China’s impending economic slowdown promises to send shockwaves through the world’s economies and is compelling them to assess exposure and explore mitigation strategies. Nowhere is the imperative more pressing than in Africa, where linkages with China are of considerable intensity and consequence - in the last two decades, China has played an outsized role in Africa, becoming its largest trading partner and builder of infrastructure, rendering local economic prospects increasingly synchronous with those of China’s. More broadly, the fates of households and businesses all over the world are closely linked with Africa’s economic prospects and, by extension, its relations with China. The countries of Africa are some of the last low wage regions on the planet that are slated to take on the mantle of being the world’s factory and supplier of cheap manufactures. Shocks and economic headwinds in Africa, therefore, translate into potentially higher prices for the rest of the world. China’s linkages with Africa, thus, have consequences that transcend the bilateral relationship and affect societies directly.

A slowing China, however, is not an unalloyed negative for African economies - it is more of a mixed bag than would be apparent. While African exporters of natural resources will certainly suffer, restraints on Chinese financing could bear a silver lining for the economies of Africa.

To be sure, the headwinds do stand out. Downward pressure on commodity prices due to weak demand from China will definitely contribute to substantial incontinence in Africa’s economies. Many of the continent’s economies are sustained by natural resource exports and China, on account of its vast domestic manufacturing ecosystem, has served as the principal market for these. For example, as of 2017, 54 percent of Angola’s total exports to the world comprised of crude oil exports to China. The figures for the Republic of Congo stood at 44 percent during the same year. Similarly, 32.7 percent of Zambia’s total exports consisted of copper exports to China. The same pattern is observable with respect to the Democratic Republic of Congo’s cobalt exports. As such, with domestic demand and manufacturing activity in China waning, Africa’s resource-dependent countries risk losing a large chunk of their business. When China’s economic prospects last dimmed in 2015, aggregate imports from Africa fell by a sizeable 40 percent. Moreover, contrary to the expectations of some commentators, a Chinese move to replace part of its American imports of crude oil with those from Africa will do little to ameliorate the downward pressure. China’s crude oil imports from the USA stood at one percent of the total in 2017, nowhere near the expected attenuation of oil demand in the event of a slowdown; in 2015, China’s total oil imports from Africa were reduced by 48.3 percent. China’s slowdown will, thus, invariably exert downward pressure on the growth of Africa’s resource-intensive economies.

When it comes to China’s infrastructure development and financing, Africa’s prospects are more of a mixed bag. On the negative side, although Xi Jinping announced a 60 billion USD commitment towards Africa at the 2018 Forum on China-Africa Cooperation (FOCAC), China’s ongoing domestic debt excesses could ostensibly necessitate more restraintful lending practices to African recipients. It has already been observed, for instance, that China’s concessional lending commitments were reduced at the 2018 FOCAC in comparison to previous summits. Additionally, in 2016, China’s construction revenues in Africa fell for the first time since 1998, indicating that tolerance for defaults may be waning and a slowdown in infrastructure financing could be imminent. Meanwhile, the African Development Bank estimates that the continent’s infrastructure spending requirements amount between 130 and 170 billion USD a year. As such, China’s slowdown and the concomitant credit constraints will likely affect plans to plug Africa’s infrastructure gap. Nevertheless, a lending slowdown will also bear tangible benefits for Africa that are less appreciated.

Firstly, credit constraints faced by China’s policy banks will facilitate stricter due diligence with respect to the identification of profitable infrastructure projects. This will also drive Chinese financiers of infrastructure to prioritise regionally integrative projects, and introduce a degree of multilateralism to China’s engagement with Africa, which has hitherto been largely bilateral in nature. Hints of changes in this direction have, indeed, become apparent in the years since China’s economy began losing steam. Since the 2018 Forum on China-Africa Cooperation (FOCAC), for instance, President Xi has repeatedly expressed China’s commitment to align the Belt and Road Initiative (BRI) with the African Union Agenda 2063, an aspirational policy document that places a particularly strong emphasis on regional integration within the continent. Congratulating the 32nd Summit of the African Union held in February, 2019, President Xi stated that, “China is willing to work with Africa to implement the FOCAC Beijing Summit outcomes, promoting the alignment of the joint construction of the Belt and Road with the implementation of the AU Agenda 2063, the UN 2030 Sustainable Development Agenda as well as other development strategies of African countries.”

Secondly, China’s slowdown will serve as a drag on the growth of debt in African countries, providing their policymakers with time to assess the effects of infrastructure development and plan future spending in in a more deliberative manner. This will amount to an attenuation in the financial risks associated with China’s lending in Africa, which has been considered a significant threat to local economies. While they will likely fall short of infrastructure spending targets, they will simultaneously be incentivised to boost absorptive capacities by improving institutions and human capital, as opposed to relying on large capital inflows. As noted in the African Development Outlook 2018 report, “African countries do not need to solve all their infrastructure problems before they can sustain inclusive growth.” A slowdown in China will draw more attention to this reality.

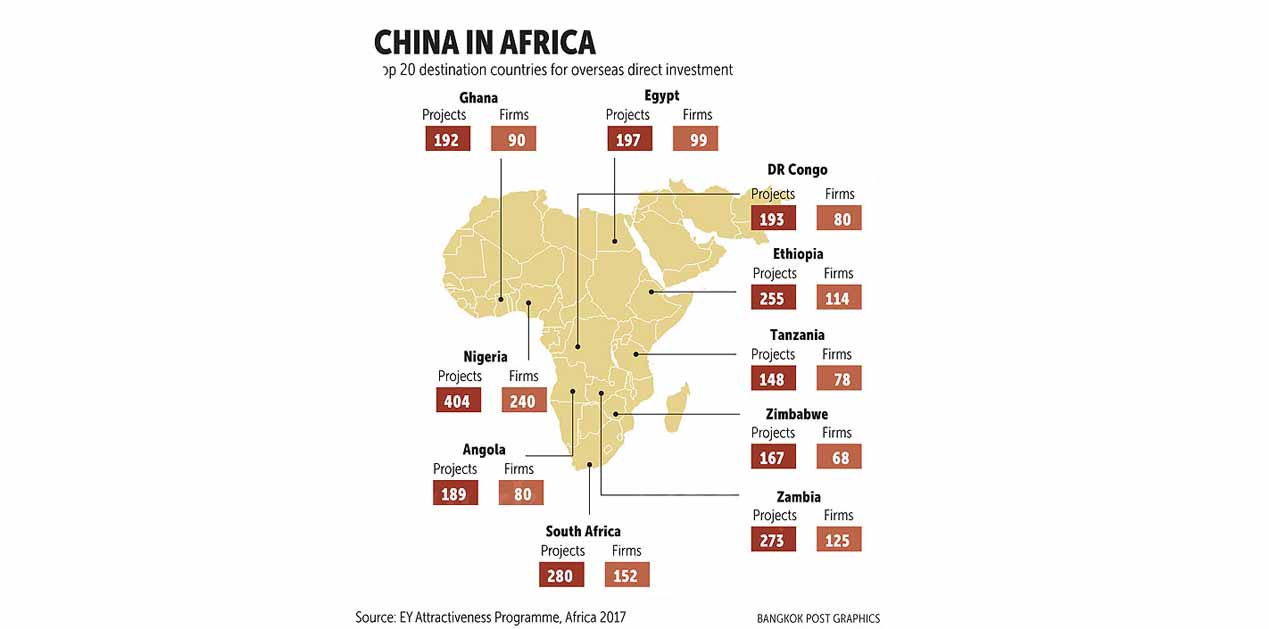

Finally, private industry in Africa is poised to benefit from a recalibration in China’s economic engagement with Africa. In order to sustain positive ties with African partners even as growth in resource imports and infrastructure financing atrophy, China will be induced to significantly ramp up foreign direct investments in Africa, an aspect which has been relatively neglected in relations. In 2016, Chinese FDI in Africa at 2.4 billion USD only comprised 1.2 percent of its total outward FDI and amounted to only 4 percent of Africa’s total inward FDI, when calculated based on United Nations’ data. China is already moving to increase its FDI in Africa, as its economy slows. The 2018 FOCAC was the first wherein an explicit commitment of 10 billion USD towards investments in Africa was made. Before that, in 2017, Huawei had indicated that it would invest a billion USD in Africa towards facilitating what Steven Zheng, Chief Marketing Officer Global Services of Huawei, has called a Digital Operations Transformation. Similarly, Alibaba has launched a USD 10 million fund to train African entrepreneurs and has expressed a commitment to develop the capabilities of local e-commerce players rather than entering the local telecommunications market itself. China’s increased investment focus, especially in the telecommunications sector, will possibly allow for more technology transfer than is generally associated with infrastructure development.

While these silver linings are unlikely to prevent the impending recession Africa is confronted with, it will allow the continent’s constituent economies to cultivate a more symmetric relationship with China and pursue more organic, and less risk-ridden, economic growth. Tribulations in the short-run should not obscure them.

(Uday Khanapurkar is a Research Assistant at the Institute of Chinese Studies, Delhi)

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Image Source: https://static.bangkokpost.com/media/content/20171204/2562967.jpg

Post new comment