India-Iran relations are underpinned by cultural, religious and linguistic bonds. The name Iran means the ‘place of Aryans’.Sanskrit and Avesta shared common roots. Modern Farsi language has influenced both Urdu and Hindi. We often forget that till 1947, India had shared borders with Iran and Afghanistan. After partition, we lost the geographical contiguity with both the countries. Pakistan continues to block Indian access to Afghanistan. Chabahar port, when fully developed, will offer India the shortest land access to Afghanistan. The signing of contract for Indian participation in Chabahar, and offer of financing the railway connecting the port to Zahedan, are the significant outcomes of PM Modi’s visit.

Prime Minister Modi’s visit to Iran took place against the backdrop of an evolving situation in the region and Iran’s emergence from sanctions. Expected American withdrawal from Afghanistan, and resurgence of Taliban, has created uncertainties. Rise of ISIS in Iraq and Syria is a major challenge to regional stability. ISIS has also appeared in some parts of Afghanistan.

The lifting of sanctions has not changed Indian policy towards Iran. We continued to be engaged with Iran even during the sanctions period. We can now deepen our engagement. There were extensive negotiations on Chabahar port starting in 2011. This resulted in signing of an MOU by Shri Nitin Gadkari on 6th May, 2015. Modi Government approved investment in Chabahar port in October, 2014. This was much before the nuclear agreement was reached.

However, lifting of sanctions has made a qualitative change. It has opened the way for Iran’s reintegration with the international mainstream. There has been a stream of high level visits by European leaders to Tehran. The trend had started earlier. More than a dozen EU Foreign Ministers visited Iran before the nuclear deal was reached. The level, and frequency of visits, has gone up since. Immediately after the nuclear deal was reached in July 2015, German Deputy Chancellor and Economy Minister visited Tehran with a large business delegation. President Rouhani was received in Paris and Rome. Recently, the Swiss President visited Iran. President Putin, PM Xi Jinping and PM Nawaz Sharif also travelled to Tehran.

India continued to buy crude oil from Iran during sanctions period. This was a formidable challenge in the absence of normal banking, re-insurance and shipping services. We had to work out new arrangements to continue crude purchase, though the volume went down, as was the case with other countries. We understood that sanctions are a passing phase in the life of an ancient civilization. There is a political consensus on engagement with Iran. Major initiatives like participation in Chabahar port have been pursued by successive governments.

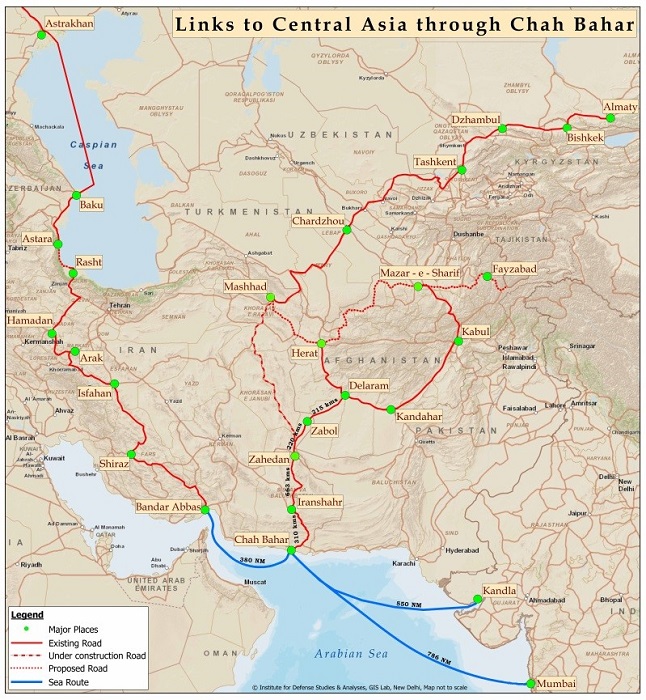

PM Modi’s visit has focused on connectivity and trade issues. Expansion of Chabahar port and International North South Transit Corridor (INSTC) will improve regional connectivity. Increased trade will bring development to the entire region.

Chabahar Port:

Iran had offered participation in Chabahar port during President Khatami’s visit to India in 2003. The process which began during the Vajpayee government’s term is being brought to culmination during PM Modi’s tenure. The Indian participation in expansion of Chabahar port is in keeping with Iran Government’s priorities. The port is outside the Hormuz Strait, and hence will be insulated from any conflagration in the Gulf. Expansion of the port will also bring more trade and development to Sistan-Balochistan province. This is a strategic region bordering Pakistan and Afghanistan with few natural resources. In recent years, it has also witnessed an upsurge in terrorist attacks by groups based in Pakistan.

A trilateral Transport and Transit Agreement was also signed between India, Iran and Afghanistan. Though Indian trade with Afghanistan is already passing through Iran, this will put the transit trade on a more enduring foundation.

President Rouhani said that third countries could join the agreement. He stressed that it was “not against any other country – it is beneficial to the entire region”. PM Modi also stressed “trust not suspicion; co-operation not dominance; inclusivity not exclusion”. He added that “motives of economic growth and empowerment would drive it. It will build our security without making others vulnerable. It would break barriers among our nations.”

Hinterland connectivity:

Chabahar is connected to Mashad and Sarakhs on Iran’s tri-junction with Turkmenistan and Afghanistan by a road that runs more than 1,000 km. However, it lacks rail connectivity without which movement of large volumes is not possible. During PM Modi’s visit, an MOU was signed by IRCON with Iranian railways for development of Chabahar-Zahedan rail link.

The rail link could help evacuation of iron ore from the Hajigak mine in Afghanistan in which a consortium of Indian companies have interest. However, this will require extending the railway line beyond Zahedan to Mashad.

The Chinese are already active in the region, and have completed a 6,000 kms railway line from eastern China to northern Iran.

Chabahar Free Trade Zone:

Chahabar Free Trade Zone (FTZ) offers good opportunity for Indian investment in a Urea plant, and petrochemical industries. It is being developed in close proximity to the port. It has the added advantage of tax exemption for 20 years, and duty free import. Iran has already built a 900 km pipeline, bringing gas from Assaluyeh in the west, to Iran Shahr north of Chabahar. The remaining segment of around 100 kms can be completed before the industry comes up in the FTZ.

Iran has the world’s second largest gas reserves. Recently, it has announced a new gas pricing policy. This has brought down the price of gas from 13 cents per cubic meter to 8 cents per cubic meter. There is also discount for gas feedstock prices for the Urea plant in the free trade zone. The gas pricing formula is valid for 10 years, which provides stability in a long term investment decision. Though the exact price needs to be negotiated, it will be cheaper than pool gas price of USD 7.5 for fertilizer sector in India. Indian investors will of course decide whether the difference in raw material cost is sufficient.

Given attractive gas feedstock prices, and Chabahar’s proximity to India, production, and freight cost will be low. This could help bring down the Government’s subsidy burden.

China is already building a refinery in Chabahar Free Trade Zone for supplying heavy oil to Afghanistan.

India could also co-operate with Japan for development of the port, and railway line.

Sub-sea Pipeline:

A private sector group SAGE has proposed a sub-sea pipeline from Chabahar to Gujarat coast of India. The sub-sea pipeline will not pass through Pakistan’s territory. It does not, therefore, carry any political risks. Financial risks will be borne by SAGE. Modern technology makes piped gas for distances up to 2000 kms cheaper than LNG

Chabahar is directly south of Turkmenistan. Sub-sea pipeline from Chabahar could also be used for evacuating gas from Turkmenistan to India. This was also mentioned in PM’s speech during his visit to CIS countries in July.

International North-South Transit Corridor (INSTC):

International North-South transit corridor (INSTC) offers transit to Russia and CIS countries. There already exists a rail link between Bandar Abbas Port in the South and Amirabad Port on the Caspian, and Inchebarun on Iran-Turkmenistan border. The rail link between Kazakhstan-Turkmenistan-Iran was inaugurated by the Presidents of the 3 countries in December 2014. There are two other ports on the Caspian-Bandar Anzali and Astara , which are connected by road with Bandar Abbas. There is a North-Eastern trunk of this corridor, which passes through Sarakhs on Iran’s border with Turkmenistan. While substantial infrastructure exists for transit , Indian trade needs to make more use of it. Even during the sanctions period, INSTC was being used by UAE, CIS countries and China.

India also has observer status with Ashkabad agreement, a transit-trade arrangement between 4 countries, including Uzbekistan, Turkmenistan, Iran and Oman. This will provide a route to CIS countries.

Hydro-carbon:

Iran also offers opportunities for investment in upstream oil and gas exploration. These were discussed during the visit of MOS PNG Shri Pradhan to Tehran in April, 2016. At present, an OVL led consortium is negotiating a contract for Farzad B offshore gas block with 12.5 tcf in place gas reserves. Apart from Indian interest in Farzad B, there would be other oil and gas blocks, which will be part of the next bidding round.

Iran’s production cost for both crude, and gas, is very low. For crude, this ranges from USD 8-10 per barrel. With this price level, Iran’s production will remain competitive despite steep drop in oil prices, though its budget will need price level of around USD 40 per barrel. Iran has a diversified economy. During pre-sanction period, oil revenues accounted for 30 percent of GDP, and 55 % of the government budget. The figure is substantially lower in the wake of fall in oil prices.

Iran’s crude exports went down from 2.2 million barrel per day during pre-sanction period to around 1 million barrel per day globally. Recovering its market share for crude exports is a major priority for the Iran government. Its share in Indian market also halved from 21 million ton to around 8.5 million ton. Since lifting of sanctions, Iran has managed to boost its crude exports to more than 2 million barrel per day. Its exports to India has also gone up substantially.

Iran will need access to Indian market to boost its oil exports. According to a recent report of the International Energy Agency (IEA), India showed the highest oil demand growth in the world in the first quarter of 2016. It is replacing China as the driver of growth globally.

Oil prices have recovered from a low of USD 27 per barrel to around USD 49 per barrel. After the recent OPEC meeting on 2nd June failed to agree to a production ceiling, WTI fell by 0.9 % to 48.71 per barrel, while Brent fell by 1 % to USD 49.71 per barrel. Predicting oil price behavior over long term is hazardous. Earlier this year, the expectation was crude prices will remain lower for longer. They have recovered by more than 85 percent since then. This price level is still only half the level seen when downward trend started 2 years ago. With low prices, defending market share has become critical for oil exporting countries.

Trade and Economy:

During sanctions period, a Rupee payment arrangement was devised for part payment of Iran’s oil dues. Since June 2012, this has saved the country Rs 90,000 crores of foreign exchange, and sustained Indian exports of around Rs 80,000 crores so far. There is need to move on, and restore pre-sanctions arrangements. After rupee payment arrangement became operational in June, 2012, for two consecutive years, Indian exports went up by 38.97 % (FY 2012-13) and 48.35 % (FY 2013-14) respectively in dollar terms. UCO bank provided a much needed channel for making part payment for crude import, and financing Indian exports. Since then exports have started coming down. In post-sanction phase, the environment will become more competitive. In order to sustain, and increase exports, India has to move into project export sector. This needs extending credit and Iran has an excellent credit record with debt to GDP ratio of 2 %.

We need to clear the oil payments to Iran, which were held up due to sanctions. A beginning has been made. USD 750 million out of a total of USD 6.4 billion have been paid before PM Modi’s visit. It is hoped that with more banking channels opening up, balance dues will be cleared soon. Oil payments are a contractual obligation of Indian companies. The pending dues are important to a country strapped of cash.

The Iranian economy proved its resilience during the sanctions period. Since President Rouhani came to power, the economy had shown positive growth, Riyal stabilized and inflation was brought down to 14% from a high of 35% over past two years. During the sanctions period, GDP shrank by 6.8 % in 2012-13, and 1.9 % in 2013-14. In 2014-15, the growth figures moved into positive territory (3 %). The recent visit of the IMF Mission to Iran predicted a growth in GDP of 4-4.5%. Oil accounted for 30% of GDP before the sanctions. The combination of reduction in volume of crude exports due to sanctions, and low oil prices, has driven this figure further down to 18% in the last financial year. Thus Iran’s oil dependency is much below that of many other oil rich countries. Iran also has a conscious policy of diversification, though this will require more time and effort.

Majlis elections:

Recent Majlis elections have validated the nuclear deal, and strengthened President Rouhani’s hands. There are conflicting claims about exact strength of Reformist and Principalist groups in 10th Majlis. However, the salience of the Principalist group has been reduced. Independents will hold the balance. Like in most systems, Independents tend to side with the Government. The re-election of Larijani as Speaker suggests continuity.

Af-Pak

The situation in Af-Pak region will be in a flux following the expected American withdrawal after 2017. Iran is concerned with the rise of ISIS in Afghanistan. Iran hosts nearly 2 million Afghan refugees. USD 2 billion of transit trade also passes through Iran to Afghanistan. There is also religious affinity with Shia, Hazara groups and Iran. Iran is not included in the Quad group on Afghanistan; this group has not made much progress in any case. With the recent killing of Taliban leader Mullah Mansour, factional killings and violence in Afghanistan may intensify. India has made major contribution to Afghanistan’s development, and has a stake in peace in that country.

ISIS:

Rise of ISIS in Syria and Iraq also points to the need for co-operation amongst the countries of the region. There could be a convergence of interests between Saudi Arabia and Iran in combating ISIS, though unfortunately this strand has been clouded by rise of sectarianism. ISIS has attacked and killed Saudi guards on its border with Iraq. It could pose a limited territorial challenge to Iran; it has a greater ideological pull for Sunni Arab population of the Kingdom. India has an interest in the stability of the region, which accounts for 60 % of our crude oil imports, and Indian diaspora of more than 6-7 million. India could be a security provider.

After the nuclear deal:

Integration of Iran in the international mainstream is in the interest of all countries, particularly the regional neighbours. Excluding it will increase instability. The ideology espoused by ISIS challenges the State system, which came into being in the M.E. after first world war. There are strong economic grounds for working together. Before the sanctions, UAE had more than USD 21 billion of trade with Iran. UAE also provided banking channels. Most of the exports coming out of the country were re-exports. Iran continues to have good relations with Oman.

Will the nuclear deal survive a Republican victory in the US Presidential race? The extent, and level of EU’s engagement with Iran after lifting of sanctions, makes it difficult to envisage that it will re-impose sanctions. Russia and China are even more unlikely to do so. Unilateral US sanctions will hurt US corporate interests, and will not have the effect of a comprehensive sanctions regime.

India's relationship with Iran is not aimed at other countries. PM Modí’s visit has imparted a momentum, which needs to be sustained by timely and concerted implementation.

The author is former Ambassador of India to Iran.

Published Date: 7th June 2016, Image Source: http://www.oneindia.com

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of the Vivekananda International Foundation)

Post new comment