China’s rapid climb to become the second largest economy in the world in a span of 40 years has also meant that it is now the world’s largest carbon emitter. The air pollution has been so severe that in 2015, a research paper indicated that it has contributed to 1.6 million deaths per year in China.1 China’s northern coal and steel producing provinces are responsible for most of the air pollution in China. The 19th Party Congress has decided to spend around USD 6.4 billion to cut nitrogen dioxide and sulfur oxide by three percent and also claimed that pollution has decreased by 50 percent in the last five years.2

The Chinese are spending twice as much as the United States of America (US) on solar energy. This is helping them lower carbon emissions. Two thirds of solar panels used globally are manufactured in China. But it is also diversifying at a faster rate by investing heavily into Electric Vehicles (EV) and venturing into Cobalt mining.

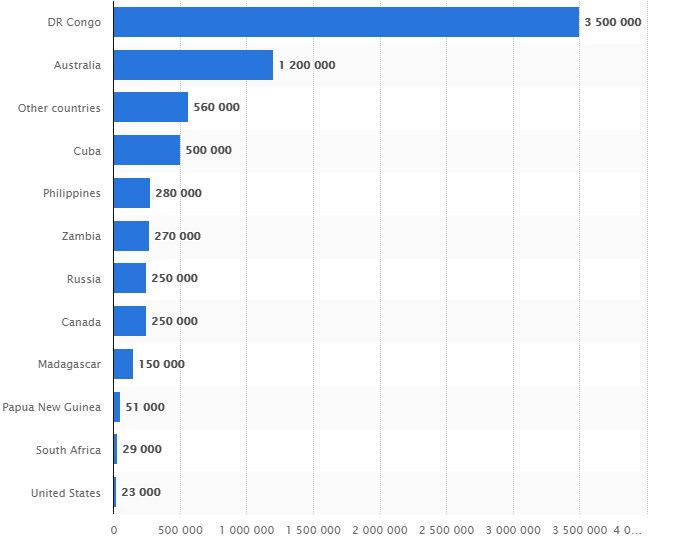

Cobalt is used in batteries which are used in mobile phones and EVs. At least 10 percent of it has to be used in the cathode for safety and battery longevity. 3 China is on its way to secure its control over major Cobalt production sites and over global supplies and also to assert its dominance in the EV industry globally. It is already in control of 62 percent of the Cobalt production of the world and has invested heavily in the Democratic Republic of Congo (DRC), which is the largest producer of Cobalt and holds the largest Cobalt reserves in the world.4 Chinese state owned enterprises are already on their way to control major Cobalt mining companies in the world, primarily by securing a chunk of their supplies, especially in DRC.

Western companies such as Apple, Volkswagen and BMW are rushing towards securing Cobalt for their smartphones and vehicles respectively. This is in response to the British and French Governments having declared intention to ban fossil-fuel driven vehicles by 2040. This has led major European car makers to put in more money into buying Cobalt, fearing scarcity that would affect the production of electric and hybrid vehicles in the future that must have lower carbon emission.5 Meanwhile, Apple is considering dealing directly with mining companies to secure its supplies so that it doesn’t hamper its products like laptops, watches and mobile-phones which are powered by Lithium-ion batteries.6 The world’s annual need for Cobalt is about 100,000 ton per year but 97,000 ton is supplied, while 30,000 ton is kept in the inventory. More than half of this supply is used for Lithium-ion battery and other rechargeable batteries.7

The Chinese, through their domestic policies and business decisions, have made their intentions clear, they want to lead and remain so for a long time in the hi-tech EV market. They want to capture the market and sideline competition before EV’s become a trend, and a necessity to keep a check on climate change. The Chinese scramble to secure Cobalt production and the subsequent panic buying by private enterprises in Europe and the US has driven up Cobalt prices. It currently stands at USD 38 for half a kilogram, which is three times the value of what it was earlier. According to a Japanese estimate, the value can go up to USD 50 in the next few years. Chinese companies are benefiting a lot from this increase in price while the largest Cobalt mining company in the world, the Anglo-Swiss multinational commodity trading and mining company, Glencore, has not benefited as mining is a small component of the company. 8

In November 2017, in one of the industry conferences (China International Nickel and Cobalt Industry Forum) Chinese delegates did agree that they have to reduce their dependence on DRC for Cobalt supplies. China has one percent of world’s Cobalt reserves which is not enough for its growing needs. The Chairman of Guangdong Jiana Energy Technology Company, a major supplier of Cobalt salts and other components for Lithium batteries, mentioned in the sidelines of the conference that China is “over-reliant” on DRC. Notably, Jiana is one of the Chinese mining companies that have invested in DRC’s reserves. This conference has led to Chinese firms finding new ways to reduce its dependence on the unstable African country; given the current political climate in DRC, relying on supplies from there carries risk. China is in need of around 54,000 tons in 2018, 17.4 percent more than 2017.9

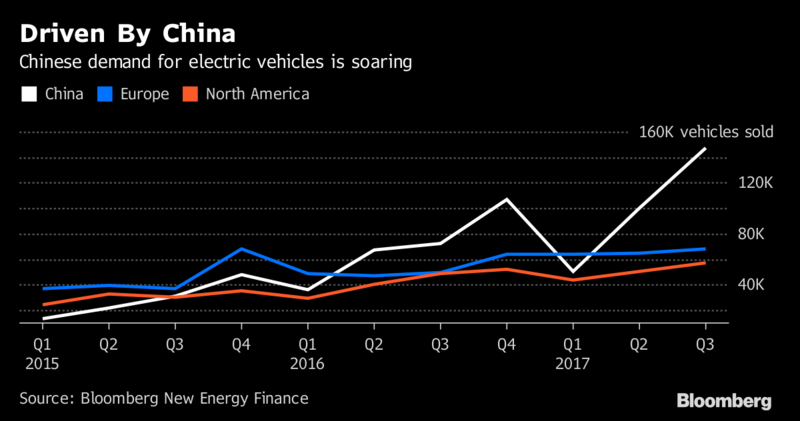

The Chinese are also securing their supplies from Glencore. Chinese firm GEM Company Limited has got Glencore to sell a third of its Cobalt production for the next three years which is around 52,800 ton of Cobalt hydroxide, a critical component to develop Lithium-ion batteries. Glencore has mines not just in DRC, but also in Canada and Australia.10 This securing of supplies from Glencore could be seen as a shift from “over-relying” on DRC as discussed during the industry conference in China in November 2017. Chinese companies, while ensuring their supplies, also intend to venture into the global EV market and sell their products in Europe. China is already leading the pack and intends to have 7 million annual sales by 2025. Its major car companies like Build Your Dream (BYD) Company and Geely Automobile Holdings Limited are backed by known investors like Warren Buffett and Goldman Sachs Group respectively. In fact, BYD Company sold more EV than Tesla, a well-known American EV manufacturing company, in 2017.11

China dominates the market with 80 percent of the production of refined Cobalt, which is also used by Tesla. Chinese intention of cleaning up their air, and Governments in Europe clamping down on fossil fuel driven cars, has inflated the value of Cobalt. The Chinese EV firms have successfully entered into the European markets. German based intercity bus company Fixbus has tied up with a Chinese firm (Zhengzhou Yutong Bus Company) to test their all-electric bus and begin tests between Paris and Amiens. The buses have a range of 200 kilometers, but the range is expected to go up with rapid technological innovations. Fixbus ferries 40 million passengers in Europe which means that the Chinese EV firm involved will be expected to provide more buses if the test run is successful.12

The rate at which the Chinese are expanding, it could become difficult for India to catch up with China in the EV sector, and even if it does, the supplies will be dependent on what prices the Chinese firms controlling the production and the technology decide to sell it to India and the rest of the world. The alternative solution, which Indian automobile manufacturers are exploring, is Hybrid (the Electric and Internal Combustion Engine) option. The Indian Government has for the time being dropped its plan to move to EV’s, giving the Indian automobile manufacturers choice and time to put in their resources into various solutions rather than just focusing on EV.

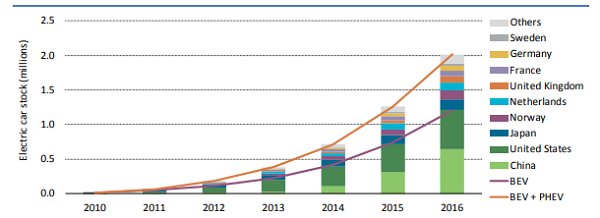

The International Energy Agency launched Electric Vehicles Initiative (EVI) in 2010. The initiative was launched after deliberations between Energy Ministers of major economies. Members included Canada, China, Finland, France, Germany, India, Japan, Mexico, the Netherlands, Norway, Sweden, the United Kingdom and the United States. China and the United States are co-leaders of this initiative.13 In a report by European Environmental Agency, the plan is to halve fossil-fuel driven cars by 2030 and to phase them out by 2050. While electric vehicle sales have increased in Europe but only 0.15 percent of the cars running on European roads are Battery Electric Vehicle (BEV) & Plug-in Hybrid Electric Vehicle (PHEV).14

Meanwhile, in the US it is estimated that 65 percent of car sales by 2050 are going to be electric due to growth in charging stations, lower technology costs, and more acceptance by the consumers.15 It is the second largest market for EVs. In 2015, it accounted for largest global electric car stock but was overtaken by China in 2016.16 In 2017, EV and Hybrid sales globally jumped 63 percent compared to September 2016. The pack was led by China, which accounted for half of those sales, followed by Europe which accounted for 24 percent of the 350,000 EVs sold all around the world.17 The Japanese are in the 4th position as far as sales of light EVs are concerned.18 But the Japanese firms have changed their focus from EV to Hydrogen Fuel Cells and that might be the reason why EV sales have fallen in Japan.

The Chinese are expanding into a business which would be profitable to both the state and its firms. The way the Europeans are jumping into the EV bandwagon, the future of communication electronics and automobiles may not belong to them but to the Chinese firms considering the rate at which they are securing their Cobalt supplies. Firms involved in defence equipment production, automobiles and electronics from all around the world will also be dependent on the Chinese inventory. China would have the potential to control the industry because of the amount of money it has invested in securing supplies.

To conclude, the China’s companies have already ventured into the EV market and have asserted its dominance when the market is still at an infant stage, and as it grows the Chinese investments are expected to pay off. According to a report by Indian Bureau of Mines, India does not have a primary Cobalt reserve. Most of it is imported.19 Meanwhile the Indian EV policy which was publicised appears to have lost its steam. The NITI Aayog, which is still formulating policies for EV, realises that India does not have the necessary infrastructure to support EV and is coming up with solutions to ensure a smooth transition.20 Today it costs USD 80,000 to buy one metric ton of Cobalt and prices are expected to go up as the European and American firms stock up supplies.

India has to formulate a policy soon to give more clarity to the automobile manufacturers in India, and while the policy is formulated, invest in proper infrastructure to support EV or Hybrids. More delays would mean that its firms - private or state owned- would have to buy Cobalt at an exorbitant price while importing it from either the West or by looking at the current trend, primarily from China, with the attendant costs and risks.

References

1. Air Pollution in China: Mapping of Concentrations and Sources, a report by Berkeley Earth at http://berkeleyearth.org/wp-content/uploads/2015/08/China-Air-Quality-Paper-July-2015.pdf (Accessed March 21, 2018).

2. China's War on Pollution Will Change the World at https://www.bloomberg.com/graphics/2018-china-pollution/ (Accessed March 21, 2018).

3. The role of Cobalt in battery supply at http://www.indmin.com/Article/3586106/The-role-of-Cobalt-in-battery-supply.html (Accessed March 21, 2018).

4. Apple aims to lock up Cobalt supply deals for iPhone, iPad batteries at www.scmp.com/tech/enterprises/article/2134130/apple-talks-buy-key-mineral-used-batteries-china-secures-bulk. (Accessed March 21, 2018).

5. Apple and BMW put charge into Chinese Cobalt stocks at https://asia.nikkei.com/Markets/Commodities/Apple-and-BMW-put-charge-into-Chinese-Cobalt-stocks?page=1 (Accessed March 21, 2008).

6. Here's Why Apple Wants to Buy Cobalt Directly From Miners at http://fortune.com/2018/02/21/apple-buy-Cobalt-miners/ )Accessed on March 21, 2018).

7. Ibid v.

8. Ibid iii.

9. China urged to ease reliance on DRC for Cobalt at https://www.reuters.com/article/us-china-metals-electric-vehicles/china-urged-to-ease-reliance-on-drc-for-Cobalt-idUSKBN1D70GT (Accessed March 22, 2018).

10. Glencore signs massive Cobalt sale deal with China's GEM at https://www.reuters.com/article/us-gem-glencore-Cobalt/glencore-signs-massive-Cobalt-sale-deal-with-chinas-gem-idUSKCN1GQ3B3 (Accessed March 22, 2018).

11. Ibid ii.

12. "Made in China" e-buses to be used in world's 1st all-electric long-distance routes at http://www.globaltimes.cn/content/1094443.shtml (Accessed March 21, 2018).

13. Electric Vehicles Initiative (EVI) at https://www.iea.org/topics/transport/evi/ (Accessed March 22, 2018).

14. Electric Vehicles in Europe, a report by European Environmental Agency at https://www.eea.europa.eu/publications/electric-vehicles-in-europe/download (Accessed March 22, 2018).

15. The Future Of Electric Vehicles In The U.S., Part 2: EV Price, Oil Cost, Fuel Economy Drive Adoption at https://www.forbes.com/sites/energyinnovation/2017/09/18/the-future-of-electric-vehicles-in-the-u-s-part-2-ev-price-oil-cost-fuel-economy-drive-adoption/#33f2cd51345c (Accessed March 22, 2018).

16. Global EV Outlook, a report by International Energy Agency at https://www.iea.org/publications/freepublications/publication/GlobalEVOutlook2017.pdf (Accessed March 22, 2018).

17. Global Electric Car Sales Jump 63 Percent at https://www.bloomberg.com/news/articles/2017-11-21/global-electric-car-sales-jump-63-percent-as-china-demand-surges (Accessed March 22, 2018).

18. Ibid xv.

19. Indian Minerals Yearbook, 2015 at http://ibm.nic.in/writereaddata/files/12092016171712IMYB2015_Cobalt_09122016_Adv.pdf (Accessed March 22, 2018).

20. Govt drops the idea of an India EV policy at https://www.livemint.com/Industry/mmhL6JOC61yIfeiIQKlLZN/Govt-drops-the-idea-of-an-India-EV-policy.html (Accessed March 22, 2018).

(Views expressed are of the author and do not necessarily reflect the views of the VIF)

Image Source: https://www.homeenergystorage.com.au/lithium-ion-batteries/

Post new comment