The effects of the United States of America’s (U.S) pulling out of the Joint Comprehensive Plan of Action (JCPoA) in early 2018 had an impact on the global oil trade, which continued in 2019. The renewed unilateral sanctions on Iran and applied pressure on countries importing oil from Iran had an adverse impact on India’s oil imports. The international oil market volatility was augmented by protests in Venezuela, Iraq, and the proxy war between Iran and Saudi Arabia.

In early 2019, the United States decided to remove waivers known as Significant Reduction Exemption (SRE). The SRE helped countries dependent on Iranian oil to not attract sanctions from the U.S. The removal of SRE was to cut off Iran’s primary source of income. For India, 2019 was the year, where it had to explore other options because of a lack of alternative payment systems along with extra-territorial economic prowess of the US.

In the Middle East, the proxy war between Iran and Saudi Arabia, along with escalating tensions between Iran and the U.S, played a significant role in oil prices and trade. In the first half of 2019, U.S and Iran confrontation reached a flashpoint when Iran shot down a U.S drone, and around the same time, the U.S accused Iran of attacking oil tankers near the Gulf of Oman. The U.S also sent 1,000 additional troops to protect the essential maritime trade route from “Iran and its proxies.” 1

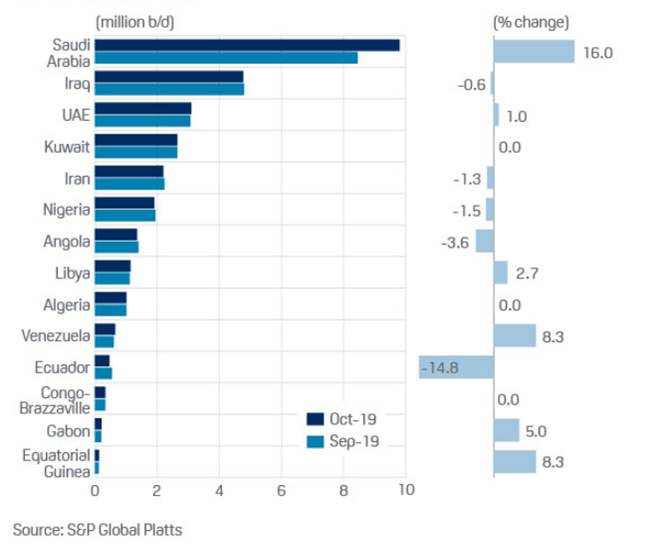

Iran-Saudi Arabia relations took a turn for the worse when Saudi Arabia accused Iran of sabotaging two of its oil tankers near the coast of the United Arab Emirates.2 In the latter half of 2019, Saudi Aramco’s oil facilities were part of drone strikes by Yemen’s Houthi rebels, who are allegedly backed by the Iranians. The attacks on facilities led to a loss of approximately 5.7 million barrels per day (BPD) of total Saudi oil output. Meanwhile, estimates suggest that Iran was able to sell only 100,000 BPD which is roughly one-tenth of their export volume, and had an impact on their annual budget.3

At the beginning of 2019, Qatar left the Organisation of Petroleum Exporting Countries (OPEC) as it wants to focus on the production of natural gas.4 Libya5 and Iraq have increased output after facing difficulties in the first half of 2019. Iraq hit record production figures in August 2019 with an output of 4.88 million barrels per day (BPD) and defied the 14 member-state OPEC who are trying to keep a floor under the declining oil prices. Iran’s decrease in output and Iraq doing precisely the opposite makes it challenging to keep peace within OPEC.6

In Venezuela, the political crisis has led to a dire humanitarian situation. The Venezuelan economy, which is heavily dependent on oil exports and has the highest reserves in the world, has seen a continuous drop in oil production. Crumbling infrastructure along with the exodus of Petróleos de Venezuela, S.A. (PDVSA) trained employees to other oil-exporting nations or oil companies and U.S sanctions are becoming increasingly detrimental to Venezuela’s economy and global oil prices.7

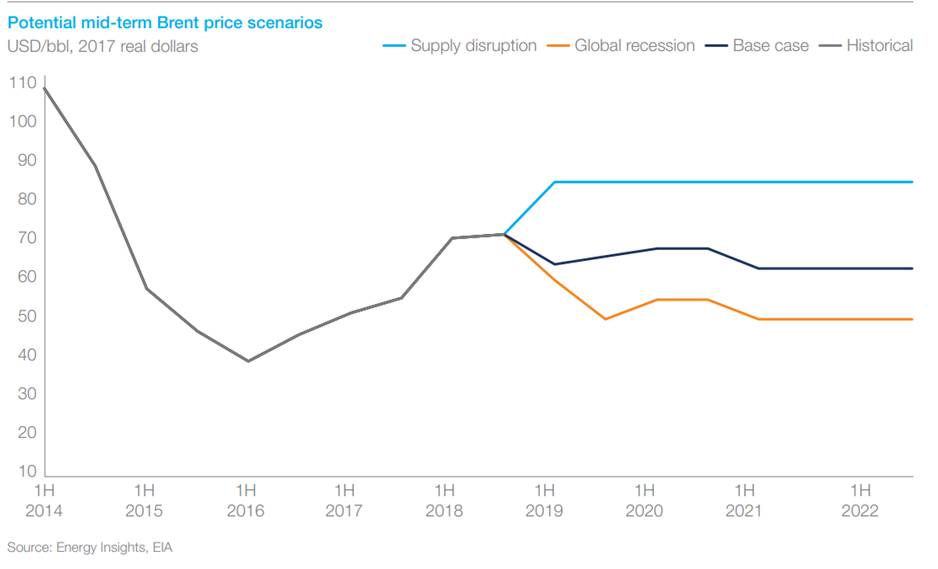

The critical highlight in 2019 is also the launch of Aramco Initial Public Offering (IPO), which can be touted as the most prominent business event of 2019. The IPO was valued at 1.7 Trillion. The Saudi Arabian government wants oil prices to be at 80 USD per barrel to generate more revenue as 2019 was the seventh straight year when government spending outstripped the revenues. By the second day of trading of Aramco, its valuation had reached 2 trillion USD.8

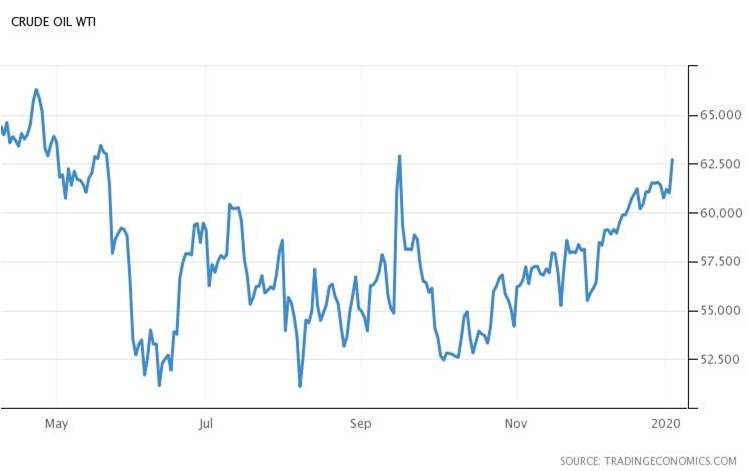

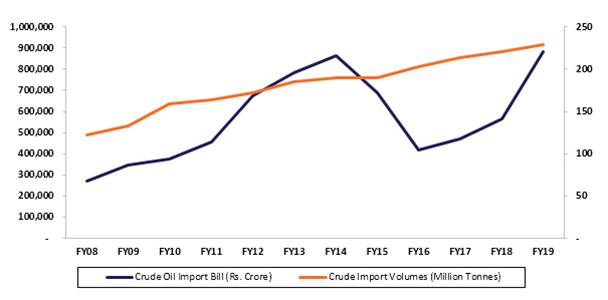

In September 2019, when India’s Finance Minister announced a reform package to stabilise the Indian economy, the Houthi rebels conducted drone strikes on critical Saudi facilities, as mentioned in the above section. The attack led to Brent-Crude gaining the sharpest single-day gain. Saudi Arabia after the attack decided to reduce output by 50 per cent. The oil import bill for India from 2014 to 2019 has more than doubled. The prices are steep in India due to the custom duties imposed by the Government of India. An increase in oil prices also weakened the Indian rupee leading to the trade deficit and adversely affected the current account deficit and trade deficit. The spike in oil prices has affected and will continue to affect several macros negatively. 9

Indian airlines like Air India and Jet Airways are on the verge of bankruptcy and is bankrupt, respectively due to the ongoing crisis and high rates contributed by high taxes on aviation fuel. An addition to the woes of these airlines is Pakistan closing its airspace after the Balakot airstrikes which has led to the addition of costs of domestic airlines. 10 These big moves had an impact on the Indian economy as it imports over 70 per cent oil to sustain its energy needs, has led to stagflation due to weak consumer demand and higher oil prices. 11

India, in 2019, in order to circumvent the sanctions and to maintain a steady supply of oil, has signed essential agreements. Indian Strategic Petroleum Reserves Limited signed an agreement with Saudi Aramco to lease a part of the 2.5 Million tonne Padur storage in Karnataka. India is also involved in developing more reserves to add 12 additional days to the already existing ten days of strategic reserves. Saudi Aramco has also shown interest in buying out Bharat Petroleum Corporation.12

Meanwhile, India-Iran relations in the context of oil imports have not been impressive. India has strategically reduced imports from Iran in light of U.S sanctions and removing SRE.13 Javed Zarif, the Iranian Foreign Minister in late 2019, accused the U.S of “bullying” India as oil imports from Iran were cut immediately in reaction to the removal of SRE in early 2019. Zafari emphasised during a press conference with the Indian Women Corps (IPWC) that India should factor in the higher costs that will be incurred by the Indian agricultural sector if India does not import petrochemicals and export rice from and to Iran respectively. Zarif, did point out that India has rejected the U.S sanctions and has made it clear that it only recognises sanctions by the United Nations.14 In the meantime, the U.S has become one of the top exporters of oil to India as imports from Venezuela and Iran have wind down significantly in 2019.15

To conclude, India’s options due to recent developments in the Middle East seem limited but raise significant prospects, challenges, and questions for 2020.

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Links:

[1] https://www.vifindia.org/2020/January/13/complicated-2019-for-the-international-oil-market-and-trade

[2] https://www.vifindia.org/author/aayush-mohanty

[3] https://www.mckinsey.com/solutions/energy-insights/global-oil-supply-demand-outlook-to-2035/~/media/231FB01E4937431B8BA070CC55AA572E.ashx

[4] https://www.spglobal.com/en/research-insights/articles/oil-prices-and-aramco-ipo-raise-stakes-for-opec-cuts

[5] https://tradingeconomics.com/commodity/crude-oil

[6] https://www.indiainfoline.com/article/general-blog/the-surge-in-oil-price-and-indian-economy-119091700125_1.html

[7] https://www.vox.com/world/2019/6/21/18700857/us-iran-standoff-timeline

[8] https://www.theguardian.com/world/2019/may/12/uae-four-merchant-ships-reported-sabotaged

[9] https://www.aljazeera.com/news/2019/09/drone-attacks-saudi-aramco-blow-iran-tensions-190916051658838.html

[10] https://www.aljazeera.com/news/2018/12/qatar-withdraw-opec-january-2019-181203061900372.html

[11] https://ihsmarkit.com/research-analysis/crude-oil-trade-libyan-production-and-exports-back-to-normal.html

[12] https://www.cnbc.com/2019/09/06/iraq-is-pumping-record-oil-disrupting-opecs-production-cutting-plans.html

[13] https://www.bloomberg.com/news/articles/2019-03-15/scattered-across-globe-pdvsa-roughnecks-wonder-about-going-home

[14] https://www.thehindubusinessline.com/economy/rising-crude-oil-prices-is-a-key-challenge-to-new-government/article26904408.ece

[15] https://www.thehindubusinessline.com/economy/emerging-economies-like-india-more-vulnerable-to-big-oil-price-moves-report/article29438725.ece

[16] https://economictimes.indiatimes.com/news/politics-and-nation/india-signs-deal-with-saudi-arabia-for-strategic-oil-reserves-retail-matters/articleshow/71811385.cms?from=mdr

[17] https://m.economictimes.com/industry/energy/oil-gas/us-deadline-ends-india-stops-purchasing-iranian-oil/articleshow/69475495.cms

[18] https://www.indiatoday.in/india/story/india-us-iran-javad-zarif-1619837-2019-11-17

[19] https://www.indiatoday.in/diu/story/how-the-us-is-realising-india-s-oil-concerns-1602730-2019-09-24

[20] https://images.rigzone.com/images/news/articles/153583_582x327.png

[21] http://www.facebook.com/sharer.php?title= Complicated 2019 for the International Oil Market and Trade&desc=&images=https://www.vifindia.org/sites/default/files/153583_582x327.png&u=https://www.vifindia.org/2020/January/13/complicated-2019-for-the-international-oil-market-and-trade

[22] http://twitter.com/share?text= Complicated 2019 for the International Oil Market and Trade&url=https://www.vifindia.org/2020/January/13/complicated-2019-for-the-international-oil-market-and-trade&via=Azure Power

[23] whatsapp://send?text=https://www.vifindia.org/2020/January/13/complicated-2019-for-the-international-oil-market-and-trade

[24] https://telegram.me/share/url?text= Complicated 2019 for the International Oil Market and Trade&url=https://www.vifindia.org/2020/January/13/complicated-2019-for-the-international-oil-market-and-trade