In July 2017, when the Narendra Modi government introduced goods and services tax (GST), there was strong apprehension among some smaller neighbours that it would act as a barrier to shore up their exports to India. The apprehensions were baseless as GST is a domestic tax. It replaced an archaic source and transaction-based tax system by destination-based taxation, ensuring the same tax for each good and service across the country. As is now apparent, the integration of imports with GST brought rich dividends to smaller neighbours, almost all of whom reported sharp increase in exports to India over the last two years.

Imports Are Up

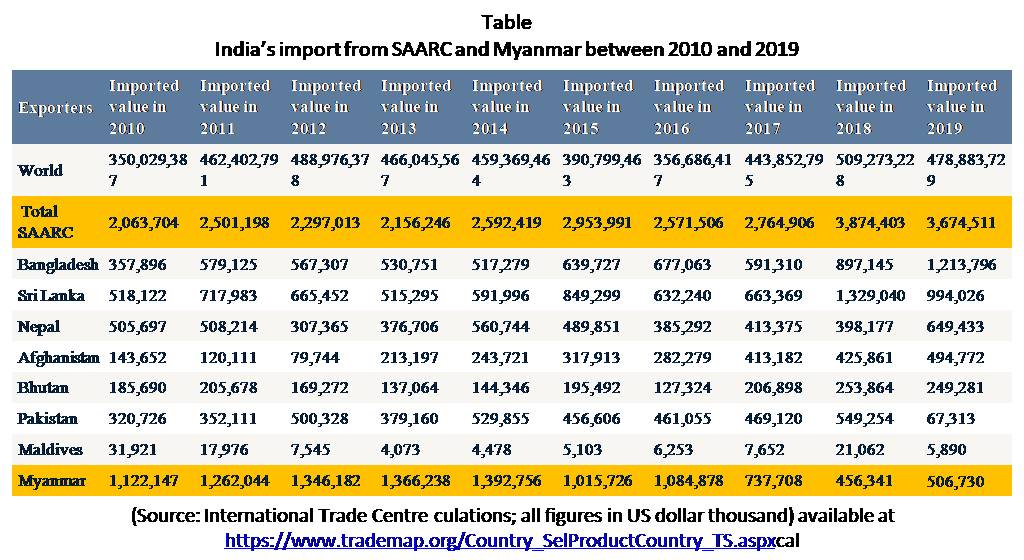

Between 2017 and 2019 (calendar), India’s imports from SAARC nations (Bangladesh, Nepal, Bhutan, Afghanistan, Pakistan, Sri Lanka, Maldives) increased by nearly 33 per cent - three times faster than the rate of growth in Indian exports - to reach $3.67 billion. During the period, China’s imports from the same set of countries (SAARC minus India) increased by 10 per cent to $3.33 billion. This is irrespective of a robust China-Pakistan trade relation.

Evidently, Indian imports from SAARC increased by a wider margin of 40 percent, in 2018, to reach a record high of $3.87 billion. The tally came down in 2019 due to fresh barriers to imports from Pakistan after Pulwama terror attack. Overall, on a two-year scale, barring Pakistan, Myanmar and Maldives; each of India’s smaller neighbours witnessed a dramatic rise in exports to India (see Table).

Pakistan trade is a political issue. Imports from Myanmar have been suffering for the last five years due to over emphasis on agricultural and forest products. It is not clear why exports by Maldives rose sharply in 2018 and fell in 2019. However, the volume stands at barely a few million dollars.

Trade Framework

There are definite reasons behind the surge in imports. However, to understand that we must take stock of the preferential trade framework offered by India to smaller neighbours under various mechanisms. As per the declaration made at Hong Kong ministerial of WTO in 2005, India granted duty free tariff preference (DFTP) to all least developed countries (LDCs) in 2008. The scheme was fully implemented in 2012 (amended in 2015) to offer duty-free access to more than 98 percent of India’s tariff lines. Bangladesh, Nepal, Bhutan, Myanmar, Afghanistan are eligible to trade under the scheme.

This apart, Nepal, Bangladesh, Afghanistan and Bhutan also enjoy duty-free, quota-free access to Indian market on a wide range of items under South Asia Free Trade Area (SAFTA). Sri Lanka, which is not an LDC, has the option of trading either through SAFTA or the India-Sri Lanka FTA (operationalised in 2000). The FTA offers Colombo duty-free access to Indian market in a number of items including apparels. Nepal and Bhutan enjoy extra preferential treatment due to their landlocked nature and currency pegging with Indian rupee. As per bilateral treaty (1996, 2009), India offers some unique concessions to Nepal, over and above the benefits under SAFTA and LDC scheme.

GST Reduced Barriers

Despite such preferential framework India’s total imports from SAARC grew by only 12 percent between 2012 (when LDC scheme was fully implemented) and 2016 (the year before GST was introduced). There are many reasons behind this. Trade with Afghanistan suffers from logistics issues. Maldives and Bhutan are too small to make a major impact. Nepal lacks competitiveness in the global market and 71 percent exports are directed to India. Nearly 85 per cent of export revenue of Bangladesh and 45 percent of Sri Lanka; come from garments. India has bigger and more integrated textile capacity.

Finally, “duty-free” in global trade parlance doesn’t mean without any duty. It means the item is spared from paying the basic ‘customs duty’. In the pre-GST period, imports attracted Additional Customs Duty, Special Additional Customs duty etc, over and above the Basic Customs Duty, as a means to protect the domestic production. This apart, imports were charged countervailing duty (CVD) at the same rate as central excise which was payable on domestic production of similar goods. Sales of imported items in the domestic market attracted VAT at equal rate to the domestic produce.

The framework underwent complete change in the GST regime. As per the Dual-Tax model adopted by India, GST rates are split in three categories Central GST (CGST), State GST (SGST) and IGST. The CGST and SGST collections go straight to the tax coffers of the Centre and the consuming State.

If a good is produced and consumed in the same State it would attract only CGST and SGST. But if it crosses the State boundary IGST will come into picture, which will be shared between the States, including the transit State. Imports are treated as inter-State transfers and attract IGST, at the same rate as is applicable on domestic produce, and duties other than basic customs duty are subsumed with IGST. The net result is: while neighbours already enjoyed exemption from paying basic customs duty on most of the items, post-GST the Additional Customs Duty, Special Additional Customs duty etc were in effect withdrawn.

Truly Duty-Free

Neighbours, particularly LDCs, now enjoy truly duty-free export advantage to India and that is reflecting in data. Between 2017 and 2019, Bangladesh’s exports to India increased by 105 percent, Sri Lanka nearly 50 percent, Nepal 57 percent, Afghanistan 20 percent and Bhutan 21 percent. Bangladesh being the largest is the maximum gainer, followed by Sri Lanka and Nepal. Such export growth of neighbouring economies, however, is unlikely to sustain for too long as the nature of competition hasn’t changed.

Garment makers of Bangladesh or Sri Lanka cannot expect much headroom vis-à-vis Indian manufacturers who have access to domestic supply of raw material and accessories. Also, Bangladesh is expected to lose its LDC status soon. Given the disparity in size and capacity in South Asia, the future growth will depend on complimentary value chain creation.

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://english.cdn.zeenews.com/sites/default/files/2017/10/22/633303-gst.jpg

Post new comment