Governments worldwide are at the time engaged in containing COVID-19 and have either initiated unprecedented lockdowns or following strict social distancing protocols for public safety and prevent community transmission. The World Health Organisation declared pandemic has the policymakers go back to drawing boards to chart out what is going to be the "new normal" as countries look forward to rebooting their economies. Amidst the chaos, China has been actively testing its digital currency called the e-Renminbi (RMB) in some of its larger cities.

China's confidence in the technology comes from two of its biggest private enterprises Tencent and Ali Baba, who pioneered the digital payment systems in the country. Both companies' payment platforms account for 90 per cent of the country's digital transaction. The aim behind these payment platforms was to enable creating a vast ecosystem for online and offline goods and services. The data gathered would help transform the financial services in China. The People's Bank of China plans could be path breaking as e-RMB would be transferred without the use of the internet. Government employees and public servants in China have been paid their monthly salary of April using this new form of currency. In one of the cities, the e-RMB was used for subsiding public transport, and in another, the trial focused on the food and retail sector.

In 2019, China announced that its digital currency would be similar to social media giant Facebook's digital currency Libra. Facebook’s Libra network and the currency do not exist, but there are plans to launch it sometime in 2020 (although that might change due to COVID-19). China, at the time, claimed that along with bearing similarities with Libra, their digital currency would be used across all payment platforms operating in China. Although, questions were raised as to why the country would need digital currency when payment platforms are developed and widely accepted. The Central Bank's answer to this question is that a push for digital currency would help protect the country's foreign exchange sovereignty.The announcement came at a time when China was embroiled in a trade war with the U.S.1

Global regulators were not enthusiastic about Facebook's Libra project as the extensive use of the digital currency could lead to money laundering due to the social media giant's transnational reach. China's central bank's second in command believes that their version of the digital currency would be able to strike a balance between anonymous payments while preventing money laundering.2 Western economists like Kenneth Rogers (former chief economist of the International Monetary Fund) are skeptical of the acceptance of China's digital currency worldwide. China, unlike the U.S, has an opaque financial system along with burdensome capital controls added with limits on their foreign holdings equities. The records of the transactions of this new digital currency will go through a clearing house controlled by the Chinese government. If the currency is widely accepted world over, then it would put considerable restraints on U.S authorities to check the transactions.3 U.S authorities, especially the Department of Treasury, have permitted insight into the transactions of the widely used Society for Worldwide Interbank Financial Telecommunication (SWIFT) in Belgium. However, one should not expect the same level of cooperation from Chinese authorities, especially when their plan is to bypass the U.S dollar.

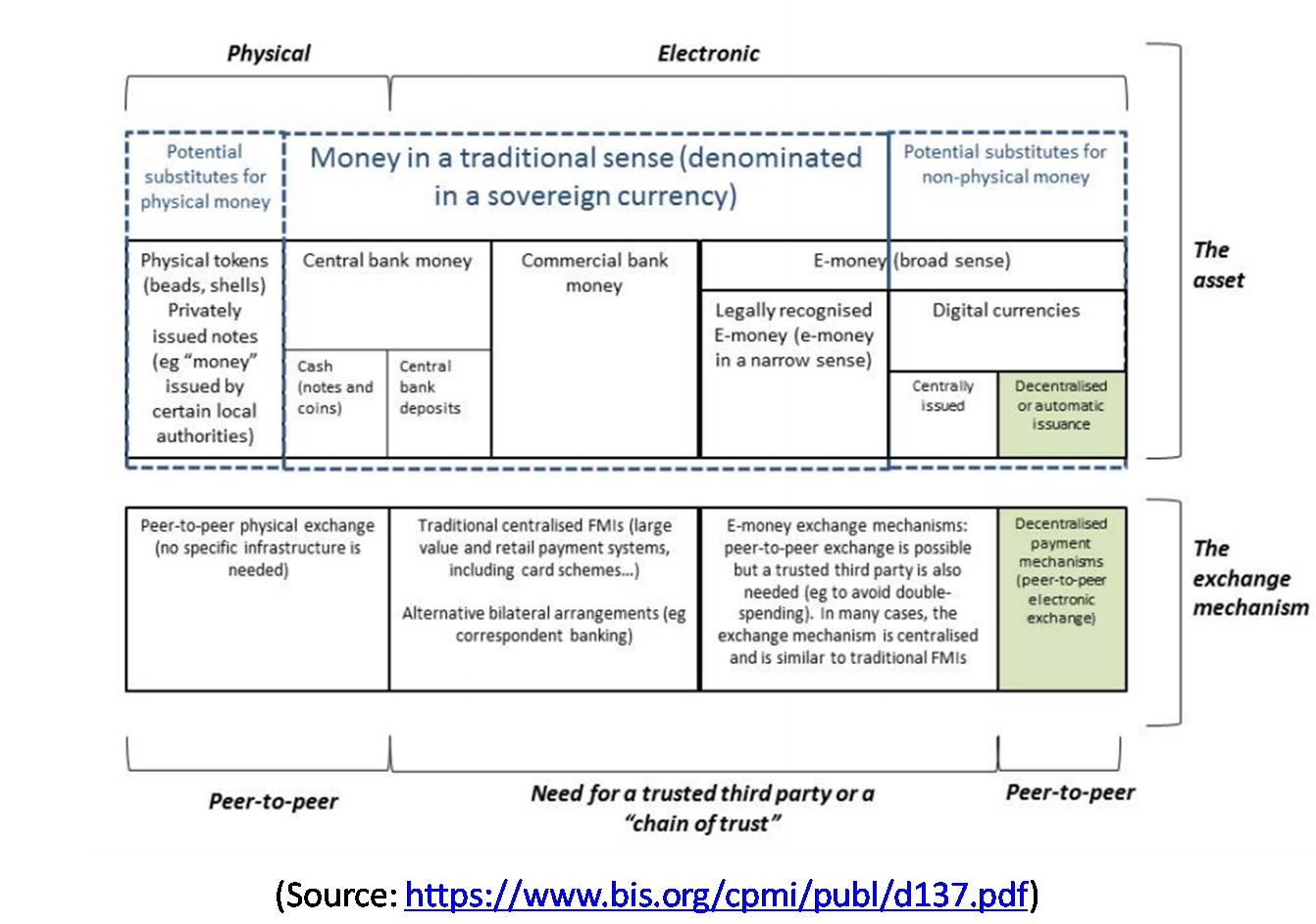

Capital controls by the government have led to various ways of money laundering and terror financing, which law enforcement agencies relentlessly track. The introduction of digital currencies would add to the existing problem. They would also affect the exchange rates and monetary policies in the future. A global digital currency would lead to the removal of all levers of capital controls of the government.4 Facebook's Libra comes with its own set of problems, which are privacy, financial stability, money laundering, and concerns about consumer protection, as highlighted by the Federal Reserve Chair, Jerome Powell.5 The risks of digital currency when not regulated by the governments are higher, especially when they run the risk of lack of regulatory intervention and price volatility. Besides, block chain technology, which is the backbone of digital currency, might have considerable impact not just on financial services but also on healthcare, law, education, government, and other sectors.6

China’s digital currency would be backed by RMB, unlike Libra, which is going to be backed by a basket of currencies. While the central bank pushes and advocates for a cashless economy, contradictions arise when it sees any other digital currency or payment system as a threat to its financial security.7 Libra poses a challenge to the centre’s capital control and might not enter the Chinese financial market as Facebook is banned. The centre also came down heavily on crypto currency trading, which according to them, threatens the financial security of the country. The clampdown on the trading and non-availability of Libra in Chinese markets clears the path for e-RMB’s rollout in the future without any competition. The trials are taking place, but further research and development of the digital currency were put on hold in February 2020 due to COVID-19, which means that a countrywide launch might be delayed for a few months.8

In 2008, Satoshi Nakamoto published the world's first white paper on Bitcoin using cryptography as the base for creating a worldwide, decentralised currency. Since then, the digital currency saw a dream run, reaching a valuation of 100 Billion USD attracting investors and interests from technology enthusiasts, the black market, and the legitimate market. One of the concerns about the security of the digital currency is that it is secure in practice but not in theory. The decentralised structure of the currency has led to unique political and socio-economic challenges. The operation and maintenance of this digital currency are distributed to a number of peers known as miners. The miners were held accountable through a balanced incentive scheme. Over the years, advances in hardware have led to the centralisation of Bitcoin, which then generated congregations of miners into pools. Many of these pools are based out of China.9

China, during this run of Bitcoin, exploited the tools at their disposal to influence these mining pools and Bitcoin at large. These tools included centralised control over financial services and the economy while operating extensive surveillance and censorship on domestic internet. The multiple rounds of restrictive regulations affected the Bitcoin market internationally and in China in 2017.10The growth of this crypto currency started in China in 2013, and Chinese exchanges dominated the global exchange market of Bitcoin indicated by transactions executed in RMB as opposed to other currencies. During this time, though, China's position on Bitcoin and similar crypto currencies were ambiguous, and regulators were not serious about instituting tight controls. Concerns were raised about the subversion of capital controls, speculative risks, and criminal activity until 2017 when regulations were tightened on the exchange industry.11

China’s digital currency has been in development since 2014 with the aim that it will simplify settlement payments for the banks. The launch of the digital currency would be disruptive and could lead to countries researching and developing their digital currencies. The central bank controlled digital currencies in the future would lead to the creation of different settlement mechanisms for cross border transactions. This could reduce dependency on U.S dollar clearing. In China’s case, this is an added benefit as they look to improve the efficiency of transactions.12

China has been wary of weaponisation of the U.S dollar, and fears of post-COVID-19 U.S response would target the Chinese economy and, in extension, the Belt and Road Initiative (BRI). "Isolate, Disconnect and punish China" is how the U.S response would be according to Chinese analysis, which would lead to dire consequences not just for China but for the U.S economy in their opinion. Further on, an example cited of weaponisation of the U.S dollar was when European companies trading with Iran were threatened with sanctions and would be unable to use the SWIFT dollar settlement system not just for their Iranian businesses but for businesses worldwide. These actions were enabled through unilateral sanctions placed by the U.S on Iran a year after pulling out of the Joint Comprehensive Action Plan (JCPoA). China does not see a future where a countrywide sanction like Iran would be placed, but its companies (citing Huawei) would face the brunt.13

The digital currency tests by China are part of a larger play to establish an alternative to the U.S dollar-dominated trade system. The RMB based alternate trade system depends on the development and deployment of a sovereign digital currency within China, which would be followed by regional adoption. The e-RMB system would ensure that companies and countries using this system would not be affected by any politically motivated sanctions which are disruptive. The e-RMB test comes at the time when COVID-19's impact did not affect the stability of the Chinese currency, as the authorities claim. The Chinese see the U.S dollar and the newly tested sovereign currency working together, and if the need arises, it would be mutually exclusive.14 On the domestic front, for China, it would be easier for the authorities to track and tackle issues of corruption and money laundering and "protect" their foreign exchange sovereignty.15

Beijing, in recent years, has been pushing for foreign entities to use the RMB. The initiative has been mostly unsuccessful, but the testing of the digital currency might lead to the possibility of using e-RMB in everyday transactions worldwide, according to a CEO of an American peer to peer payments technology company. These comments and observations come at a time when the U.S dollar is the world's "reserve currency." Fifty-eight per cent of all foreign exchange reserves and forty per cent of the world's debt is denominated in U.S dollars.16

The U.S response at the time has not responded to these trials. A bigger problem is that in the presidential debates, there has been no mention or focus on the looming threat and how no clarity on what the next U.S President's game plan is to counter China's move. President Trump on Twitter in 2019 while expressing his dislike for Bitcoin mentioned as to how there is one "real currency" in the U.S, which is robust, reliable, and dominant, and that is the U.S dollar. When asked how he would contain North Korea's nuclear weapons program, Joe Biden, the Democrat's Presidential Candidate, said," I would be putting pressure on China to put pressure on North Korea, to cease and desist from their nuclear power." The answer did not take into consideration that digital currencies are a hurdle to Washington's plans of containing threats to their national security in the future. COVID-19, coupled with low trust in the U.S leadership, may lead to a situation where digital currencies are bypassing dollars into a reality, which is already under process in China. The former Governor of Bank of England has called for creating a "digital hegemon," and the Federal Reserve Chairman, Jeremy Powell, has expressed anxiety regarding Facebook's Libra and e-RMB and the systemic risks they pose for the dollar.17 Concerns with China's digital currency lead to strategic concerns worldwide for U.S national security as it might undermine its powers of unilateral sanctions and lesser levers to pull and get better leverage against its opponents.

The question then arises as to whether the U.S is looking towards digital currency. At present, the U.S government has its hands full due to COVID-19, but discussions for a U.S digital currency have not been fruitful. In September 2019, a few representatives in the U.S Congress urged the Federal Reserve to start the development of a U.S digital currency in order to maintain U.S dollars' popularity in the international markets for settlements. As a caretaker of the world’s reserve currency, the Federal Reserve has to be more careful and take into consideration privacy, monetary policy, financial stability, and operational risks of the U.S digital currency once launched.18

Facebook's Libra announcement also put the European Union on notice. German and French governments were not enthusiastic about the announcement and saw it as a threat to "monetary sovereignty." The statements came at a time when the European Central Bank had started taking an interest in a potential public digital currency. Some commentators have suggested that the European Union should take a different route and consider embracing an existing and mainstream digital currency due to rapid technological advances and concerns of consumer protection, cyber-security. In this case of waiting for a mainstream digital currency, it is highly unlikely that the ECB would endorse something which is not under their control as they also grapple with the reality that Libra, Bitcoin, and e-RMB are considered to be the future.19

China's determination to be self-reliant and the subsequent threat to dollar add a new dimension to the U.S-China technology rivalry. The technology in question is still in its nascent stages and focused on consumer spending. Once it is deployed widely into the country's banking systems, it would be the next significant disruption, and preparation for the same has already begun. Along with creating an alternative China-controlled worldwide financial system, it would strengthen China's surveillance strength as it would give them the ability to track and monitor spending flows. Unlike the U.S leadership, Xi Jinping, the President of China, stands behind the idea of block chain and, in extension, the digital currency, giving the People's Bank of China to be next big thing in fintech.20

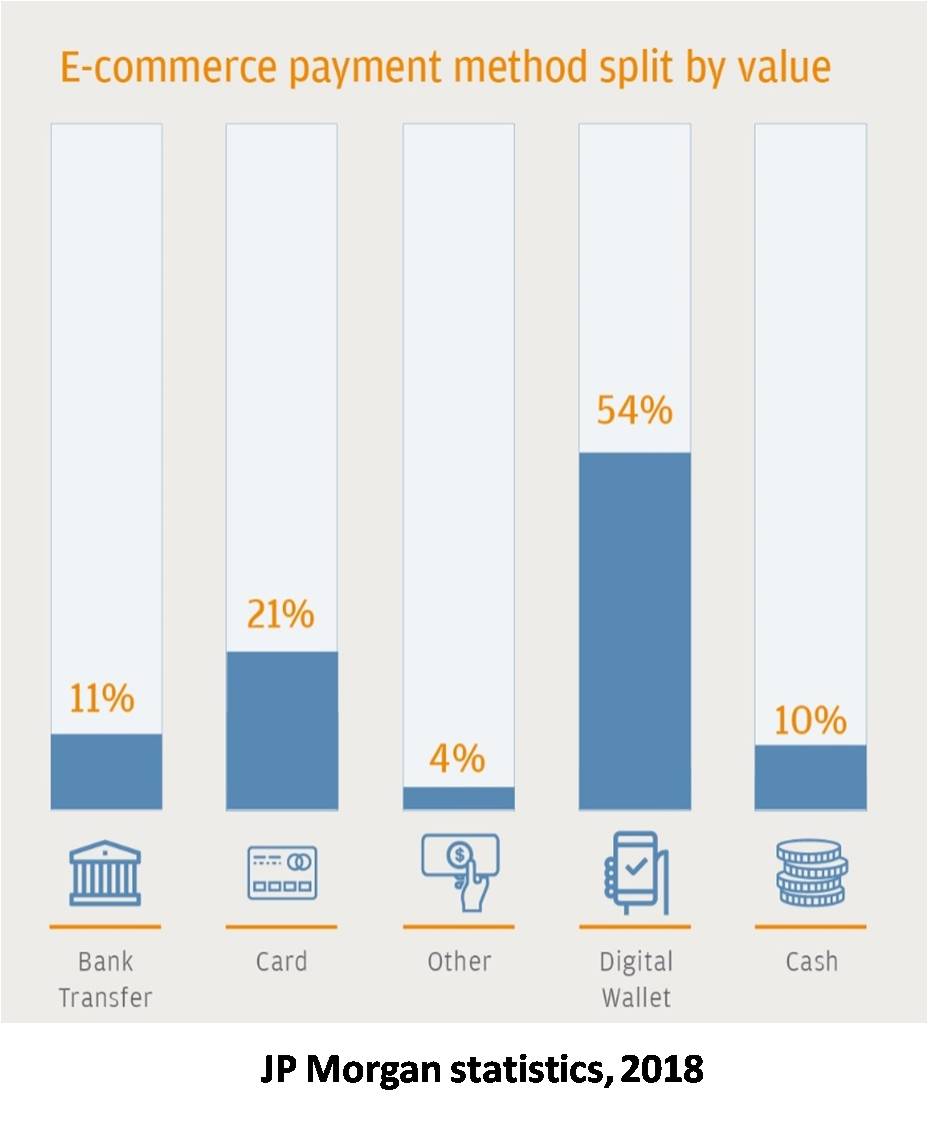

China capitalised on the widespread use of smartphones and bank accounts in the country to go forward with this change. It is not that the U.S and Europe do not have these technologies, but they are reliant on old-tech like credit cards. The credit card infrastructure is omnipresent in the U.S and Europe, and to enable a change would take a long time. China, on the other hand, was a cash economy twenty years ago, so the transformation has been more comfortable for the financial services there to accommodate the changing realities. People accepted the new payment platforms in China and used it, leading to e-RMB being tested.

For the time being, COVID-19 has put much pressure on the global economy and especially the Chinese economy, which is dependent on exports. The leadership in China is looking to shift the focus from export-led growth to domestic consumption, which means that comprehensive plans of e-RMB would include the rural economy and smaller cities and towns in the future. The timeline of the same could be discussed in the annual meeting of the Chinese parliament in May 2020. It is yet to be seen if the central bank in China would be well-equipped for providing good quality service, especially in the retail sector. Central banks are not profit-oriented or customer-facing specialists.The success of the trials and the subsequent roll out at a large scale could be expected in early 2021 as the Communist Party of China celebrates its centenary and widely used before the Winter Olympics in 2022 in Beijing.

The pandemic gives a chance for crypto currencies to stand out. The 2008 Global Financial Crisis gave birth to Bitcoin, and its growth led to the development of digital currencies. Printed money is a carrier of viruses, and digital currencies ensure otherwise. In its current form, digital currencies have a long way to go as it also has to make way to the deprived sections of the society who are dependent on cash and mostly affected by inflation. China’s plans to look inwards and focus on the rural economy (it is still not clear what has been the effect of COVID-19 in rural areas in China) would mean that a full-fledged cashless economy is a distant dream. Any central bank in charge of digital currencies has to go for an all-in or nothing approach. If the currency is to be launched, it has to be for everyone. For the time being, the launch of a central bank digital currency, China puts it in a collision course with not just the U.S dollar but also private crypto currencies like Bitcoin and Libra. The new front of the tech war has been opened by China in this strategic rivalry between them and the U.S.

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Links:

[1] https://www.vifindia.org/2020/may/11/covid-19-paves-the-way-for-a-cashless-economy-in-china

[2] https://www.vifindia.org/author/aayush-mohanty

[3] https://www.reuters.com/article/us-china-cryptocurrency-cenbank/china-says-new-digital-currency-will-be-similar-to-facebooks-libra-idUSKCN1VR0NM

[4] https://www.theguardian.com/business/2019/nov/11/chinese-digital-currency-facebook-libra

[5] https://www.livemint.com/opinion/online-views/cryptocurrencies-could-constrain-a-country-s-choices-1567447742065.html

[6] https://cryptomaniaks.com/china-e-yuan-economic-arms-race

[7] https://www.entrepreneur.com/article/302778

[8] https://www.scmp.com/economy/china-economy/article/3043134/chinas-new-digital-currency-isnt-bitcoin-and-not-speculation

[9] https://www.globaltimes.cn/content/1180737.shtml

[10] https://www.ft.com/content/e3f9c3c2-0aaf-11ea-bb52-34c8d9dc6d84

[11] https://www.cnbc.com/2019/09/13/chinas-new-cryptocurrency-and-yuan-rmb-internationalization.html

[12] https://www.coindesk.com/why-arent-the-candidates-talking-about-digital-currency

[13] https://www.brookings.edu/blog/techtank/2019/12/13/the-current-landscape-of-central-bank-digital-currencies/

[14] https://www.finextra.com/newsarticle/34753/eu-looks-to-join-digital-currency-wave-in-response-to-libra

[15] https://in.reuters.com/article/us-china-crypto-breakingviews/breakingviews-chinas-e-yuan-will-be-more-cryptic-than-crypto-idINKBN1YR0DC

[16] https://unsplash.com/photos/TZB-1vfImhY

[17] http://www.facebook.com/sharer.php?title=COVID-19 Paves the Way for a Cashless Economy in China&desc=&images=https://www.vifindia.org/sites/default/files/photo-1571952924075-5f11bad74738.jpg&u=https://www.vifindia.org/2020/may/11/covid-19-paves-the-way-for-a-cashless-economy-in-china

[18] http://twitter.com/share?text=COVID-19 Paves the Way for a Cashless Economy in China&url=https://www.vifindia.org/2020/may/11/covid-19-paves-the-way-for-a-cashless-economy-in-china&via=Azure Power

[19] whatsapp://send?text=https://www.vifindia.org/2020/may/11/covid-19-paves-the-way-for-a-cashless-economy-in-china

[20] https://telegram.me/share/url?text=COVID-19 Paves the Way for a Cashless Economy in China&url=https://www.vifindia.org/2020/may/11/covid-19-paves-the-way-for-a-cashless-economy-in-china