At the COP-26 summit in Glasgow, Prime Minister Modi had committed India to some bold environmental targets, to achieve which the Centre must work with the State where the economic activities take place that also take their toll on nature. It would require huge investments in energy technology to improve the efficiency of our energy use to achieve the targets. However, most states, ridden with huge debt burdens especially in the wake of the pandemic, won’t be able to find the resources necessary for such investments. States are also beset with huge environmental problems connected with livelihood and other issues which they cannot address for want of resources, especially now with their economies battered by the pandemic. Hence we must think of alternative innovative strategies to address both the problem of inadequacy of resources and environmental issues, if India is to achieve the targets committed at the COP-26.

The paper attempts to suggest such a strategy, taking a cue from what the Twelfth Finance Commission did to address the debt problem of the states with remarkable success, as also from the philosophy of the nature-for-debt swap transaction experiences of many indebted countries which had faced the risk of defaulting on repayment of their external debts. Such transactions have succeeded in reducing their debt levels substantially in exchange for their commitment for environmental protection and conservation of nature. Citing the examples of Punjab and West Bengal, the paper suggests that the Centre may begin a similar exercise by undertaking to waive a part of the debts of states owed to the Centre in exchange for their commitments backed by proof of achieving agreed environmental goals, in a methodology similar to that adopted by the Twelfth Finance Commission.

In one of the most ambitious targets by a developing country to combat climate change, at the COP-26 summit in Glasgow in November 2021, Prime Minister Modi had pledged to cut India’s total projected carbon emissions by 1 billion tonnes and reduce the carbon intensity of the nation’s economy by less than 45 percent by 2030. The commitments also included achievement of net-zero carbon emissions by 2070, while meeting 50 percent of India’s energy requirements from renewable energy and increasing non-fossil fuel power generation capacity to 500GW by 2030. The Intergovernmental Panel on Climate Change (IPCC) has mandated that global CO2 emissions must be no more than 18.22 billion tonnes in 2030 for the world to stay below 1.5°C rise in temperature, which translate into 2.14 tonnes per capita emission of CO2 in 2030. To reach this goal, global emissions must be halved by 2030 and Net Zero should be achieved by 2050, which would require the rich OECD countries to get to Net Zero by 2030, China by 2040 and India and the rest of the world by 2050. However, the targets so far have been inequitable - OECD countries have declared a Net Zero target for 2050 and China this target for 2060. At CoP-26 China, the world’s largest carbon emitter and responsible for 11 per cent of all emissions, didn’t make any new commitments. Critics expected the USA to have pledged net-zero emissions much before 2050 to make up for its historically high emissions, this didn’t come either. In this context, the bold announcements coming from a country with low Human Development Index ranking of 131 and as yet struggling hard to provide a decent standard of living to millions of its poor expectedly generated a lot of enthusiasm and appreciation among the global community. The targets also may not be unachievable, provided we build appropriate strategies, with focus and determination.

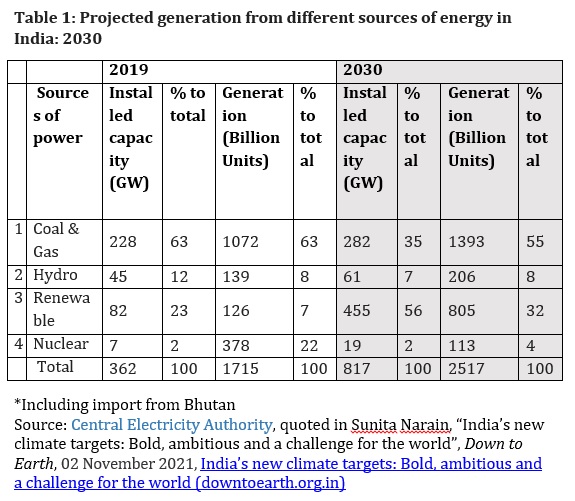

A developing economy requires ever more energy to grow faster. In terms of energy consumption, India’s per capita energy consumption is expected to surge three to four times over the long term. Given that coal-fuelled power projects generating about 200 gigawatts (GW) is the mainstay of India’s current power generation which account for more than half of the generation capacity, this will require massive investments in technology to increase the efficiency of energy use for reducing carbon emissions in the years to come to reach the net-zero target by 2070. India has the world’s fourth-largest reserves and is the second-largest coal producer, and a complete shift away from coal is out of question at this stage of development. Indeed, as Table1 shows, the generation from fossil fuels like coal and gas in absolute terms is projected to increase a little, though their shares in then total energy bundle will decline by 2030. As per these projections, India should be able to meet the target of 500GW of non-fossil fuel power generation capacity by 2030, as committed.

Given India’s current CO2 emissions (2021) at 2.88 billion tonnes, the Centre for Science and Environment projected India’s generation in a business-as-usual scenario at 4.48 billion tonnes by 2030. To cut it by 1 billion tonne will mean a 22 percent reduction within 8 years, no doubt an ambitious target. This means the per capita emission must be reduced from the current 2.98 tonnes of CO2 to 2.31 tonnes by 2030. In comparison, the per capita emission in 2030 would be 9.42 tonnes for the USA, 8.88 tonnes for China, 4.12 tonnes for the European Union and 2.7 tonnes for the UK which hosted the COP-26. [1]

But projection is one thing and living up to it is quite another. Carbon intensity measures CO2 emissions from different sectors of the economy which are to be progressively reduced as the economy grows. Huge investments, estimated by Niti Aayog at Rs 115-135 billion, will be required across all sectors to reach the targets committed. India has already made it mandatory for coal-fuelled power projects to use biomass pellets as 5 percent of their fuel, which will benefit farmers. The government has also embarked on a plan, tentatively named SAMARTH, to support India’s energy transition while containing pollution from the crop-stubble burning by converting them into pellets and facilitating their sale. [2] Many more such initiatives and innovations will be required to achieve the targets, which will mean gradual phasing out of coal, switching to electric vehicles, decarbonising polluting and energy-intensive industries like cement, iron and steel, non-metallic minerals and chemicals,creating forests to absorb carbon dioxide, and installing more solar power plants, etc.

Finding the sources of finance for the required investments would be another important hurdle to overcome. Besides, our vulnerability to climate change remains high as witnessed by recurrent floods (most recently in Kerala and Uttarakhand), droughts – a McKinsey estimate says that up to 200 million Indians could experience lethal heat at least once a year by 2030 [3] - losses of rainforests and biodiversity, depletion of groundwater, etc. These will impact human lives, livelihoods and leave their footprints on the economy, and will have to be factored in a comprehensive strategy to achieve our sustainable development goals while decoupling GDP growth from emissions at a stage of development far ahead of what the developed countries had faced in their trajectory of growth. Strategies for minimising emissions must therefore be combined with strategies for climatic adaptation while ensuring environmental justice for people through adequate social protection, especially in cases of calamities and extreme weather conditions. In the whole endeavour, nature has to be treated as an ally and the range of our habitats and biodiversity have to be protected which play a vital role in capturing carbon from the atmosphere, reducing vulnerability to climate-induced disasters, and in providing livelihoods. At the same time, environmental laws and enforcement must be strengthened and most importantly, the co-operation of the states has to be ensured. This is the most crucial element and this requires creating a suitable incentive structure which is what this paper is all about.

In our federal set-up, activities that impact the environment lie mostly within the jurisdiction of the states as enumerated in the List II – State List -of our Constitution, like agriculture, water (except regulation and development of inter-state rivers and river valleys which belong to the List I – Union List), while some other environment-related activities belong to List III –the Concurrent List, like forests, wildlife, factories and electricity (save taxes on electricity that belongs to the State List as the Concurrent List contains no taxing entries). In respect of the entries in the Concurrent List also, though there are overlapping responsibilities of the Centre and the states, it is the states that are primarily responsible for these activities which it undertakes through their government departments. Thus controlling these activities in a way that does not impact the environment adversely would require the whole-hearted and proactive cooperation of the states.

States are supposed to intervene when market failures like negative externalities, say, created by polluting industries or human activities, cause environmental and other problems, like formers in Punjab and Haryana burning rice stalks and creating the winter pollution that affects everyone. States have not been able to restrict these activities because of lack of appropriate technology, problems of coordination and inadequacy of finances. With most states suffering from mounting debts in the wake of the pandemic, financing environmentally sustainable activities like reducing CO2 emissions or protecting groundwater levels etc. will likely become progressively difficult, especially for debt-ridden state like Punjab. In Punjab, fertiliser subsidies and free powers given to the farmers along with price support through MSP have created a chaotic environmental situation tantamount to a crisis, depleting the groundwater levels due to indiscriminate pumping of water, changing cropping patterns in favour of rice and wheat that requires excessive use of water and contaminating water sources through seepage of unused fertiliser residues. These problems are also not unique to Punjab - many other states suffer from similar problems but because of inadequate resources are presently unable to make the necessary investments in protecting and developing natural habitats, rainforests and biodiversity. Developmental activities like construction of dams etc. often take a toll on nature and cause suffering to people including loss of habitats and livelihoods.

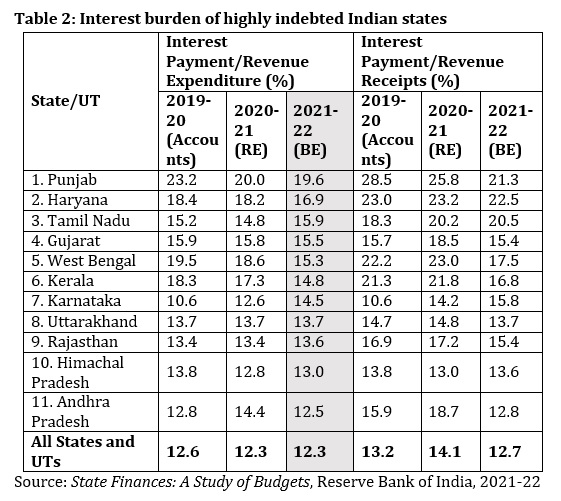

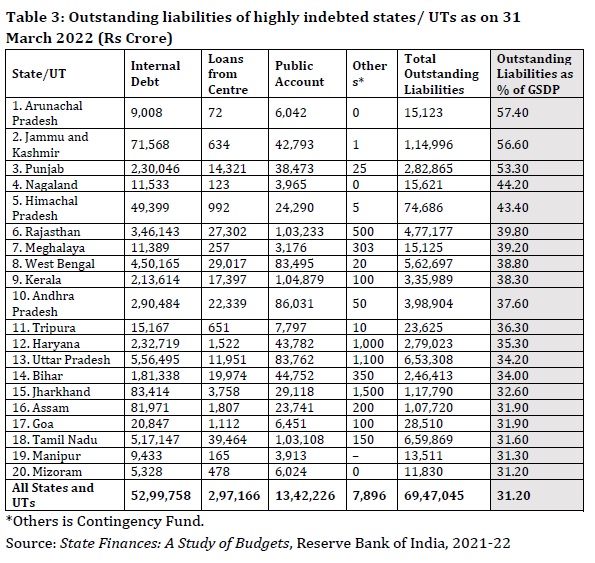

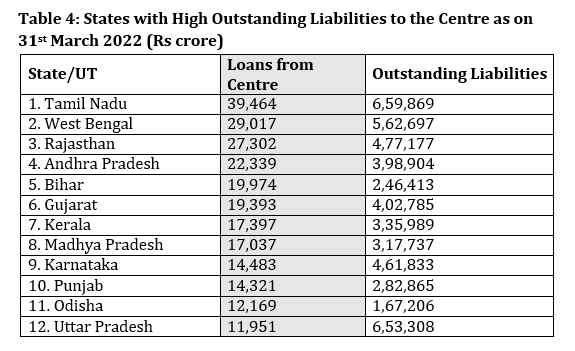

It is a well-recognised fact that states, like people, respond to incentives and an effective public policy always succeeds in creating an incentive structure to change their behaviour. At a time when all states were deeply sinking into vicious debt traps due to unsustainable revenue expenditure and surging fiscal deficits, the 12th Finance Commission brought them from the brink by offering strong incentives in the form of debt write-offs, conditional to their fiscal discipline though the enactment of Fiscal Responsibility and Budget Management (FRBM) Acts and generation of revenue surpluses. As a result of the substantial incentives offered, most Indian states came back from the brink of financial collapse and started generating surpluses in their revenue accounts, not so much by raising taxes but by curtailing unproductive expenditure and by increasing the efficiency of allocations. Today after the Pandemic had battered the economies of the states and the Centre alike when most economic activities had come to a standstill for protracted periods of time, the debt burden of all the states have increased unsustainably, and many states are again staring at the possibility of falling into a debt trap where they would be borrowing just to be able to repay their existing debt servicing obligations. This also makes them extremely vulnerable to future economic shocks and the pandemic is as yet far from over. Table 2 shows the interest burden of the highly indebted states in India, having interest payment as a percentage of revenue expenditure above the national average (2021-22 BE). It can be readily seen that Punjab and Haryana, the states which are facing almost irreversible environmental disaster because of their environmentally harmful public policies over the years bear the highest interest burden. Table 3 shows the outstanding liabilities of highly indebted states/UTs as on 31 March 2022 and Table 4 shows the states with outstanding dues to the Centre exceeding Rs 10000 crore as on 31st March 2022.

For nudging these states to launch environmentally sustainable policies and strategies so asto achieve the national targets, an incentive structure similar what the 12th Finance Commission had offered may need to be thought of. The structure should primarily incentivise the states to adopt environmentally sustainable measures in exchange for a reduction in their debt. In this, a cue can be taken from international experiments involving highly indebted countries which have met with remarkable successes in sustaining the environment and protecting the biodiversity while substantially reducing their debt burden and making both the debt and the environment sustainable. Such a scheme can be financed by grants from international financial institutions, NGOs working in the climate sector and trading in carbon credits generated from environmentally productive outcomes of policies to be followed by the states. Carbon trading is a thriving market in India and has the potential to generate sufficient income to fund such schemes in the long run, with proper policy, direction and focus. A report from the Deloitte Economics Institute indicates that India must act now to prevent the country losing US$35 trillion in economic potential over the next 50 years due to unmitigated climate change. [4] The report reveals how the country could gain US$11 trillion in economic values instead over the same period, by limiting rising global temperatures and realising its potential to ‘export decarbonisation’ to the world.

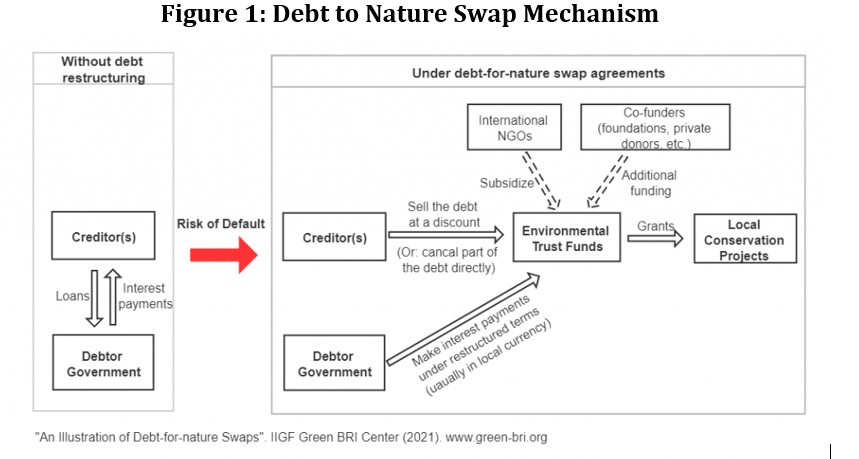

The international experiences are about what is basically a debt-for-nature swap scheme first conceived by Thomas Lovejoy, vice president of the World Wildlife Fund, in 1984, in response to the deteriorating tropical rain forests and mounting debt obligations in developing countries, especially in Latin America. Through this swap, the debtor country’s debt stock was reduced in exchange for its commitments to protect nature. It was seen that much of the world's biological diversity was harboured in countries that were also highly indebted. Debt-for-nature swaps leveraged funds for use in local conservation efforts based on a model in which private sector NGOs bought the debtor country’s debt at a discount in exchange for local currency investments in the indebted country. This is different from debt-for-equity swaps that have a very different purpose to generate profits for the investor. In contrast, a debt-for-nature swap seeks to provide additional funds for conservation activities within a country and does not seek profit; in this swap, there is no transfer of ownership or repatriation of capital to a foreign investor. [5] The mechanism for such swaps is explained diagrammatically in Figure 1 and later in Figure 2.

Source: Debt-For-Nature Swaps: A Triple-Win Solution for Debt Sustainability and Biodiversity Finance in the Belt and Road Initiative (BRI)? – Green Finance & Development Center (greenfdc.org) [6]

A debt-for-nature swap thus essentially involves purchasing a foreign debt, converting that debt into local currency and using the proceeds to fund environmental conservation activities. The key is the willingness of creditor governments or financial institutions to sell their debts at a discount which naturally raises the question why would any lending institution agree to forego a part of its outstanding dues from the debtor country. The answer lies in the hard economic logic that in case the debtor is likely to default in paying an instalment that is overdue, it may never be able to do so. It will thus make commercial sense to sell the outstanding debt at a discount rather than wait for an uncertain repayment in the future. The additional benefit that such a transaction would beget is to make the debtor country environmentally sustainable so that it can generate income from ecotourism and other environment related activities which may help honour its reduced debt obligations. Such swaps became feasible with the emergence of a secondary market in 1982 that enabled banks to sell and trade foreign debts at discounted rates. In the early 1980s, many developing countries, especially in Latin America, had borrowed substantial loans from commercial banks or foreign governments, and in the face of growing concerns that most of these debts would never be repaid and hence were not worth their face values, creditors were not averse to sell or trade such debt at discounted rates. Taking advantage of the secondary market now, they started divesting their outstanding loans to NGOs at discounted rates by lowering the interest rates, changing the currencies of the debtsto local currencies or refinancing the debts at lower market values. While the debtor countries thus reduced their foreign debt burden and forex outgo on account of interest and debt servicing, the creditors were able to absolve themselves of high-risk debts to an extent. [7] It was thus a win-win situation for all. As James P. Resor, Director, Conservation Enterprises, World Wildlife Fund, USA, observed, “The debt swap mechanism came to be viewed as a clever way to multiply contributions to conservation in developing countries. Donor conservation organizations liked it, since they saw a way to increase funding for badly needed conservation efforts in these countries. Many developing country governments embraced it as a tool to help manage their foreign debt situation as well as promoting selected conservation and development programmers in their countries. And, from a publicity standpoint, the idea of swapping debt for nature sold well.” [8]

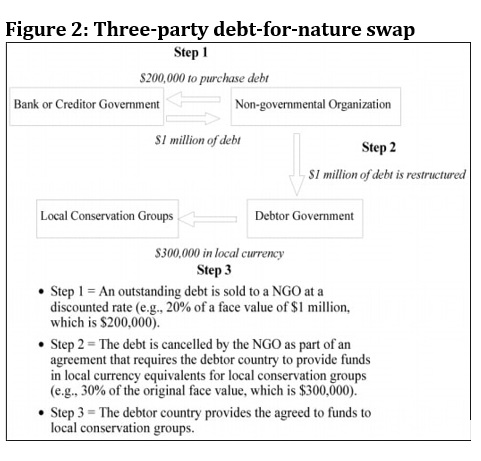

Usually, it is a three-party swap in which an NGO purchases an outstanding debt from the creditor through the secondary market at a significantly discounted rate, and then renegotiates the debt obligation with the debtor country. The NGO then sells the debt back to the debtor country at a higher price than it itself has bought, but still significantly lower than the original payment the debtor country would have to make. While repurchasing its debt, the debtor’s obligation is forgiven, and “some of the left over capital that would have gone into paying off the original commitment are funnelled into grants, bonds or funds that will be directed towards pre-agreed upon conservation investments or enacting environmental policies”. [9]

Source: Congressional Research Services, 2010.Unasylva - No. 188 - Funding sustainable forestry - Debt-for-nature swaps: a decade of experience and new directions for the future (fao.org)

The world’s first debt-for-nature swap took place in 1987 in which the environmental NGO Conservation International (CI) arranged for cancellation of US$650,000 of Bolivia’s foreign debt in exchange for the Bolivian government’s agreement to set aside 3.7 million acres of land in the Beni Biosphere Reserve adjacent to the Amazon Basin for conservation purposes. Under this transaction, CI acquired US$ 650000 of Bolivian external debt at a discounted price of only $100000. It also agreed to provide $250000 in local currency for management activities in the Beni Reserve. This was an example of a three-party swap involving a debtor, a creditor and an environmental NGO acting as a broker.

In addition to CI, the Nature Conservancy and WWF have also been frequent mediators of debt-for-nature swaps. Instead of trilateral swaps, bilateral swaps are also possible directly between the debtor and creditor countries in which the creditor country restructures a portion of the debtor’s obligations, or sells the debt to the debtor at a discount. The swaps can also be multilateral, for example in 1992, Finland, Sweden, Norway, France, Italy, Switzerland and the US agreed to restructure a portion of Poland’s debt which resulted in the creation of a non-profit ‘EcoFund’ for protecting Poland’s biodiversity and to manage its waste, reduce greenhouse gas emissions and prevent soil contamination. [10] The fund had received US$580 million by 2003.

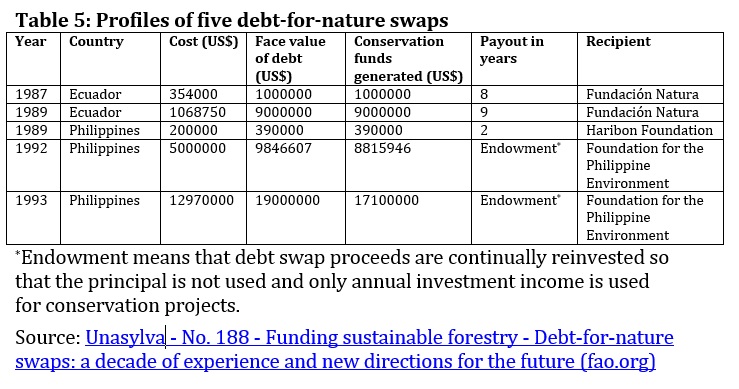

Since 1987, many such debt-for-nature swaps have taken place all over the world. A 2010 US Congressional research report estimated that, between 1987 and 2010, debt with face value worth US$170 million had been purchased globally for $49 million in three-party swaps, which generated around $140 million in local currency funds for debtor countries to redirect towards conservation projects. Table 5 shows some of these transactions which have met with a high degree of success in terms of conservation outcomes.

Seychelles, an archipelago of 115 islands in the Western Indian Ocean and home to many rare coral reefs and endangered species, and whose economy is overwhelmingly dependent on marine tourism and fishing, had recovered from a sovereign debt default in 2008. But its economy continued to be vulnerable to external shocks and its marine ecosystem continued to deteriorate for want of sufficient conservancy funds. In 2018, it collaborated with the United Nations Development Programme (UNDP), the Global Environment Facility and the Nature Conservancy in a deal that restructured its sovereign debt ofUS$21.6 million owed to Paris Club members (mostly the UK, France, Belgium, and Italy) in exchange for its commitments to protecting 400,000 square km area in the ocean. This was the first of nature for debt swap transactions to have focussed on marine ecosystem and biodiversity conservation. A fund called Seychelles Conservation and Climate Adaptation Trust (SeyCCAT) was established, which bought the debt from the creditor countries at a discount. The government of Seychelles agreed to pay back loans to SeyCCAT at a lower interest rate, spend the savings on ocean conservation work and designate 30 percent of its marine area as protected, free from unregulated economic activities such as fishing and drilling. By March 2020, Seychelles had made all debt-related payments on time and completed the protection of 32 percent of its waters.

Nature for debt swaps have taken place in many countries spanning all continents. While the amounts of debts swapped exceeding $1 trillion till 2019 constituted but a small portion of developing country’s outstanding debts, it resulted in significant gains in conservation and other social outcomes, besides influencing the way the conservation organizations, donors and creditor governments approached the topic of financing conservation over the long term to benefit several sectors. It has ushered in a new way of thinking about conservation while tailoring the mechanism to particular national circumstances in a creative manner. The aim is toforge strategic partnerships in order to attract private investmentsin a way that balances economic returns with long term sustainability goals.

Indeed, if economies were measured by their natural capital, many countries would be richer than what they are. Belize is a country rich in biodiversity - the Belize Barrier Reef, the second largest expanse of coral in the world, is packed with turtles, manatees and many other threatened species which attract tourists from all over. But the pandemic dried up tourism almost completely, contracting its GDP and spiralling the tiny country’s public debt from almost 100 percent of GDP in 2019 to more than 125 percent in 2020. It forced Belize into a nature for debt restructuring in November 2021, when it bought back its only international bond, a US$ 553m liability it calls the “superbond”, at a discount of 55 cents to a dollar. It funded the purchase with US$ 364m of fresh funds arranged by the Nature Conservancy. The payback is due over 19 years with a coupon rate that begins below that of the superbond but rises above it over time. The transaction is backed by the proceeds of a “blue bond” arranged by Credit Suisse, which Belize has pledged to invest in marine-conservation projects, promising to protect 30 percent of its waters by 2026. This restructuring reduced Belize’s external debt by US$ 250m, or 12 percent ofits GDP. [11] Earlier in 1996, Belize had established the Belize Protected Areas Conservation Trust (BPACT) to be funded largely by domestically generated revenues from a US$3.75 “conservation fees” and earmarked taxes collected fromeach of the estimated 140000 tourists visiting the country annually. Several organizations, including WWF, are already pursuing similar fees for natural resource use to generate more funding for conservation as well as encouraging more environmentally sustainable patterns of resource use. [12] Closer home, the Royal Government of Bhutan has established a hard currency trust fund for conservation in collaboration with WWF and the UNDP in 1991, which has a US$ 20 million endowment with contributions from the Global Environment Facility (GEF), WWF and the Governments of the Netherlands, Norway and Switzerland.

The financial conditions faced by debt-ridden countries like Seychelles, Belize etc. which had forced them into the nature for debt swap transactions as discussed above are very similar to the situations now being faced by many Indian states, especially in the wake of the pandemic. Most states are carrying a huge debt burden, the servicing of which is increasingly consuming more and more of their own resources. They are also faced with environmental and ecological problems, to address which they do not have enough resources. Let us take the case of Punjab for example. As we have seen earlier, Punjab has a high ratio of 53.3 percent of its outstanding liabilities to GSDP and its interest takes way nearly one fifth of its revenues. Of its total outstanding liabilities of Rs 2.83 lakh crore, Rs 14321 crore (5 percent) are owed to the Centre.

Experts have warned from time to time that Punjab is facing an ecological disaster due to its overuse of pesticides and chemical fertilisers in the soil which are available cheap at a subsidised price. They have pointed out that Punjab’s rivers and ground water may no longer be safe for human consumption and may be related to increasing incidence of diseases like cancer. As opined by the Central Ground Water Board, “The State was at the forefront of ushering in green revolution to achieve national food security and adopted intensive agricultural practices. The intense agricultural activity has prompted usage of large quantity of fertilizers and pesticides for better crop yield. This has resulted in both ground water and surface water pollution over space and time. Of late, many Organizations and people at large have expressed serious concern about deterioration of water quality in different parts of the State. Water quality problem has posed serious health hazards and people are affected by various water borne diseases.” [13] Besides, burning of paddy residues causes severe pollution problems not only in Punjab but also in neighbouring areas like Delhi. On top of it, the state’s policy of providing free power to the farmers for irrigation has resulted in depletion of groundwater to dangerously low levels. Studies have indicated that Punjab may be rendered a desert within 25 years if the exploitation of its underground water resources continues at the current rate, that at the current rate of extraction, all available groundwater resources till the depth of 300 metres in the state will end in 20-25 years and that all available groundwater resources at a depth of 100 metres will be depleted within 10 years. [14] Experts have warned that the main culprit of the falling water levels is the rice crop which requires excess water. Farmers get free water and hence wastage is rampant. The cropping pattern is determined again by MSP and hence cannot be changed, especially after the farmers’ agitation that forced the Centre to withdraw the three proposed farm bills. A Punjab Agricultural University study regarding groundwater fluctuations over the span of 28 years (1988-2016) found that there had been an average fall of 51 cm annually. Separate reports by the National Aeronautics and Space Administration (NASA), National Institute of Hydrology, Roorkee, and IIT Kharagpur have highlighted the concern over non-renewable loss in ground water volume.

These problems are not unique to Punjab alone. Other debt-ridden states like Kerala, West Bengal and Tamil Nadu also face several environmental and conservation issues linked to livelihoods of people. Let us take the case of West Bengal, which has one of the richest ecosystems in the world in its Sundarbans delta spread over 10000 square kilometres covering West Bengal and Bangladesh (40 percent in West Bengal). It contains one of the world’s largest mangroves forests and is known for its exceptional biodiversity, including numerous threatened species such as the iconic Royal Bengal Tiger and several species of river dolphins. As a 2014 World Bank Report has noted, “The forests of the Sundarbans form a powerful natural barrier that protects Kolkata Metropolitan Region’s roughly 14 million inhabitants and other human settlements from cyclones, rising sea tides, and other adverse natural events that otherwise would have taken a massive toll on human life and property.” [15] There are various conservation and related livelihood issues like increases in salinity due to freshwater reduction from the upstream and sea level rise depleting the availability of human staples such as safe drinking water. In many areas, salinity has increased beyond the safe threshold for agriculture, threatening food security. Many socioeconomic and biophysical tipping points have already been exceeded. While some of the climatic changes like sea level rise, increasing incidence of cyclones or rise in salinity may be outside human control, as the report cautions, “Blindly following a Business-As-Usual (BAU) development scenario will make matters worse because huge numbers of the residents of the Sundarbans will remain in harm’s way. Moreover, increasing income or building extensive infrastructure throughout the region will attract more people to areas that are fundamentally in decline and hostile to human habitation.” While the state government implements some centrally-sponsored schemes, the funding, capacity of institutions and agencies are all inadequate. Riddled with poverty, the local population spread over its 1100 villages of which 62 are situated on the fringes of the forest are living on the edge, and limited options for livelihood have forced communities to exploit natural resources indiscriminately.

A majority of the population here depends on fuelwood for thermal energy and are heavily dependent on forest resources such as fish and crab. This biotic pressure and unsustainable exploitation of forest resources has caused degradation of the natural habitat and consequent loss of biodiversity. The state does not have the resources to meet their needs or for protection and strengthening of the embankments, restoration of defunct river courses to bring freshwater, or for the development of aquaculture, rainwater harvesting and desalination for increasing agricultural productivity. Even the Centre does not have enough budget to address any of these problems effectively. The Central Ministry of Environment, Forests and Climate Change has a total budget of only Rs 3030 Crore (2022-23), of which Rs 930 crore are earmarked for Centrally Sponsored Schemes like Green India Mission, Project Tiger, conservation of biodiversity and aquatic systems etc., and Rs 963 crore are earmarked for Central Sector Schemes like National Coastal Mission, control of pollution, environmental protection etc. The rest are earmarked for establishment expenditure and autonomous institutions. With such miniscule budgets, it is impossible to address the environmental problems faced by most states.

It is in this context that a mechanism similar to nature for debt swap mechanism can incentivise the states to focus on environment and conservation. Like the formula prescribed by the 12th Finance Commission for reduction of the debt of the states owed to the Centre, a formula which may vary from state to state depending on their ground situations may be adopted afterconsultation and agreement with the states, mediated by an institutional mechanism akin to the GST Council where both the centre and all states will find representation. The objective is to incentivise the states to restore the environmental balance in exchange for a waiver of a fixed percentage of their debt owed to the Centre, to begin with, which may help address the present dismal scenario. For example, if, say, a state like Punjab can show a reversal of the depletion of groundwater or reduction in their pollution contents, the Centre may undertake to write off a portion of its debt owed to it. The scope of such waiver may also be extended by including the internal debt of the states owed to financial institutions most of which are controlled by the Centre. The possibility of roping in international climatic agencies or Green NGOs to mediate nature-for-debt like swap transactions may also be explored, if feasible, to address the debt problem of the states in a larger way. But even otherwise this may not impose severe pressure upon Central finances in the short term, while incentivising the states to become more proactive to at least arrest their continuous environmental degradation, if not reverse it. This can even be developed into a permanent institutional mechanism embedded in the future Finance Commission recommendations to help bring the states back from the brink of environmental disasters.

[1] Sunita Narain, “India’s new climate targets: Bold, ambitious and a challenge for the world”, Down to Earth, 02 November 2021, India’s new climate targets: Bold, ambitious and a challenge for the world (downtoearth.org.in)

[2] “India's COP26 commitments to help with new green technologies: ICRA”, Livemint, Jan 05 2022.

[3] Will climate change mean India will get too hot to work? | McKinsey

[4] “India’s turning point: How climate action can drive our economic future”, August 2021.

[5] Unasylva - No. 188 - Funding sustainable forestry - Debt-for-nature swaps: a decade of experience and new directions for the future (fao.org)

[6] Yue, Mengdi and Nedopil Wang, Christoph (January 2021): “Debt-For-Nature Swaps: A Triple-Win Solution for Debt Sustainability and Biodiversity Finance in the Belt and Road Initiative (BRI)?”, Green BRI Center, International Institute of Green Finance (IIGF), Beijing.

[7] Tristan Boveafrica, “What Are Debt-For-Nature Swaps & How Can They Address Countries’ Climate and Debt Crises?”, Feb 16th 2021 What Are Debt-For-Nature Swaps & How Can They Address Countries' Climate and Debt Crises? | Earth.Org - Past | Present | Future

[8] Unasylva - No. 188, Op cit,

[9] Tristan Boveafrica, “What Are Debt-For-Nature Swaps & How Can They Address Countries’ Climate and Debt Crises?”, Op cit.

[10] Tristan Boveafrica, “What Are Debt-For-Nature Swaps & How Can They Address Countries’ Climate and Debt Crises?”, Feb 16th 2021 What Are Debt-For-Nature Swaps & How Can They Address Countries' Climate and Debt Crises? | Earth.Org - Past | Present | Future

[11] Belize shows the growing potential of debt-for-nature swaps | The Economist, November 13, 2021.

[12] Unasylva - No. 188 - Funding sustainable forestry - Debt-for-nature swaps: a decade of experience and new directions for the future (fao.org)

[13] Water quality issues and challenges in Punjab - India Environment Portal | News, reports, documents, blogs, data, analysis on environment & development | India, South Asia

[14] Punjab well on way towards being a desert state in 25 yrs : The Tribune India

[15] Building Resilience for Sustainable Development of the Sundarbans through Estuary Management, Poverty Reduction, and Biodiversity Conservation Strategy Report, 2014

(The paper is the author’s individual scholastic articulation. The author certifies that the article/paper is original in content, unpublished and it has not been submitted for publication/web upload elsewhere, and that the facts and figures quoted are duly referenced, as needed, and are believed to be correct). (The paper does not necessarily represent the organisational stance... More >>

Links:

[1] https://www.vifindia.org/article/2022/october/07/innovative-strategies-for-arresting-environmental-degradation

[2] https://www.vifindia.org/author/Dr-Govinda-Bhattacharjee

[3] https://en.wikipedia.org/wiki/Sundarbans_National_Park

[4] http://www.facebook.com/sharer.php?title=Innovative Strategies for Arresting Environmental Degradation while Addressing Debt Problems of the States&desc=&images=https://www.vifindia.org/sites/default/files/Sundarban_Tiger.jpg&u=https://www.vifindia.org/article/2022/october/07/innovative-strategies-for-arresting-environmental-degradation

[5] http://twitter.com/share?text=Innovative Strategies for Arresting Environmental Degradation while Addressing Debt Problems of the States&url=https://www.vifindia.org/article/2022/october/07/innovative-strategies-for-arresting-environmental-degradation&via=Azure Power

[6] whatsapp://send?text=https://www.vifindia.org/article/2022/october/07/innovative-strategies-for-arresting-environmental-degradation

[7] https://telegram.me/share/url?text=Innovative Strategies for Arresting Environmental Degradation while Addressing Debt Problems of the States&url=https://www.vifindia.org/article/2022/october/07/innovative-strategies-for-arresting-environmental-degradation