also reported in 2017 that the Chinese Government is pushing the biggest techchincal firms to offer a stake to them. Any news of these investments by SOE’s lead to their stocks rising higher than ever. While this is helping, but at the same time, the Government is now practically forcing private enterprises to invest or divest their financial assets without any particular set of rules and guidelines. The Party officials have not given any clear statements regarding stakes in private enterprises, and have said that private stakes will be acquired through various means.13 The Party is looking for a way to have veto power over the private enterprises, especially on internet companies, to keep an eye on internet activities as new stricter rules and regulation have been put in place.14

Xi is leading China towards an even more centralised economy, where there is a give and take between the SOE’s and the private companies with the Party in the middle, pulling strings whenever required. He is trying to make sure that the flagship of China’s economies should remain the SOE’s, and not private enterprises. How China plans to balance this out will be an interesting case study; as the Make in China 2025 blueprint puts particular emphasis on increasing the productivity of SOE’s. However, whether it be able to increase productivity remains to be seen as political control is increasing, wages are rising, and the population is declining. The Make in China 2025 blueprint could also be seen as another thrust by the Chinese Government; to put more capital, know-how, and technology to overcome the problem of labour supply. 15 However, until there is greater adherence to market-oriented principles, the Chinese Government might find itself in a difficult position. The Make in China 2025 blueprint does not give any indication of SOE’s or the Chinese Government following these principles.

References

1. Organic governance by Zhang Hongpei, Global Times, 5 September 2017, http://www.globaltimes.cn/content/1064895.shtml?utm_content=buffera7d49&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

2. Xi Boosts Party in China’s $18 Trillion State Company Sector, Bloomberg News, 8 July 2016, https://www.bloomberg.com/news/articles/2016-07-07/xi-boosts-party-say-in-china-s-18-trillion-state-company-sector

3. China Unicom gets funding and stake boost from parent in ‘mixed ownership reform’ by Eric Ng, South China Morning Post, 23 August 2017 http://www.scmp.com/business/companies/article/2107875/china-unicom-gets-funding-and-stake-boost-parent-mixed-ownership (Accessed June 14 2018

4. Ibid 1

5. IMF Working Paper on China Balance and Prospects by Longmei Zhang, September 2016, https://www.imf.org/external/pubs/ft/wp/2016/wp16183.pdf (Accessed June , 2018)

6. While Washington Spends, China Moves to Cut Its $30 Trillion Debt Load by Brian Bemner, Bloomberg, 15 February 2018 at https://www.bloomberg.com/news/articles/2018-02-14/while-washington-spends-china-moves-to-cut-its-30-trillion-debt-load (Accessed June 8th, 2018)

7. China targets 6.5% economic growth in 2018 by Gabriel Wildau, Financial Times, March 2018 https://www.ft.com/content/3cc9e6d8-2044-11e8-a895-1ba1f72c2c11 (Accessed June 8 2018)

8. Peak Toil, The Economist, January 26 2013 at https://www.economist.com/china/2013/01/26/peak-toil (Accessed June 10th, 2018)

9. China Unveils Sweeping Plan for Economy by David Barboza, The New York Times, November 9 2008 https://www.nytimes.com/2008/11/10/world/asia/10china.html (Accessed June 11th, 2018)

10. This Is China’s Real Economic Problem by Dexter Roberts, Bloomberg, 14 July 2017 https://www.bloomberg.com/news/articles/2017-07-13/this-is-china-s-real-economic-problem (Accessed June 9th, 2018)

11. Ibid 6

12. Can Communists Be Good Capitalists? By Michael Schuman, Bloomberg, 2 October 2017, https://www.bloomberg.com/view/articles/2017-10-02/can-china-s-communists-really-be-good-capitalists (Accessed June 14 2018)

13. China's Companies on Notice: State Preparing to Take Stakes, Bloomberg News, January 17 2018, https://www.bloomberg.com/news/articles/2018-01-17/china-s-communists-will-take-more-stakes-in-private-companies

14. China's internet is reaching new levels of crackdown by Zey Chong, CNET, 19 April 2018, https://www.cnet.com/news/weibos-self-censorship-reveals-chinas-stranglehold-on-internet/

15. Ibid 4

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://commons.wikimedia.org/wiki/File:G.Tech_Technology_Factory_Zhuhai_China.jpg

Post new comment